The number of UK firms issuing profit warnings increased by 50% over 2022, according to a new study. Record levels of companies cited rising costs in the statements, suggesting that as inflation continues to hit the economy hard, things may get worse in the following 12 months.

2022 was a far cry from the economic boom many experts forecast. Bottled up demand, and a determination to make up for lost time after the lockdown months translated to very little indeed, as Covid-19 continued to leave a large portion of the workforce unable to work, while stagnant wages and massive inflation drastically reduced consumer spending power. Exacerbated by war in Ukraine, which drove up the costs of fuel and daily essentials, growth slowed to a trickle – and with HMRC’s pandemic-era debt recovery well under way, many firms found themselves bracing for the worst.

As a result, half way through the year, research from EY-Parthenon had already found that the number of businesses announcing profit warnings was spiralling in early 2022. And as 2023 gets underway, the firm has updated its research to show that the second half of the year hardly made for a convincing recovery.

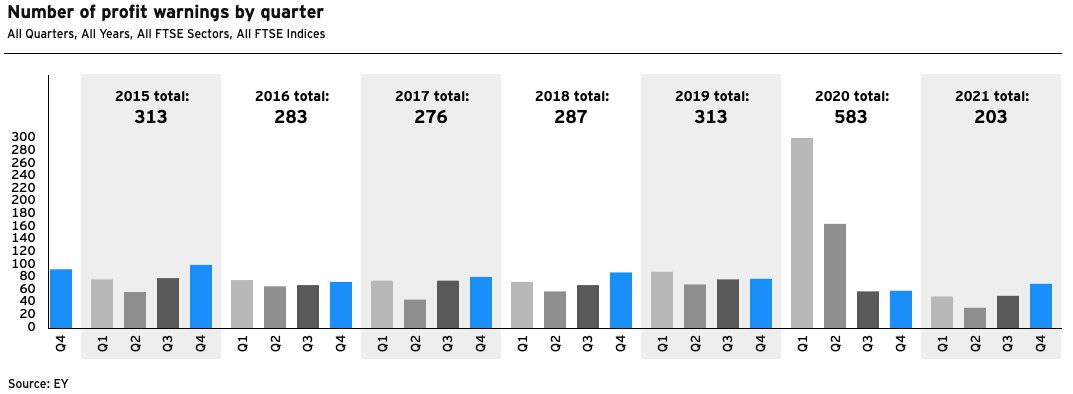

A profit warning is a statement issued by a company advising the stock market that profits will be lower than expected. In the first half of 2022, UK-listed companies put out 136 such warnings – a rise of 66% on the number over the same period in 2021. In the end, UK listed companies issued a total of 305 profit warnings for the whole year – a 50% rise from 2021.

Jo Robinson, EY-Parthenon Partner and UK&I Turnaround and Restructuring Strategy Leader, said, “2022 was a challenging year for UK companies with rising operational costs, changing consumer behaviour, and the cost-of-living crisis having an acute impact on consumer-facing sectors.”

According to EY-Parthenon, many profit warnings noted that inflation was having a more direct impact on business ecosystems, too. Half of the warnings issued in 2022 were due to rising costs – double the share in 2021 – and as this inflation shows no sign of slowing, stress is spreading into other areas of the economy, such as industrial sectors. These saw the biggest rise in warnings in the final quarter of 2022, with cost pressures passing through supply chains.

Looking ahead, Robinson added, “Forecasting and planning will remain challenging in 2023. The UK is set for a deeper recession than previously thought. For many management teams it will be the first time they have contended with this extent and complexity of challenges. Companies need to ensure they are scenario planning and have a clear understanding of how their business will adapt under different conditions, particularly as accessing capital to plug funding gaps is becoming harder.”