British business leaders are pessimistic about the country’s economy, but most still believe their own firm has a bright future. A majority of firms said they were optimistic about the performance of their firm over the coming year, while one-fifth said they were ‘very optimistic’.

Business leaders’ outlooks on the broader economy and their own firm’s prospects have regularly converged in recent times. Multiple studies throughout the protracted Brexit process, and uncertainty of the Covid-19 pandemic, showed that while bosses often feared the worst when it came to the economic health of the UK, they did not seem to believe the same headwinds applied to them.

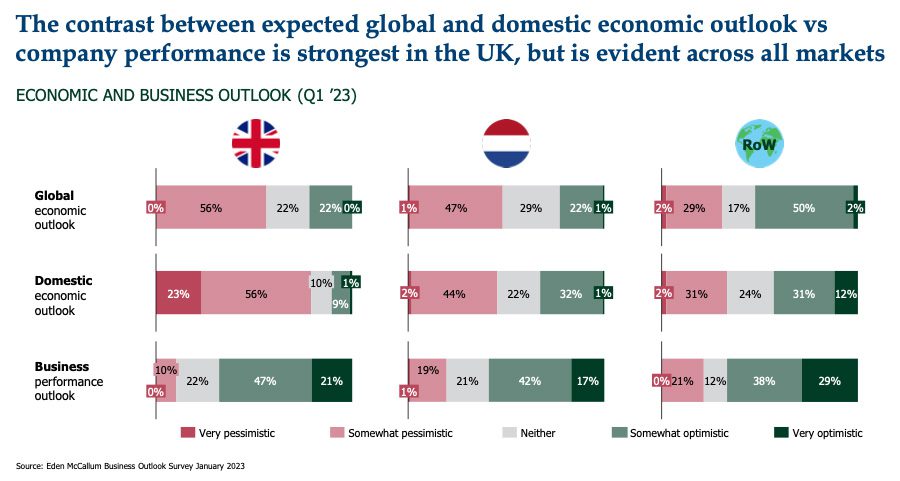

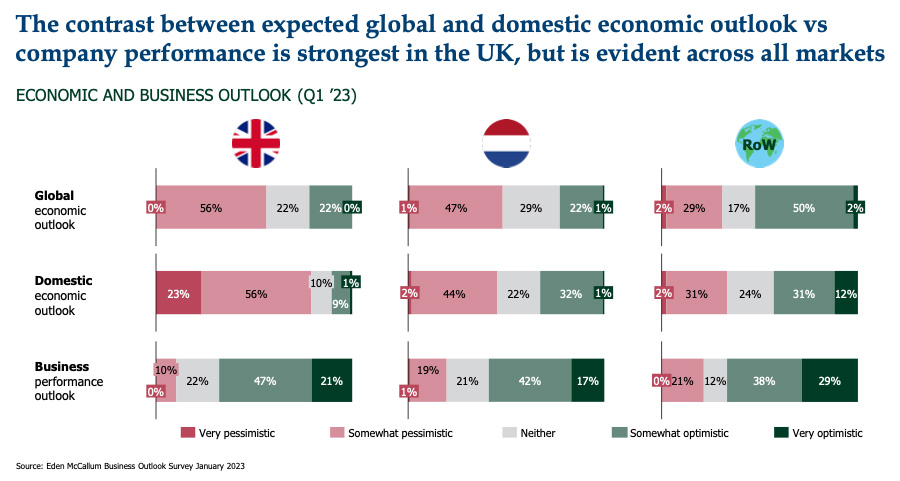

Now, a new survey from Eden McCallum has shed further light on this widening disconnect, suggesting that the UK has Europe’s widest gap between personal and general expectations. While such a contrast was evident across all markets, the UK’s businesses stood apart from the rest – with 56% of respondents “somewhat pessimistic about the global economy” and 79% either “very pessimistic” or “somewhat pessimistic” about the domestic picture, standing in stark contrast to the 68% majority that were “somewhat” or “very” optimistic on their business’ outlook.

For contrast, 57% of Dutch respondents from Eden McCallum’s poll were optimistic for their own performance, but fewer than half said they were pessimistic about the national economy, or the global economy. This was replicated across a rest-of-world average compiled by the researchers, suggesting most respondents were actually ‘somewhat optimistic’ about the global economy – while 65% were optimistic for their firms to some extent.

This booming individual confidence of UK respondents is out of step with companies’ assumptions about the national economy in particular. In 2022, Eden McCallum found that business confidence in the UK was at a massive low – with only 3% of firms even ‘somewhat optimistic’, and 60% ‘very pessimistic’. While this has rebounded moderately in 2023, optimism is only at 10% – lower than it was in 2016, the year the UK voted to leave the EU.

In contrast, optimism regarding individual businesses has rapidly spiked. Overall, the number of firms in someway optimistic on their outlooks has grown by 17%, with more than one-fifth of respondents now reporting being ‘very optimistic’ alone.

Eden McCallum’s researchers did not venture an explanation as to where this disconnect comes from. It could be simply that admitting a leader’s own company may be in trouble, is more difficult than admitting the broader economy is in trouble – but whatever the cause, sentiment is not stacking up with reality. If the majority of firms do indeed perform the way they believe they will, then the wider British economy will be performing positively. That may be easier said than done, though.

Speaking on the findings, Dena McCallum, co-founder of Eden McCallum, said, “If we take a glass half full view, there is less pessimism about the economy and more optimism about expected business performance in all regions than there was even a few months ago.”

However, she clarified that there were still national and international issues which firms would be foolish to underestimate. However convinced a business is of its fundamentals, it is not an island, it will need to navigate local and wider-ranging pressures on inflation and labour shortages – named by 50% of respondents as their biggest worry for the coming year – if they are to realise their perceived potential.