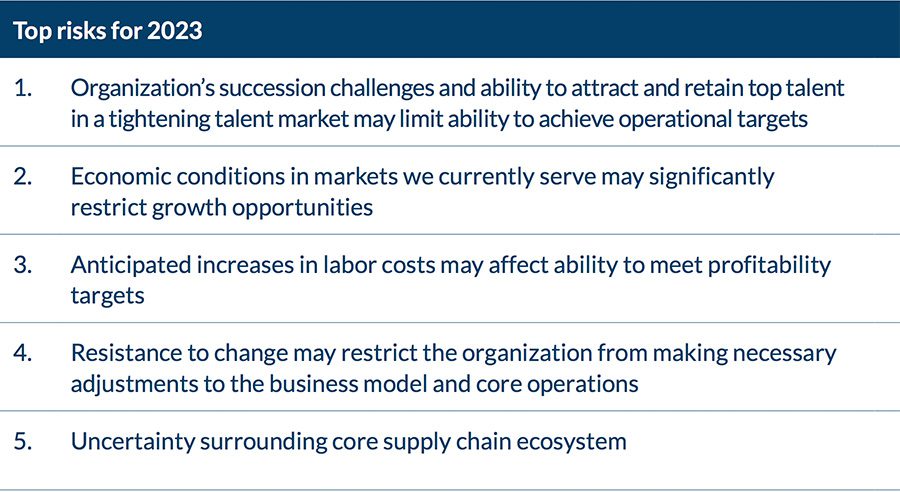

As firms look to 2023 with apprehension, a new survey has identified the top concerns of executives – not only for the next year, but the next decade. The war for talent tops both lists of concerns, but in the short term, economic uncertainty is also at the forefront of business leaders’ minds.

Protiviti polled 1,304 executives, comprised primarily of board members and C-suite executives from all major regions of the world, about their perspectives for 2023, and also in 2032. Questions ranged across 38 specific risks, along three dimensions.

Chief among concerns for now, and for later, was the issue of talent retention and succession. Some economists expected the present economic conditions to change the tightening employment market – with company collapses meaning a higher level of unemployed worker to choose from, while inflationary pressures would push those exiting roles amid the ‘Great Resignation’ back to offices on employers terms. However, the business leaders polled by Protiviti suggest that they will still struggle to fill roles in 2023 – and believe the issue is unlikely to get easier by 2032.

The fear of talent retention is currently at odds with the other great fear of executives for the months ahead – the global economic slump. It is the second most worrying item on the agenda, according to the business leaders Protiviti spoke to – however, Pat Scott, EVP in Global Industry and Client Programmes at Protiviti, argued added that they should be sure not to allow anxieties over their immediate financial situation mean they cut spending on their workforce – an action they might come to regret further down the line.

“In the current tight labour market, talent retention has naturally become a top risk that executives are worried about, however, with the added complication of a softening economy, they need to tread carefully,” Scott added. “It’s important that executives are weighing today’s economic pressures against the possible costs a decade from now and are making prudent organizational choices that increase their company’s resilience next year while laying the foundation for success in the years to come.”

Talent policies also related to some of the other top concerns for executives in the coming decade. Looking to 2032, many noted being fearful that adoption of digital technologies may require new skills which are in short supply, requiring significant efforts to reskilling of employees. But according to Jim DeLoach, a Protiviti Managing Director, these issues – as well as general talent retention – are something firms can plan for sooner, rather than later.

DeLoach contended, “Executives should weigh the current economic conditions to adjust their talent and risk management strategies. Employees are just as important as customers and should be treated as such in all decision-making in the coming months. Longer term, continued investment in succession planning, integrated upskilling and technology learning will help companies excel in employee engagement and broader corporate strategy, fulfilling the value proposition underpinning investments in new technologies and digital innovation.”

This was something also emphasised by Carol Beaumier, global leader of Protiviti’s thought leadership programme. While immediate concerns around inflationary pressures and increased labour costs might top concerns for executives now, they risk missing out on much larger amounts of money in the future, if they push away valuable labour that could help make the most of tomorrow’s technology.

Beaumier conclude, “Looking back ten years ago, it’s remarkable how much technology has reshaped the workplace since then, and the pace of change will only accelerate in the next decade. Technologies like the cloud, enterprise-grade AI, quantum computing and the metaverse were immature or non-existent ten years ago but might become table stakes by 2032. Companies need to think about how their people will continue to adapt, learn and embrace these technologies. A long-term outlook helps companies focus on where to invest to be better prepared and more resilient beyond 2023.”