The annual cycle of upgrading has left UK consumers with a glut of smartphone devices. And while more consumers are waiting longer to upgrade as inflation bites, many are still sitting on a collection of old devices worth a cumulative £1 billion.

Deloitte recently polled 4,160 UK consumers aged 16-75 for its Digital Consumer Trends survey. First, the study revealed that in line with a number of other mature markets, more consumers are waiting longer to replace their old handsets.

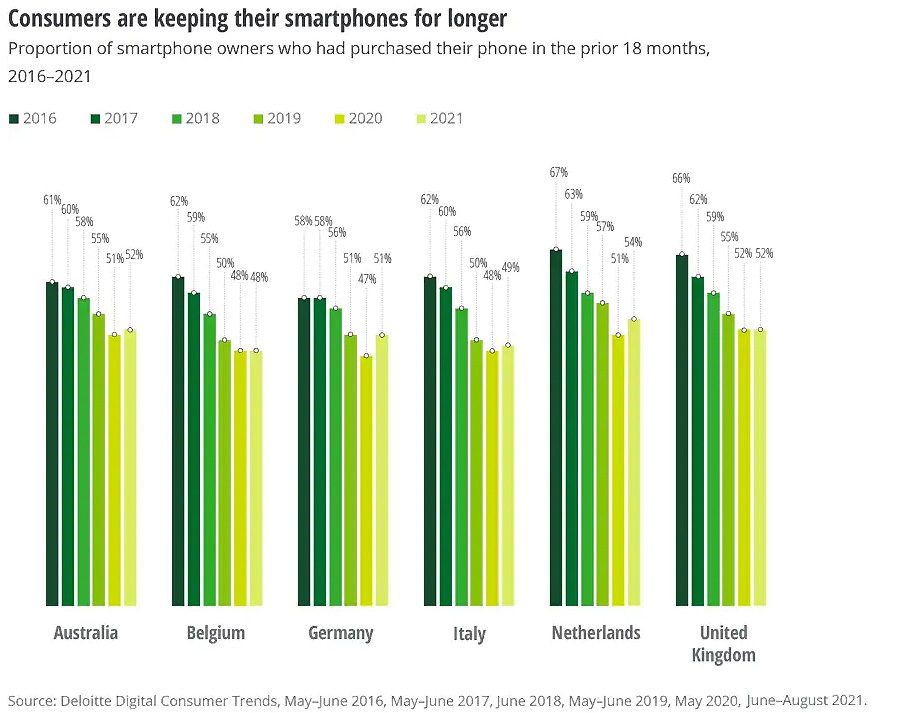

The average ownership time for smartphones has steadily been lengthening in developed markets such as Australia, Germany, Italy, Belgium, the Netherlands and the UK. In Britain particularly, between 2016 and 2021, there was a notable decline in the proportion of respondents whose smartphones had been bought in the prior 18 months, from 66% to 52%.

While this indicates many consumers are responding to shrinking consumer spending power, by scaling back their expenditure on new technology, the number of new smartphones purchased in those markets still managed to double from 5% to 10%. This suggests that second-hand purchases are losing popularity, while people continue to accrue new devices without selling on the old ones.

To that end, Deloitte found that of the UK consumers who bought or received a new phone in the last year, about seven million, or 38%, held on to their old device. This leads the firm to estimate some 24 million smartphones are being kept as spare by consumers in Britain over the last three years. Collectively, that technology is worth over £1 billion.

Paul Lee, Global Head of Research for Technology, Media and Telecommunications at Deloitte, said, “We know that smartphones are an integral part of daily life for many of us. However, with millions of devices now gathering dust at the bottom of drawers or the back of cupboards, it’s important that we realise the value of these forgotten phones. Device manufacturers and sellers should look to provide easier to use solutions for recycling or trading-in older devices so that consumers can recoup any residual value from their old tech. Growth in the second-hand smartphone market also has the power to bridge the digital divide, with a greater number of more affordable used devices on the market for all consumer budgets.”

Across the UK, only 17% of phones were purchased second-hand. This is dwarfed by the 82% bought new. Of consumers who bought new phones, 28% did so as they believed it would have a longer lifespan than one which was refurbished – while less trivial reasons included 18% calling it ‘more exciting’. At least addressing the distrust consumers have for used items could be key to changing the market in the future – and making it more sustainable. After all, around 83% of all emissions generated by smartphones come from the manufacturing, shipping and first year of usage of the device.

Emily Cromwell, Environmental, Social and Governance Lead for the Consumer Industry at Deloitte, added, “Making sustainable choices may not be top of the list for many consumers who will be feeling the cost-of-living squeeze, with over half of consumers claiming it is too expensive to adopt a more sustainable lifestyle. However, we know that there can be real benefits from recycling or trading-in items. While shipping old devices creates emissions, these are far fewer than those generated from the manufacturing of brand-new devices.”