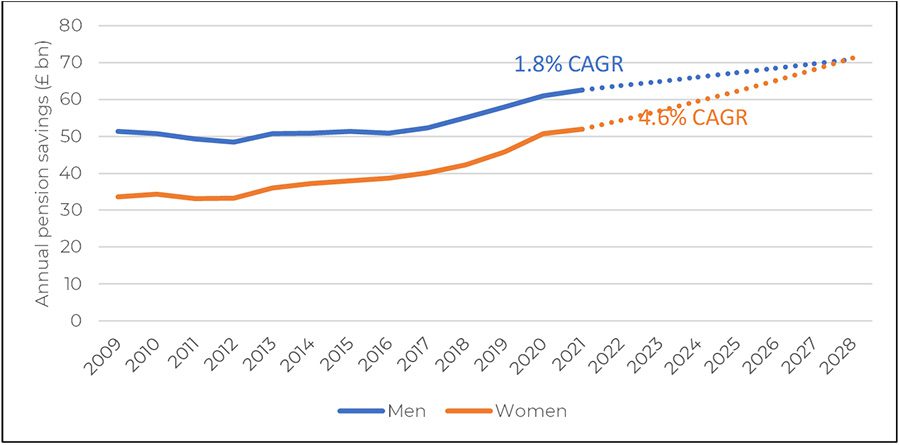

Women are set for pension saving parity with men by 2028, according to new research. However, due to the pre-existing gap, and the remaining gap between men and women’s pay, a major difference between pensions for men and women still exists.

New analysis of an FOI by independent pension, employee benefits, and investments consultancy, Broadstone, has found that the yearly pension savings of men and women is finally moving into alignment. The data breaks down yearly pension savings into employee and employer contributions as well as tax relief. According to the consultancy, women will be saving the same amount of money into their pensions as men in six years’ time.

Rachel Meadows, Head of Pensions and Savings at Broadstone, said, “Auto-enrolment has heralded a step change in pension saving in the UK, helping people build up pots for later-life who would have previously been excluded from the system. This has included younger savers, female savers and lower-income employees. It is great news that women are catching up their male counterparts when it comes to their annual contributions and could reach pension saving parity within the next six years.”

Broadstone found that women accumulated a total of £52 billion in 2021, including £4.3 billion of tax relief on their pension savings, rising from £33.6 billion in 2009 – a 55% increase. While men also increased their annual savings, the lower 22% over the same period saw women gain ground. Men’s total savings reached £62.6 billion in 2021 – including £6.5 billion of tax relief.

On this basis, savings for men had a Compound Annual Growth Rate (CAGR) of 1.8%, while savings CAGR for women was 4.6%. If this same growth rate was maintained over the coming years, it means that women’s annual pension contributions would match men’s in 2028, with both accumulating around £71 billion per annum.

“Building up sufficient pension savings to supplement the State Pension is the best way of securing a good standard of living in retirement,” added Meadows. “Even though women are some distance behind men in terms of total pension wealth, matching their annual contributions demonstrates how auto-enrolment is changing the landscape for a new cohort of pension savers.”

However, it is worth noting that the current economic slowdown may have impacted this progress. Amid the cost-of-living crisis that has seen the UK hit by record rates of inflation, women have been hit harder than men. Prices of products aimed at women have risen even faster – while the gender pay gap means they typically have less of a salary to begin with. Pensions saving rates have fallen in the UK, as workers have struggled to make ends meet, so it is likely this trend is even more pronounced among women.

At the same time, pension savings in the here and now will not make much material difference to individuals already reaching retirement. According to the UK’s Trades Union Congress (TUC), the gender pensions income gap in the UK means that retired women effectively go for four-and-a-half months each year without getting a pension. Meanwhile, earlier in 2022, Prospect Union calculated that the income gap between men and women in retirement is now 38%, more than twice the level of the gender pay gap – currently 15.4%.