As the global travel sector looks to rebound from Covid-19, the pressures of heightened inflation look to have slowed its recover. A new report suggests that while travel demand has improved since the relaxing of pandemic falling consumer confidence is weakening the market once again.

During the early stages of the pandemic, international lockdowns saw many airlines slip into crisis mode. With demand suddenly drying up entirely, many companies were forced to beg for state bailouts, or face collapse. In news which will give new confidence to airlines and stakeholders, after the rolling back of restrictions, a new study from OC&C Strategy Consultants has found that demand has recovered more rapidly than previously expected.

The report by Partners Phil Hunt, Rebecca Henshaw, Tom Gladstone, Tom Charlick, Tim Cook and Nicholas Farhi explained that the market’s recovery was expanding from strong domestic leisure markets, into business and international travel. Following the pandemic, pent up demand emerged, as customers put off holiday plans and saved over the last two years – meaning as soon as the possibility of travelling without encountering lockdowns became possible, households looking to travel rose sharply.

More unexpectedly, business travel has been returning faster than predicted, according to OC&C. Contrary to other findings, the firm contends that business travel is performing strongly now – though it also ceded that “the jury is still out on the lasting impact of the pandemic on business travel habits” due to the fact “remote and hybrid working are clearly here to stay”.

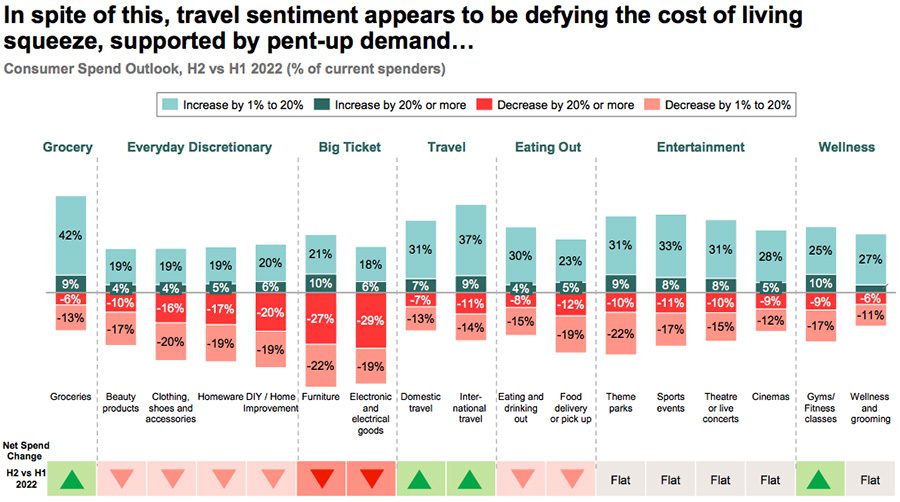

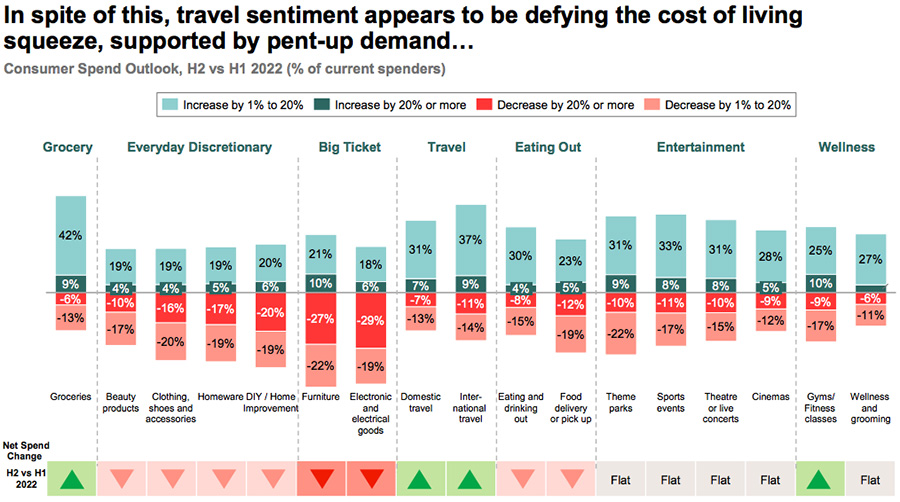

Such is the potency of this combination that OC&C suggested customers appear to be “absorbing inflationary impacts and protecting their travel spend” so far. Having been housebound for such a long period, many see travel as one of the few areas of spending that they will increase spending on over the next six months – especially as it may be the first chance for many travellers to see their families after the pandemic period.

Of the consumers polled by OC&C, only grocery spending was expected to increase by more respondents – with 42% anticipating an elevated spend of up to 20%. In contrast, 37% of consumers said they were likely to increase spending on international by the same amount – and 31% said the same in terms of domestic travel.

However, OC&C also warned that the recovery is probably going to slow, as inflation, labour shortages, and weakening consumer confidence impact the market. With fuel costs in particular spiralling, the price of flying is likely to force many consumers to put plans on hold, whether or not they are willing to increase their spending.

The researchers noted, “As banked savings continue to dissipate, and inflation continues to bite in consumer spending power, this effect is expected to unwind. Consequently, we expect a softening of the recovery through the remainder of 2022.”

Citing previous periods of macroeconomic pressure and recession, OC&C added that consumers tend to trade down into cheaper travel options at times of hardship. This typically favours domestic travel and other value travel options. Anticipating a similar dynamic now to that which followed the 2008-09 recession, short haul recovered much faster than long-haul for this reason. This could be especially pronounced in the UK – where long-haul is expected to take around two years more to recover than the US.