British mid-market companies are coming under historic financial pressure, amid a perfect storm of economic conditions. The fact many are still owed huge amounts in deferred payments from recent years is not helping – with the average small and mid-sized firm currently waiting on £150,000 per year.

The amount of cash tied up in working capital – the cash businesses need to run day-to-day operations – has increased markedly during the pandemic, as logistics, supply chain and inventory issues beset global markets. As customers delayed payments, research from PwC found that Days Sales Outstanding (DSO) – the length of time taken for invoices to be paid – reached a five-year-high, in the last 12 months, increasing to almost eight weeks (54.1 days), up by 7% annually.

With the global economy teetering on the brink of recession, this is having an adverse impact on smaller companies in particular. With inflation hitting record rates, and debt collection resuming from tax authorities, the number of SME insolvencies is booming – particularly in the UK – as mid-sized firms struggle to bring in late payments from their own clients.

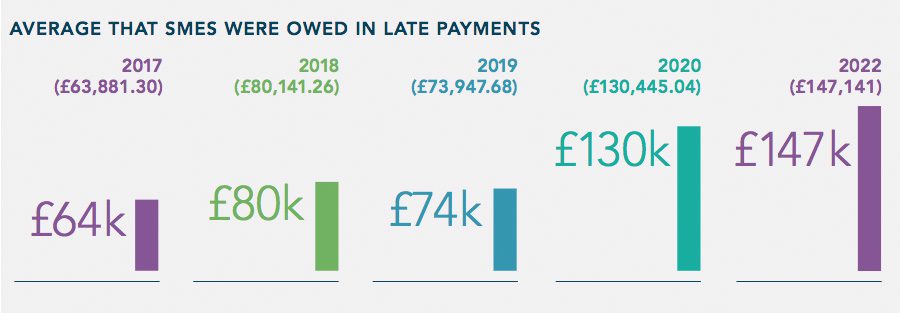

A new study from Dun and Bradstreet suggests that UK SMEs are currently owed an average of £147,141 in late payments. The firm polled 751 managers and senior managers from companies with two to 250 employees; in manufacturing, retail, professional services, construction, financial services and sales, media and marketing. This revealed the average SME was owed about £74,000 more than in 2019 – but with a plethora of financial pressures now intensifying the impact those deferrals.

David Marshall – Senior Director, Finance Solutions, at Dun & Bradstreet, commented, “There are over 5 million SMEs in our country and change is something every one of them has had to face. The crippling impact of late payments was an immense burden on businesses – even before the turbulence of the last few years – and as our research shows, it’s only getting worse.”

According to the researchers, 54% of SMEs owed money are owed more than £100,000, meanwhile 12% are owed between £200,000 and £500,000. Looking at specific industries, retail comes out on top for late payments with an average of £155,894 owed to businesses – likely owing to the rise of buy now, pay later options. However, other afflicted sectors include construction – which is enduring a massive slowdown due to the heightened cost of materials – with £152,000, and financial services with £151,746.

However, according to Marshall, there is “light at the end of the tunnel”. Despite the widely acknowledged risk of recession in the UK, SME owners are feeling upbeat, as many are now engaging with new tools and digital intelligence systems to boost debt-recovery speeds.

A majority of 71% of SME owners still think they will be profitable this year, and 66% feel confident in their job security. Looking ahead, this may even grow, as 38% of SMEs are also requesting more data surrounding open banking to help futureproof their business – with 55% of all SME owners surveyed believing more accurate data will have a positive impact moving forward, reducing financial risk and addressing supply chain concerns.

Marshall concluded, “It’s now about working smarter, faster and taking advantage of the tools and intelligence at their disposal to move closer to customers, drive efficiency and unlock new revenue streams. Businesses that use data in this way will be more competitive and able to adapt to future challenges.”