The struggles of mobile companies to persuade customers of the benefits of 5G technology are continuing, with a new study suggesting fewer than one-third of UK consumers currently using the latest generation of internet for their smartphone. The technology saw its initial roll out hampered by the pandemic, and with mobile service providers currently hiking prices, many consumers see the improvements it offers over 4G as too marginal to pay for an upgrade.

Every decade or so, a new generation of network technology comes along that promises more speed, more capacity and more uses. With each generation, network operators invest capital to upgrade their infrastructure, with the firm belief that those investments will lead to more satisfied customers and reinvigorated revenues and profits. Following on from the launch of 4G in the 2010s, however, the leap to 5G has been less noticeable with 5G New Radio speed in sub-6 GHz bands said to be only ‘modestly higher’ than 4G.

As a result, early studies into the application of the technology found that 53% of business leaders saw no near-term business case for the technology – many still believing networks can do well enough leveraging 4G, while implementing 5G is likely to invoke hefty movements of capital. This apathy also bled into the wider consumer population, and their political representatives – one-third of whom could not understand the difference between 4G and 5G – meaning when the pandemic derailed attempts to instal 5G infrastructure, making up for lost time was not seen as a key priority.

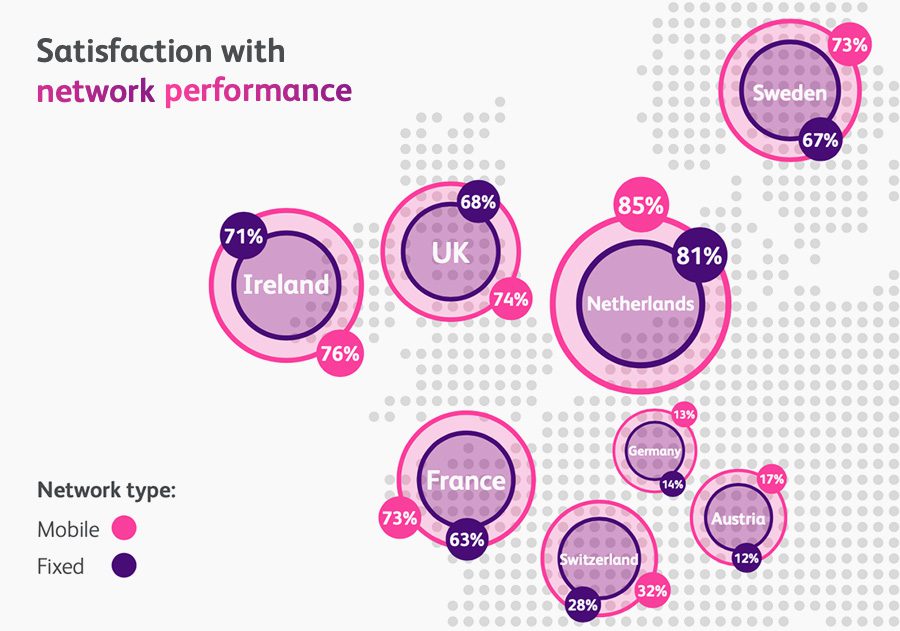

Another year on, another study from BearingPoint has found that consumers across Europe remain unconvinced of the importance of 5G. The situation seems especially pronounced in Europe, where 74% of mobile customers told the consultancy that they are satisfied with their mobile network as it is – one of the highest rates in Europe. As only 31% of consumers are already using 5G on their smartphone, this makes it seem unlikely that there will suddenly be a surge in uptake.

This is not helped by the fact that just under half of 5G users do not seem that impressed with it. Only 52% of respondents in the UK told BearingPoint that they had seen a “discernible improvement” since switching from 4G to 5G. With millions of consumers with O2 and Virgin Mobile facing 17.3% increases in their bills for making calls, sending texts and using data – as the UK’s inflation rate continues to ride high – may also put consumers off of shifting to a newer service, for fear of incurring further cost hikes.

In this context, BearingPoint believes that more needs to be done by the operators in educating consumers on the benefits of 5G, and creating compelling services. John Ward, UK CME Director at BearingPoint noted that in particular, awareness in the UK “is still low to the fact that 5G offers higher network bandwidth, better latency and higher reliability,” while providers could also do more to highlight how 5G boasts “the highest data security and the best energy efficiency among the mobile access technologies.”

Examples of how to improve uptake can be found from very close by, too. While many Irish customers were particularly distrustful of 5G during the Covid-19 lockdowns, now they understand and appreciate 5G better than most other countries covered in BearingPoint’s report – to the extent they were even inclined to pay a higher premium for 5G use cases, compared to their European counterparts.

For example, when it came to 5G having a perceived network improvement on video streaming, 12% of the wider continent expected this, compared to 16% in Ireland. Meanwhile, 57% of Irish respondents believed the overall performance of their network would increase on 5G. Further efforts to increase the still low uptake of 5G services in Ireland could further unlock rewards for the mobile sector – and do the same in the UK.

Ward added, “From a UK mobile network operator perspective our study should allow for cautious optimism, with three quarters of consumers satisfied with their mobile network coverage, and while there is still room for improvement, the UK performed much better than many of its European counterparts. The study also highlights willingness to pay a premium for 5G high quality streaming services, which should be a positive message for network operators.”