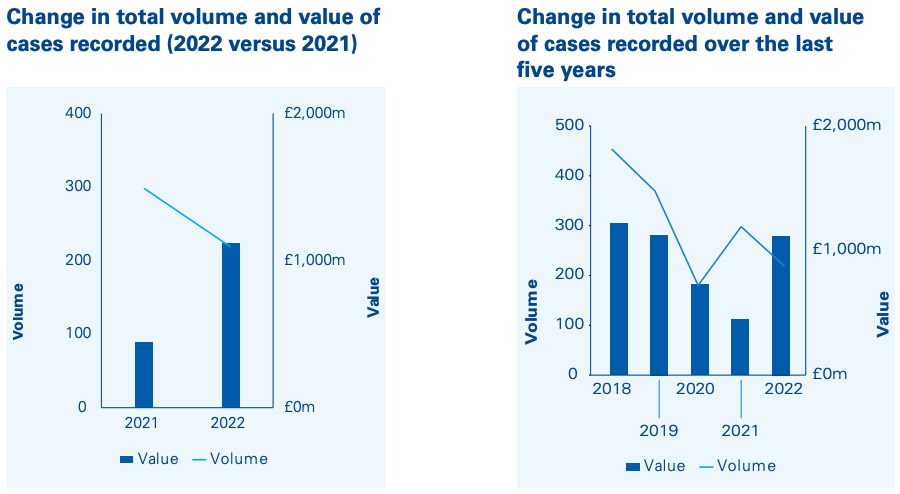

Fraud cases of more than £100,000 declined in number through 2022 – falling by more than one-quarter from the previous year. However the value of fraud is on the rise, growing by 151% over 12 months.

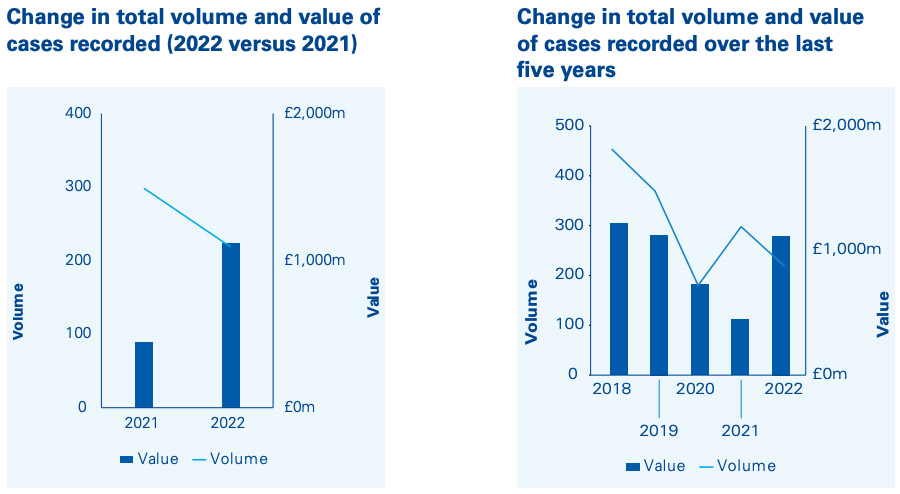

Despite widespread reports that the rapid digitalisation of the lockdown era would provide fraudsters with ‘windows of opportunity’, both the value and number of frauds fell steeply in 2020. The thought had been that hasty shifts to remote working would provide ample openings for digital raids on company finances, which had been rushed out without adequate cyber-security measures.

However, it is only since the gradual return to offices that both value and volume have returned to pre-pandemic levels. According to a new report from KPMG, the UK is particularly witnessing a resurgence in the value of major fraud cases – with a total of cases worth over £100,000 racking up £1.12 billion in 2022.

This represents a 151% rise on figures from 2021, and also sees the value of major fraud surpass 2019’s total of £1.1 billion. The trend becomes more alarming when viewed alongside the fact the number of frauds of over £100,000 fell 27% from the previous year. While the number is still higher than in 2020, it is markedly lower than 2019.

Commenting on the findings, Roy Waligora, Partner and Head of UK Investigations at KPMG, said, “In 2022, we saw the total value of fraud in the UK return to pre-pandemic levels as a few high value cases boosted the numbers. This comes as professional criminals have continued to attempt to line their pockets with high value fraud against financial institutions and their customers. The impact of fraud remains a real concern in the UK, however, the decrease in the volume of cases may be an indication of pressure on authorities and that some fraud cases are not resulting in charges, as recently outlined by the National Audit Office.”

According to KPMG’s ‘Fraud Barometer’, the steep increase in value was largely driven by five cases with a value of£50 million or above that were heard in UK courts in 2022. Amounting to a value of £648 million, they constituted more than half the total value of all the fraud cases heard – in stark contrast to 2021, which saw no reported cases over the value of £50 million.

In particular, this will bring the UK and Europe’s attempts to battle money-laundering in for public scrutiny. Money laundering cases made up more than £500 million of fraud value – even as AML fines are skyrocketing. This may see the gatekeeping function of banks become a hot topic once again – with their present role under European law having been branded by the European Court of Auditors branded as ‘flawed and susceptible to lobbying’.

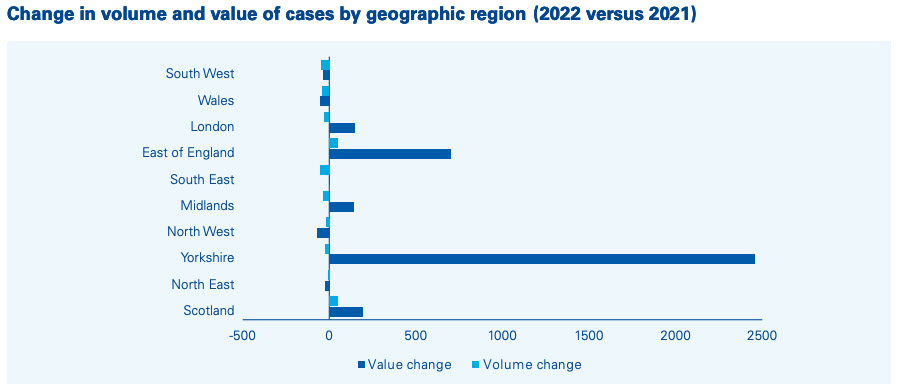

Despite London being the economic hub of the country, however, the largest growth in fraud came from other UKregions. Yorkshire and the East of England in particular saw massive growths in fraud value, even though volumeremained stable in both regions. Scotland meanwhile outpaced London on both fronts. This suggests that the sources and motives of fraud may be shifting from its traditional base, due to the UK’s worsening economic picture.

Looking ahead, Waligora, added, “The Fraud Barometer only looks at reported cases heard with a value of £100,000 or above in UK courts, so the likelihood is that the general public have been the victims of many more frauds. As the cost-of-living hits households, we are likely to see a combination of two things happen. Firstly, we are likely to see opportunist fraudsters target the public through specific scams relating to the cost of living, such as a recent energy rebate scam3. Secondly, there is likely to be an increase in frauds committed by more amateur criminals as people face financial difficulties. The public must stay vigilant, with the help of businesses, government and the police.”