With stagnant wages and record high inflation crippling consumer spending power in the UK, GDP growth is expected to crawl almost to a halt in 2023. According to new analysis of the economy, the British economy’s expansion will sink beneath 1% by the end of next year.

Yael Selfin, Chief Economist at KPMG UK, commented on the consulting firm’s report, “We expect growing external headwinds and weakening domestic momentum to see economic growth slow significantly over the next year, with a significant risk of a mild recession.”

Over the last four decades, UK policymakers have reoriented the economy toward a consumption model, rather than one based on production. With consumer demand for non-essential purchases declining dramatically, however, the ‘post-pandemic recovery’ which has been heralded for months as being on the horizon looks to have halted.

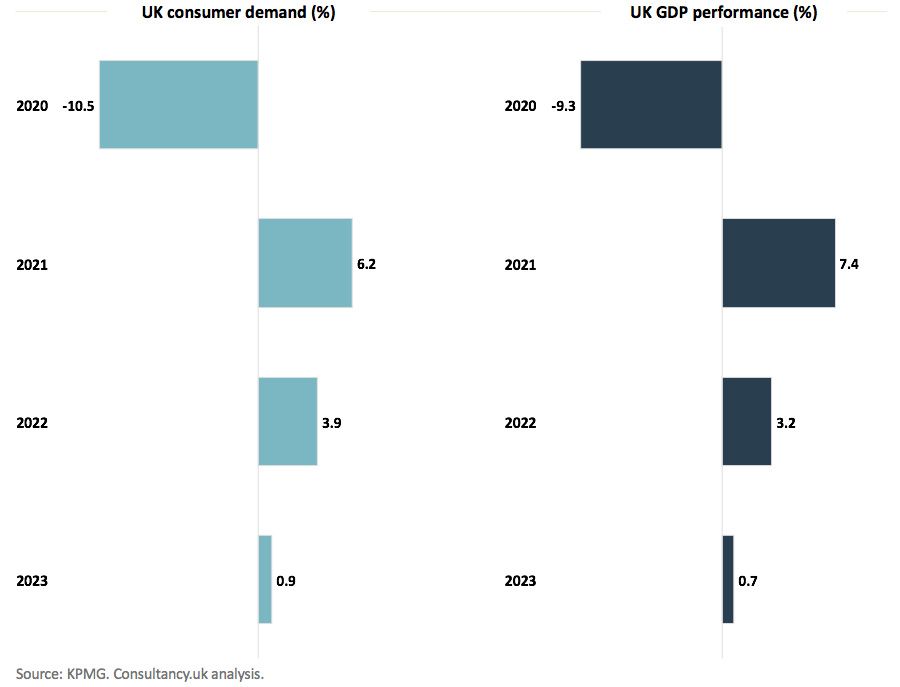

Consumer spending looks set to fall from growth of 6.2% in 2021, to 3.9% this year. And as the cost-of-living crisis continues to bite, this could sink to just 0.9% in 2023. The broader economy looks to suffer accordingly.

With the falling demand for consumer goods, manufacturing and financial services look set to be among the worst affected sectors in KPMG’s scenario. According to Selfin, manufacturing could fall by 5.1% in 2023 and 2.8% in 2024 – as the export intensive sector is also hit by Brexit headwinds. Meanwhile, financial services could also see significant losses from a downturn “as it raises the potential for significant loan losses and write-offs,” with output anticipated to fall by 8.8% and 2.5% over the next two years.

The forecast comes as the UK economy finally returns to its pre-pandemic size. But with the price for fossil fuels having hit decades long highs, climate degradation and geopolitical tensions look set to compound the crisis. There are subsequently concerns that the UK could be heading for another recession.

As things stand, KPMG expects UK GDP growth will slow to 3.2% this year and is forecast to fall further to 0.7% in 2023. The continued invasion of Ukraine and renewed lockdowns in China are putting fresh strains on commodity prices, however, and keeping supply chains under pressure – which could see growth slow even further.