Even as many companies plan to backslide on ESG commitments, as a means to downsize spending during a recession, investors are suggesting this could see them exit. The number of investors who plan on walking out is set to double in the coming period, if they cannot achieve ESG change by other means first.

At the global economy heads for recession, a recent poll found that 86% of business leaders are already bracing for a recession in the current year. Of the topics seemingly destined for the backburner, Environmental, Social and Governance (ESG) matters look set for a major de-escalation in funding. Around 50% of CEOs are pausing or reconsidering their existing or planned ESG efforts over the next six months, and while 34% have already done so.

While firms look to stabilise their bottom-lines ahead of a lean period, however, they may be setting themselves on a course that will cause clashes with investors. A new survey from PwC has shown that investors are unwilling to compromise on ESG – and are not afraid to intervene directly with companies they believe are underperforming on the matter.

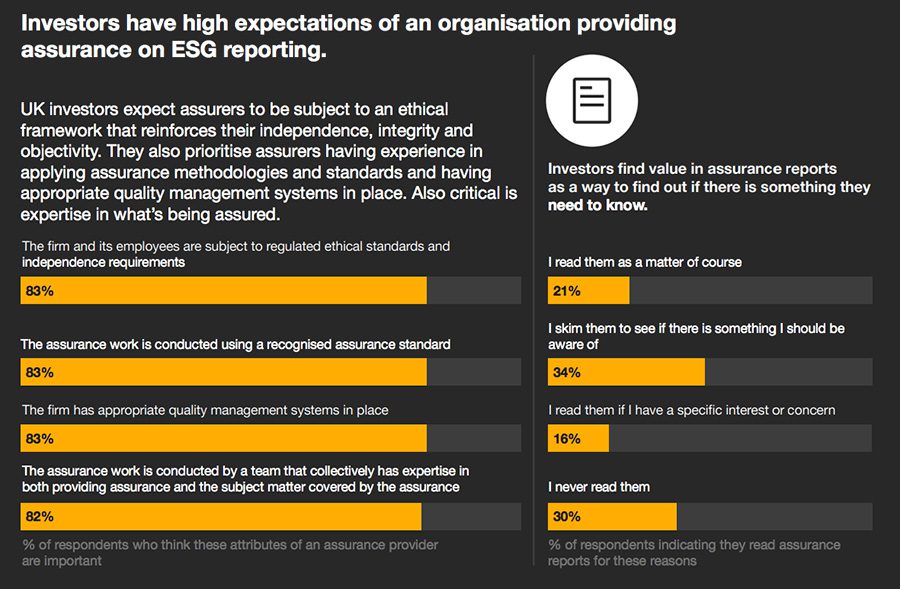

PwC conducted an online survey in which we received responses from 325 investment professionals across 43 territories. The firm found that UK investors in particular expect that companies can provide assurance of their accurate ESG reporting. To make sure that firms they have backed are on course to meet key ESG targets, 83% of investors told PwC that they expect organisations to keep their employees and management subject to regulated ethical standards, monitored independently. A 74% majority said this reporting should be carried out to the standards of a company’s regular financial audit function.

Investors find major value in assurance reports to this end. As investor analysts feel having an auditor to turn to with complaints ‘helps with accountability’, 70% read assurance reports at some point. Almost a quarter read them as a matter of course – something which, as funding dries up for many firms, could provide crucial when seeking finance in the coming months.

ESG ratings also play a part in informing investment decisions. When asked to what extent their investment analysis pertaining to ESG issues relied on external ESG ratings and scores, 67% said they did so to some extent. This included 21% who relied on them significantly. A majority of 65% agreed these ratings played roles in whether they would invest in properties – giving added importance to demonstrating ESG credentials to external reporters.

Investors also told PwC which ESG goals were highest on their agenda. Top of the list were the reduction of Scope 1 and 2 greenhouse gas emissions – a core part of net zero drives across the economy – cited by 64% of respondents. Meanwhile, a majority of 51% still said improving D&I was the next most important target, even when many CEOs are planning to slow recruitment.

Business leaders who ignore these warnings should take notice, too. If investors believe the entities they back are slouching on ESG topics they believe are essential, they will act. A 74% chunk of UK investors told PwC they would likely enter a dialogue with an under-performing company in the future. And while it was lower on the list, a growing number of investors said they would vote against director appointments, or even divest from underperformers. The number to use their vote in this way is set to rise from 19% to 53% in the coming period, while the number mooting a sale will double to 48%. However, PwC’s analysis shows some investors are also determined to have their cake, and eat it too.

While UK asset owners and asset managers said they thought it was worth companies sacrificing short-term profitability to address ESG issues, they were reluctant to see those actions have any impact on their investment returns. A 40% portion said they were unwilling to accept a lower rate of return on investment in a company that undertakes activities that have a beneficial impact on society or the environment. This was narrowly higher than the number who would tolerate such a setback – at 39%. The question for a portion of investors seemingly remains how much they really care about ESG, then, and how much they simply feel they should be seen to care about it.