UK firms suffered from a spike in fraud during the pandemic years. While cybercrime and supply chain fraud are higher than the global average, however, experts expect the experience may help firms become more resilient to financial crime in the years to come.

Britain had already seen an exponential boom in fraudulent activities before the pandemic. In the 15 years following 2003, the value of fraud rose by billions, with financial services accounting for the largest chunk of the glut, boasting a bill of just under £900 million in 2017. It was also the second year in a row that the UK had seen the value of fraud across the nation breach the £2 billion mark, having spiked sharply over 2016.

The landscape has changed drastically since 2020, though, as the Covid-19 outbreak opened even more avenues for fraudsters to commit financial crimes. With many firms having to quickly roll out digital platforms to support remote working in lockdown, cybersecurity took something of a back seat initially. As companies favoured speed over security, while fighting to preserve productivity, they left themselves open to different kinds of attacks – and not only on a digital front.

According to new research from PwC, 64% of UK companies admitted they had experienced fraud or economic crime in the last two years. Figures from PwC’s latest Global Economic Crime Survey 2022 found this put UK firms well above the global average for this year – 46% – and saw the situation worsen since the last time the survey was conducted in 2020. Then, 56% of UK firms said they had faced economic crime.

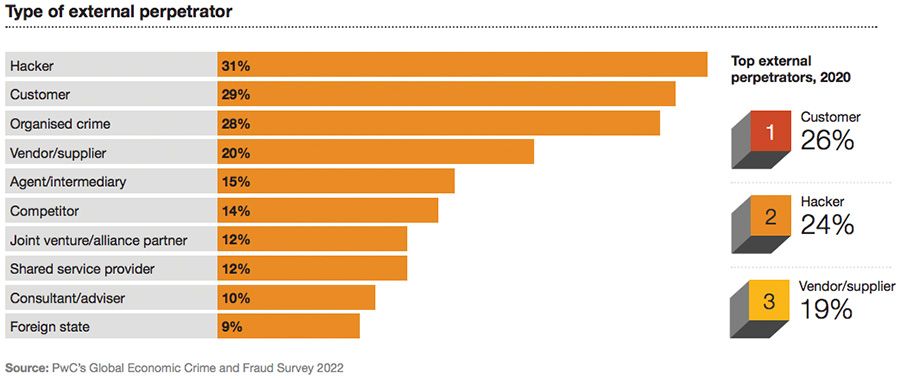

When looking at the types of fraud reported, cybercrime was the most frequent. Around 32% of UK respondents had experienced a cyber breach in the last two years – although interestingly, this was lower than the number of those who fell victim to cybercrime in the 2020 survey – at 42%. On a global level, however, hacking became more prominent. When asked the type of external perpetrator had impacted their firms, 31% of international respondents said ‘hackers’.

In the UK, one thing that boomed to rival cybercrime seemed to wane was supply chain fraud. With firms working remotely, supply chains have become more difficult to operate and monitor, and so supply chain fraud entered PwC’s list for the first time, but accounted for almost a fifth of respondents. On a global level, international respondents seemed to be hit less hard supply chain fraud, in comparison – only one-in-eight respondents cited it as impacting them.

Looking at these trends, Fran Marwood, Partner and Head of Digital & Forensic Investigations, suggested some of this is to be expected. In some ways, meanwhile, though the numbers make grim reading for UK firms, there are signs fraud will fall in the coming period.

Marwood added, “From what we are seeing in the market, I believe some of the trends are temporary, with, for example, instances of fraud and misconduct potentially remaining undiscovered as traditional controls and corporate culture evolve to keep pace with remote working. Encouragingly, in some cases, incidences of economic crimes have reduced due to the investment organisations have made in effective compliance programmes, cyber defences and fraud prevention controls.”