Despite facing a healthy outlook, professional services firms – large and small – face increasing pressure to transform and change, according to the latest Professional Services Benchmark by Pierre Audoin Consultants, commissioned by Unit4.

The report paints a picture of a largely healthy sector with some two million professional services-based firms operating across Europe.

While the sector – which consists of among others consulting firms, law firms, merger & acquisitions specialists, tax advisory firms, and engineering consultancies – is hardly alone in having been changed forever by the shocks of the past two years, it appears to be successfully transforming and in a position to help others do the same.

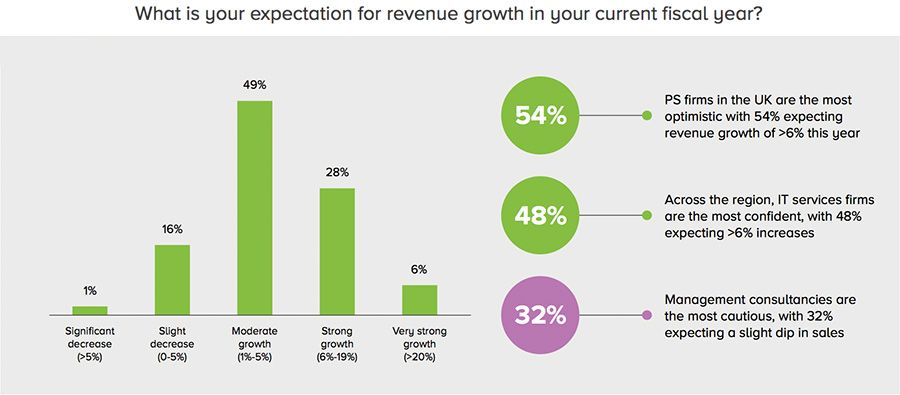

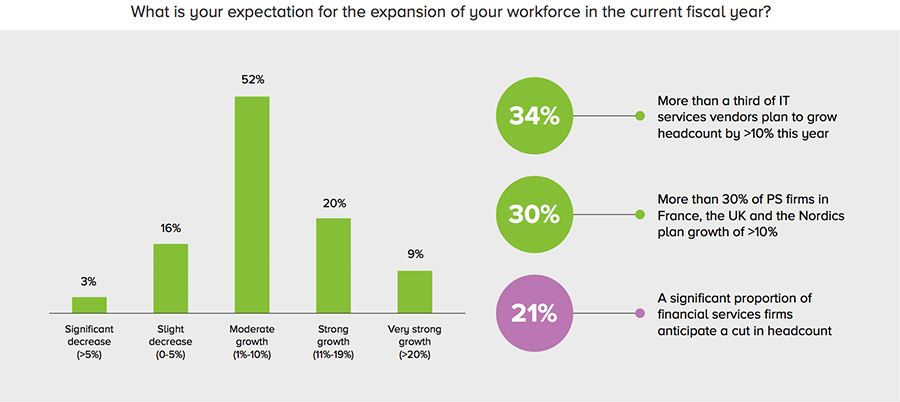

More than half (56%) of the 250 respondents surveyed said they expect to see growth of up to five per cent and a further quarter expect even more growth. Many (50%) are dependent on new logos as business continues to be disrupted by well-heeled start-ups with little to no legacy IT infrastructure and more than four in five (81%) firms are hiring.

But it’s not all plain sailing for industry players. Just as others are re-engineering working patterns, revamping commercial models and becoming accustomed to changing client needs, professional services is itself going through a period of massive change.

Legacy processes and technology can be a challenge in this regard. “Legacy processes and technology are holding firms back with 71% seeing these as a barrier to dynamic change and innovation,” said Mark Gibbison, a leader at Unit4. “The shackles of legacy systems may be deemed even more important at a time when 40% of the services sector looks to mergers and acquisitions to be a leading source of growth.”

“With acquisitions, success is predicated on being able to bottle the right formula for integration. Often, firms will take a ‘softly, softly’ approach where the acquired concern is left largely untouched for an interim period, but even here, if tracking, billing and utilisation or other key performance indicators aren’t harmonised then companies may be riding for a fall or at least they will struggle to monitor appropriate metrics accurately.”

Legacy IT is also indexed to client satisfaction. “As more professional services organisations proffer risk/reward shared-value models rather than old, time and materials perspectives, they are also risking disappointing clients in what remains a highly competitive sector. At a time when innovation and transformation are watchwords, it sends out wrong messages if companies are clearly being pegged back by old code and clunky systems.”

For the employee experience, the situation is not much different, said Gibbison. “Consultancies that are stuck with old tools will struggle to inspire their people as a generation reared on cloud, mobile and outstanding user experiences won’t want to go back to the dark ages of creaking client/server systems and menus of never-ending lists.”

