Now in its 16th year, the annual Professional Services Maturity Benchmark Report by Service Performance Insight (SPI), sheds light on the top trends and metrics in the professional services landscape. We sat down with SPI founder Dave Hofferberth to learn about the key insights consultancies can leverage from this year’s report.

Founded in 2006, SPI’s Professional Services Maturity Model has, over the years, helped hundreds of firms in the sector adapt to some of the most challenging markets in modern history.

Having led every edition since its inception, Dave Hofferberth has an eagle’s eye view on the key trends in the industry. “The industry’s maturity doesn’t typically change much between consecutive years,” he says, “but when landmark changes occur, it’s vital for consulting leaders to know where they stand in the broader market.”

“At the very beginning of the benchmark, the results helped professional services firms face the financial crisis – which threw the market into a bit of a tizz. Likewise, just three years ago, Covid-19 hit, which threw the market into a different place.”

One of the industry’s most in-depth reports for key performance indicators, the Professional Services Maturity Benchmark Report sheds light on developments across the value chain – from business development and sales to internal operations and technology adoption.

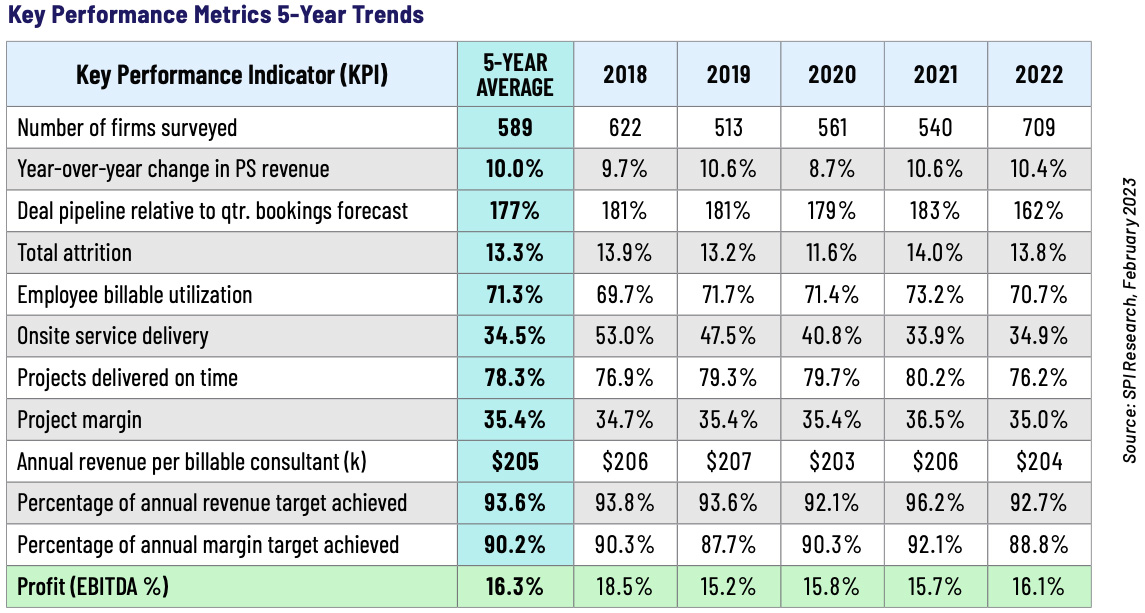

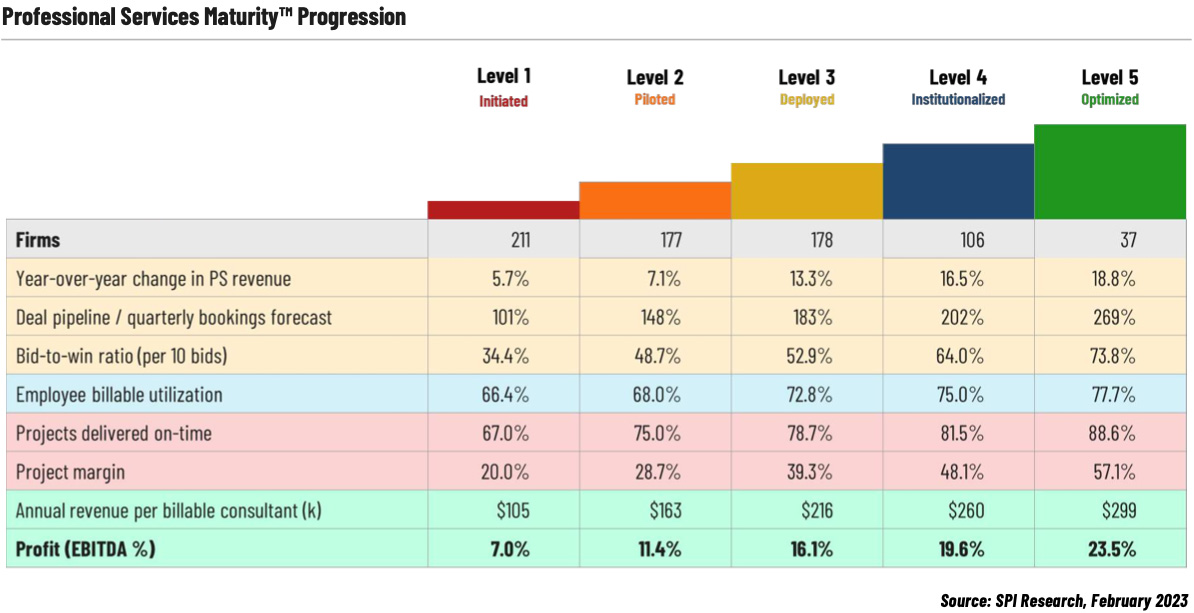

Over 150 key metrics are tracked, including revenue change, billable utilisation rates, new/recurring client percentage, project margins, profit, employee attrition, and use of project-based ERP / PSA systems.

