Revenue related to the AWS cloud market is continuing to spike, as the platform now accounts for more than one-third of available market share. Consulting firms are top performers when it comes to capitalising on this – offering the most extensive AWS services across the widest range of international markets.

As a fast-growing subsidiary of internet giant Amazon, Amazon Web Services (AWS) provides on-demand cloud computing platforms and APIs to individuals, companies, and governments, on a metered pay-as-you-go basis. The platform enables clients to grow businesses through alignment with its sales, marketing, funding, capture, and proposal teams.

With the appetite for digital services having boomed during the pandemic, AWS’ cloud products have experienced heightened demand – even after the lockdown era came to an end.

During and in the aftermath of the Covid-19 pandemic, the AWS revenue growth rate has remained between the 30-40%, while in the third-quarter of 2022 alone, it is expected to have enjoyed revenue of $20.5 billion. This represents around 30% year-on-year (YoY) growth.

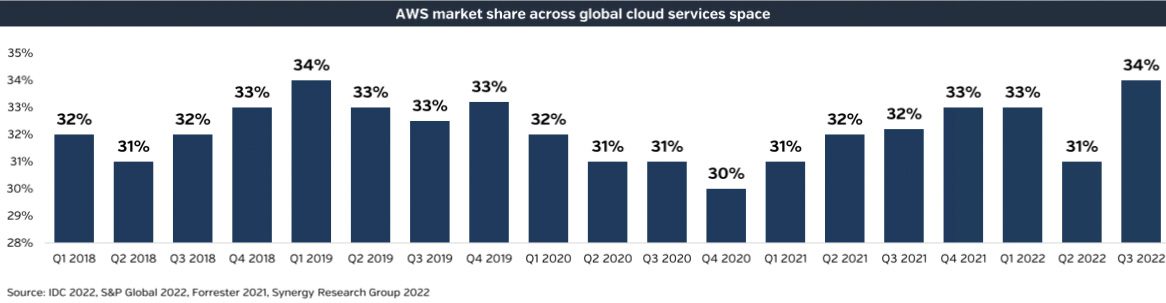

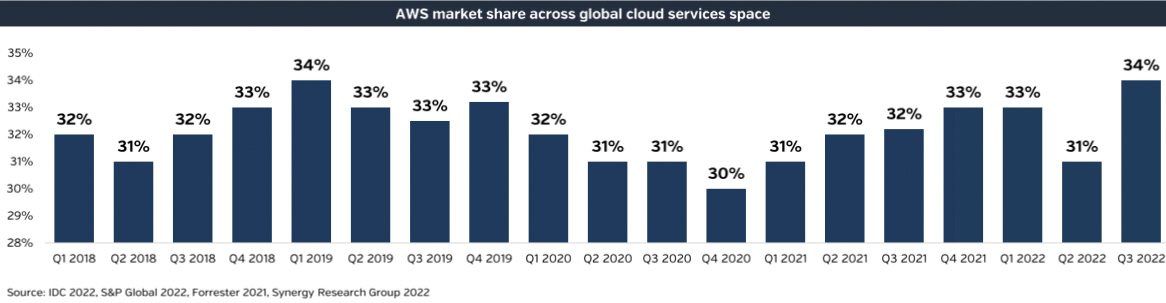

According to a new study from Equiteq, this surge has seen AWS take up a huge portion of overall market share. Since 2018, the percentage has hovered just above 30%, but at the end of 2022, it is spiking to a high of 34% – or more than one-third.

And according to Equiteq, a new partnership between AWS and another major digital firm is set to consolidate its position at the top of the market. The researchers note that AWS’ new ‘bridge partnership’ with Salesforce will see the two cloud technology giants continue to strengthen their positions through collaboration, allowing end-to-end execution of their respective services.

While AWS dominates the cloud infrastructure market, its nearest rival is currently Microsoft Azure, which Equiteq evaluates as being one of a few ‘leading visionaries’ in the sector. The same is the case for Salesforce, which finds itself ahead of a field featuring Microsoft. By collaborating, the pair will enable each other to offer holistic services on-par with the huge capabilities Microsoft has built throughout its history.

In this case, it would make sense for businesses to ramp up their AWS services – in the knowledge many of their clients will likely need support with them in the future. Equiteq’s study finds that while many companies are doing just that, however, the professional services is doing it best.

Evaluating firms in AWS’ extensive partnership network, including competencies, certifications and partner programmes, firms like Accenture, Deloitte, Infosys and PwC were found to offer the top level of service – along with the greatest global presence. This enables them to offer services to companies with international presences more easily.

In particular, Accenture retains its status as the leading AWS partner in the UK and North America, as the company’s largest Global Systems Integrator (GSI). The partnership has proven fruitful, and in 2021 the consultancy picked up a prize for Best Global Expansion at the AWS Global Public Sector Partner Awards, while earlier this year, Accenture and AWS announced an extension of their partnership to support entrepreneurs win investment.