The UK professional services market is increasingly upbeat about its prospects, with a new survey finding 88% of leaders expect to grow contract activity over the next year. At the same time, most firms insist they will grow their headcount over that period – even as some of the market’s leading players announce large numbers of layoffs.

Confidence of mid-market leaders in the professional services sector has continued to rebound in the first half of 2023, after economic challenges saw it fall at the close of the previous year. The industry’s leaders now see strong prospects, but challenges still remain amid an uncertain economic picture.

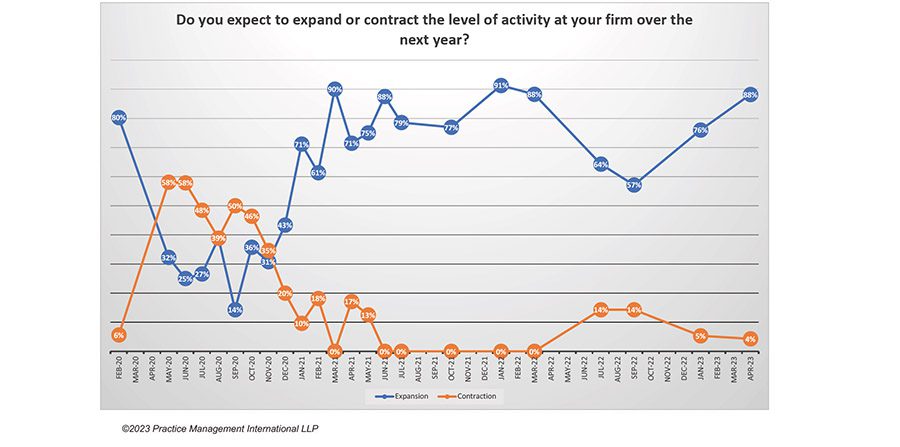

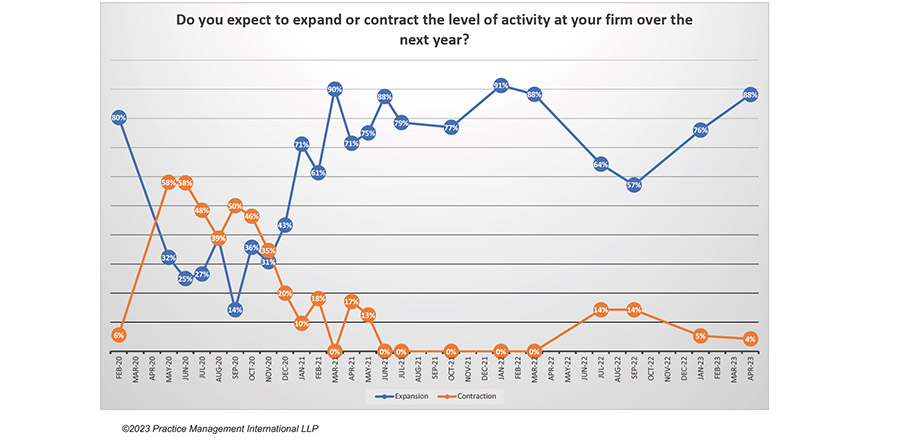

Looking to explore the hopes and fears of the professional services sector in more detail, each calendar quarter, the Managing Partners’ Forum asks a selection of 75 leaders for their opinions on the professional services market. The respondents – who mostly come from mid-sized professional services firms across the UK – are surveyed to see which project expansion, and those projecting contraction. Excluding those who predict no change, a net confidence score is then generated.

According to the latest research, confidence in the key indicators of businesses continues to ride high. An 88% majority said that they expected revenue-generating activities at their firm to grow over the coming year – up 12% from the start of the year, and the highest level of confidence since Russia’s military occupation of eastern Ukraine in early 2022.

The uncertainty caused by the invasion saw confidence plummet over the last 12 months, hitting a low of 57% in the third quarter of 2022 – when the UK’s disastrous autumn budget also sent markets into shock. The number of firms predicting a fall in activity has fallen steadily since then, though. Having ridden high at 14%, that has now sunk to 4%.

With professional services leaders confident of activity increasing, they also seem steadfastly gung-ho when it comes to hiring. At the start of the year, 74% said they were expecting to expand their headcount, while 13% thought they would contract it. Despite the months since seeing large professional services firms such as EY and McKinsey & Company launch plans to shed swathes of back-office roles, leaders seem even more convinced they will add to their headcount now – with 75% saying they will expand, and just 3% that they will contract.

Richard Chaplin, Founder and Chief Executive of the Managing Partners’ Forum commented, “Our latest quarterly trends tracker of professional services firm leaders suggests they see expanding work pipelines ahead and that concerns about the economic outlook are abating. Yet, tellingly, increasing operational efficiency remains a priority for firms in the year ahead, and skills and margin erosion continue to be issues they worry about affecting overall performance.”

UK unemployment remains near record lows in the UK, of around 3.9%, suggesting that should firms need to ramp up capacity, recruiting will be easier said than done – and may come with hefty premiums. As such, firms are hesitant to decrease headcount to adjust for cooling demand in the short-term – contributing to this insistence that headcount will not decrease. However, if performance metrics decline, and profitability comes into risk, this is liable to change later in the year.

There are already some early warning signs of this trend manifesting later in the year. While employee turnover was cited as the leading constraint preventing leaders from achieving optimal performance in the economic environment during most of 2022, peaking at 71% in September, that has steadily fallen since. Just 25% of leaders said it was their top concern now, compared with 60% of respondents who told the Managing Partners’ Forum margin erosion was now the leading constraint. The factor moved above the poor economic outlook – which saw 14% fewer leaders select it than in the previous quarter – in second, on 52% – and lack of skills or talent, on 45%.