A return to normality

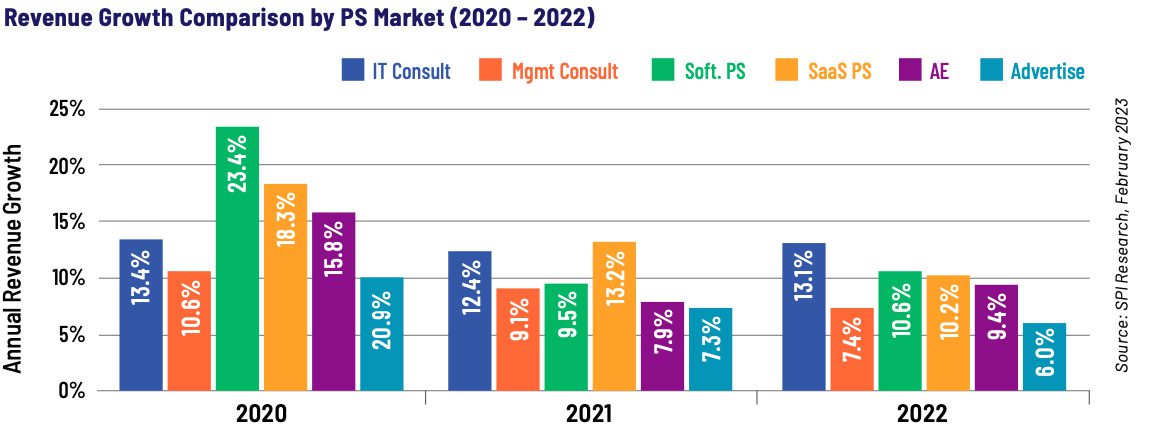

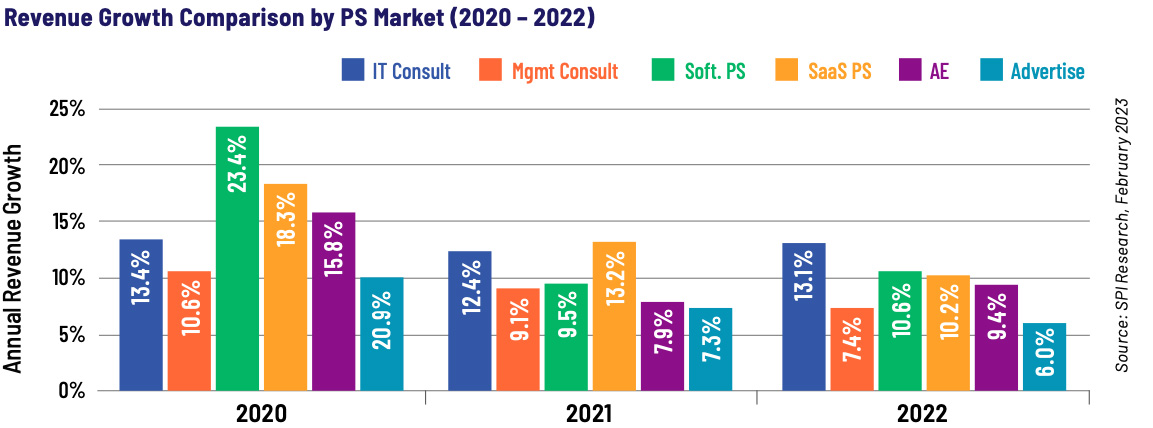

With the lockdown era now fading into memory, the latest edition of SPI’s benchmark marks something of a return to normality. According to Hofferberth, firms have reported stability in revenues and profits – keeping executives and partners happy – and a stable supply of new contracts means those revenues look set to continue.

Having crunched the numbers, Hofferberth predicts that the industry is in better shape than a year ago. “It seems leaders feel better about the increased stability than they did last year. Despite challenges such as economic slowdown and the geopolitical environment, I expect a very good year for professional services.”

That said, there will still be firms which underperform, even in good times. To that end, SPI’s report identified several worrying warning signs for professional services firms in the last year.

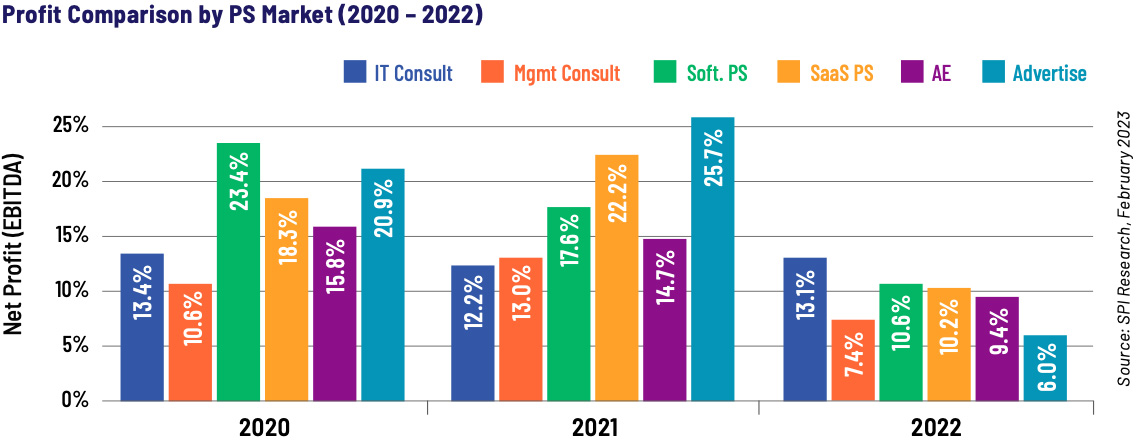

Hofferberth explains, “We saw lower project margins. If profit is stable, that’s great – but project margin is where firms make money, which impacts profits.”

Against a backdrop of rising costs (in professional services, staff represent a relatively large cost base), managing profitability will therefore be a key consideration for leaders, more so than revenue growth.

“We also see a degradation of the delivery trend: standard methodologies for delivering projects were used less, and billable hours for utilisation went down with them. On-time delivery also fell – which is critical for successful projects.”

The same applies to margins: average project margin across the industry dropped to 35%, with the percentage of firms achieving their annual margin targets dropping as well.

Looking back though, Hofferberth recalls that he founded SPI to help firms deal with challenges like these. Formerly a Research Director with Aberdeen Group and a Senior Research Director at Oracle, he already commanded 25+ years of knowhow as a technology analyst and realised that his skills could help firms across the professional services sector – not just software providers or technology vendors – understand where they could improve sustainably.