In a buoyant sector where employees “have their pick of employers”, firms will need to ramp up their focus on “wellbeing, staff satisfaction and providing the sorts of continuous learning, work and career prospects employees want,” emphasized Gibbison.

The warning comes at a time of strong competition for talent. Indeed, the report by Pierre Audoin Consultants found that workforce attrition is a large (and growing) challenge for industry players, with 30% saying they suffer under the burden of 20% churn and 60% seeing over 10% churn.

“Professional services firms will have to go the extra mile to find and (even tougher, still) retain people. They will need to think outside the box here. While it’s understandably fashionable to read the runes of what a younger generation wants, they also need to be considering the value of mature workers and coaxing experienced people to stay on or return to work on terms that suit them such as part-time roles,” said Gibbison.

“We can’t go back to the bad old days of four-fifths of consultants’ time being spent on the road now that we know how productive we can be in the remote/virtual world. A cocktail of strong IT, HR and culture will surely help.”

Looking ahead

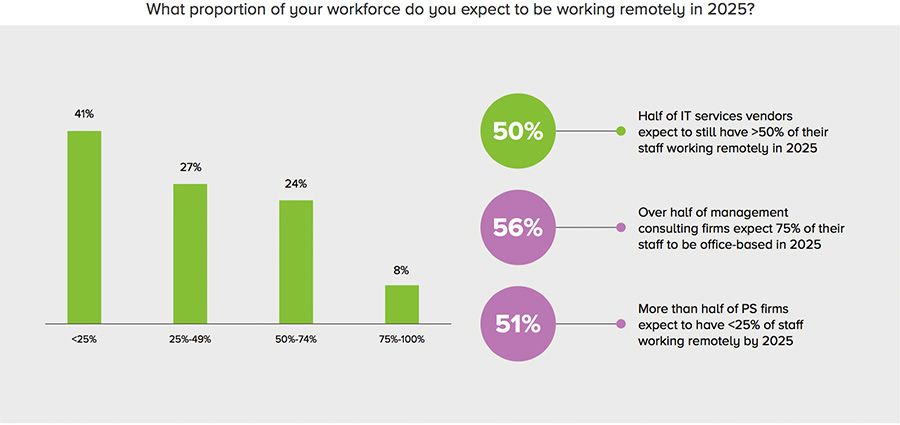

Looking ahead, the Professional Services Benchmark suggests that reports of the death of office-based work have been overstated. Most European professional services firms say they expect the 50% proportion of remote working to stay flat through 2025. And while there is some scope for estate rationalisation, only a minority (38%) spy a chance to downscale facilities through this timeframe.

“Finding hybrid models that work and are supported by IT tools and systems could be another opportunity for competitive differentiation,” said Gibbison.

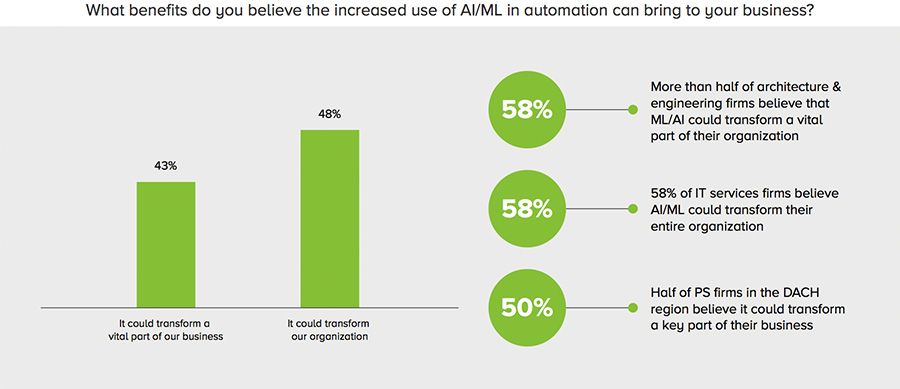

The report earmarks artificial intelligence as a game-changer, with almost half (48%) of respondents saying it has the power to transform their organisations. “Today, many CIOs report a stop/start sort of progress, but it may be those that accelerate and get through those bumps will be best positioned to succeed.”

Gibbison concluded, “As we all hope for a return to prosperity and a doubling-down on innovation to combat the challenges before us, professional services firms need to modernise themselves to be best positioned to aid others to do the same. That requires being willing to practice what they preach to clients by embracing the dynamic of more hybrid working and the knock-on effects of that.”

“This could lead to very different organisational structures and ways of generating revenue, but those who fail to meet this disruption head on may themselves become disrupted.”