Sustainability consultants are enjoying record demand, as environmental and social challenges cause businesses to pivot their business models. New research of the global environmental, sustainability and governance consulting market suggests it will enjoy a double-digit compound annual growth rate until 2027.

Environmental, social and governance (ESG) centricity is playing an increasingly important part in economic and wider societal debates – and consumers are more and more shunning companies with poor ESG track-records. With investors increasingly keen not to be caught out by backing companies that do not take these risks seriously, most companies have now come to the realisation and understanding that proactively improving upon ESG issues improves business outcomes by responding to social needs.

But even as ESG has become such a key item on the agenda, many mid-market players seem unable to rise to the challenge. The ESG goals of many firms are being hamstrung by a lack of buy-in from senior management, while calculating the carbon or social impact of every aspect of a supply chain can be a complex process that further slows change.

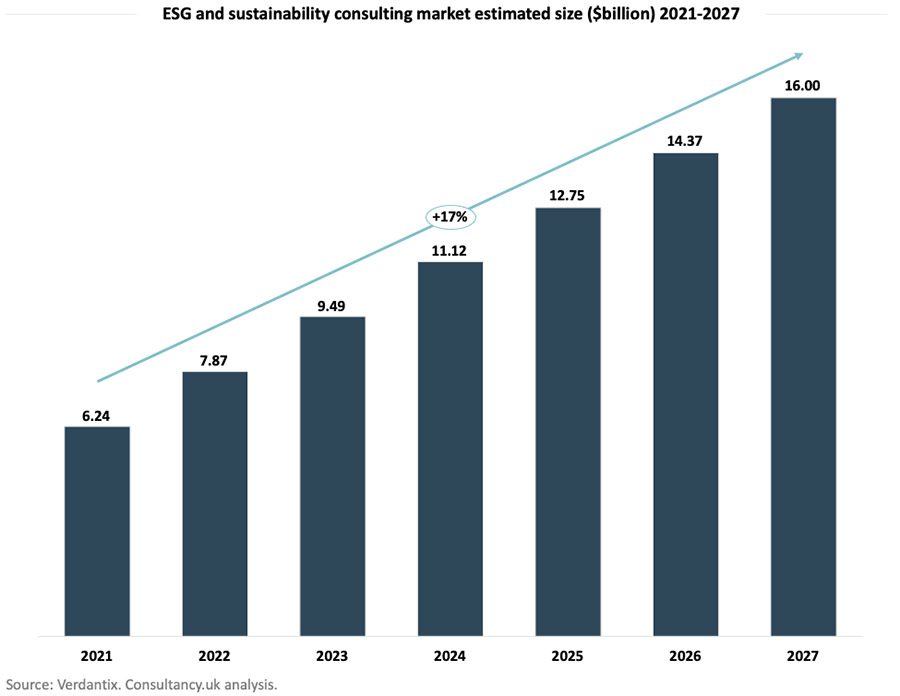

As a result, demand for external expertise, specialising in ESG, is on the rise. A new study from research and advisory firm Verdantix has forecast that spending by companies on ESG and sustainability consulting is set to more than double over the next five years to a record $16 billion.

Verdantix Research Director Kim Knickle, said, “Over the next five years, businesses will have to reorientate themselves around ESG and Sustainability priorities. This represents a complex challenge that will take place against a rapidly evolving regulatory backdrop. As a result, consultancies stand to benefit as firms look for external expertise to help them achieve transformational change and more rigorous standards of reporting.”

According to the researchers, the market will grow at a CAGR of 17% per year until the close of 2027. At that point, the market will have grown a total of 156% from its 2021 size, adding almost $10 billion in value from its $6.24 billion that year. Meanwhile, regulatory change and pressure from stakeholders will combine with GDP growth and policy development to boost all regions and sectors.

In addition, ESG factors will become more integrated into investment and M&A decision making. ESG investment is already being seen as a future driver of growth in the banking sector, for instance, where banks with a very good ESG rating have a higher net interest income and net fee and commission income than their peers. In 2022, these trends are likely to have seen the market already grow beyond the $7 billion mark.

Looking ahead, Verdantix found that growth in ESG consulting will initially be strongest in the EMEA region, with North America and APAC close behind. All ESG and sustainability consulting services are expected to achieve double digit growth over the period but corporate reporting and disclosures will see the biggest increases with a CAGR of 21%.