“I established SPI 17 years ago, and around our logo it read ‘People. Process. Capital.’ The whole purpose was to tell people in the technology space that we already understood what it would need to be used for; it needs to help better manage people, the business processes, and cash flow plus working capital. It is the overall binding glue, communicating what is going well or not well across every pillar of a company, from staffing to technology, to finances.”

The landscape’s diversity

The professional services industry is one of the most diverse landscapes around, spanning engineers, consultants, architects, designers, technologists, and much more and not every kind of professional services firm faces the same issues.

Illustrating this, Hofferberth notes that management consulting tends to be more oriented towards profit, compared to, for example, software firms. They, however, have a business model which has a long-term appeal: recurring revenues, as opposed to the project-based revenue models of consultants.

Meanwhile, the wares of consultants are far less tangible, so their business operates with different focus points. “Consultants obviously want to do a great job,” Hofferberth noted, “but they make money through the expertise that they sell rather than a defined product. This means consultancies tend to be more focused on how they can find efficiencies in their own operations, to extend their margins.”

“In particular, this means IT consultants and management consultants are more technology-oriented when it comes to running their business. Every segment of the industry applies technology, but few are as proficient in the use of ERP and PSA, for example.”

In professional services, all players tend to have well-developed client relationship and selling capabilities. However, as consultancies know their ‘product’ is what they are selling in advice and guidance, rather than something more material like a building, an ad layout, or specific software, they “have to have a little more interpersonal skills than the rest.”

Even with these skills, SPI’s benchmark finds that management consultancies have experienced slower growth and less profit than the overall survey average because ultimately, “it’s just a harder sell.” As a result, the benchmark has seen that many management consultancies are expanding their offerings, using mergers and acquisitions to branch out into other areas.

Hofferberth elaborates, “This is bringing them more work in areas such as outsourcing, training, solutions, and managed services – as opposed to traditional management consulting, which is purely advisory. These areas might be a little less profitable overall because there are more costs at play than traditional consulting, but there are two big benefits.”

Most directly, such business model diversification brings an alternative revenue stream to supplement traditional takings. “If you’re the head of any company, you’re going to need consultants of every kind and are less interested in single-service firms now.” But secondly, by providing an integrated offering, “consultants take away the potential of rivals to shift into their market and eat away at market share.”

Front-facing change

A minority of professional services firms find themselves in the financial position to leverage M&A activity, however. So, how could SPI’s analysis help smaller firms and boutiques improve their bottom lines?

“Many firms simply don’t know where to start. At a minimum, the starting point is to assess their current maturity and compare their performance metrics with the wider market to see where they are underperforming. In practice, we see that many firms just don’t know the numbers. They may know revenue, growth, and profit at the end of the year, but they don’t really get into the devil in the detail.”

Of the many metrics to run a business, Hofferberth suggests firms need to know, ‘are we using our billable utilisation well’, ‘have we delivered on time’, ‘have we surveyed clients to understand their level of satisfaction’, ‘what does our bench look like’, ‘do we have too much of one skill and not enough of another?’”

In the consulting sector, while the back-office tends to be well organised, it is often the commercial side of things where opportunities emerge. “And that’s where firms make their money.”

“If a firm came to SPI and asked us why they were struggling to grow profit, the first point we would look at is how they are generating their business. Then, we look at how they deliver services and projects,” Hofferberth says, focusing on high-margin activities.

Looking ahead, Hofferberth also recommends that consultancies use 2023 to look at profit margins through a longer-term perspective. He warns that understanding it only as a short-term goal can see firms overwork employees and overcharge clients to make more money in the immediate future – but that profit won’t be sustainable.

The SPI founder also warns for complacency at a time of major opportunity, but also major change and risks around the corner. “A lot of firms look at last year’s profit and say ‘we’re fine’ – but that’s not enough. Consulting’s outlook can change rapidly, and revenue metrics have short cycles. You must benchmark yourself against others and continuously learn from the leaders in the landscape.”

Want to find out more? Join the SPI and Deltek webinar

On Wednesday, 24th May, Dave Hofferberth will dive deeper into specific European market trends in the upcoming Deltek webinar. He’ll review professional services firms’ priorities concerning growth and profitability, emerging technologies, and future trends. Attend the webinar via this link.