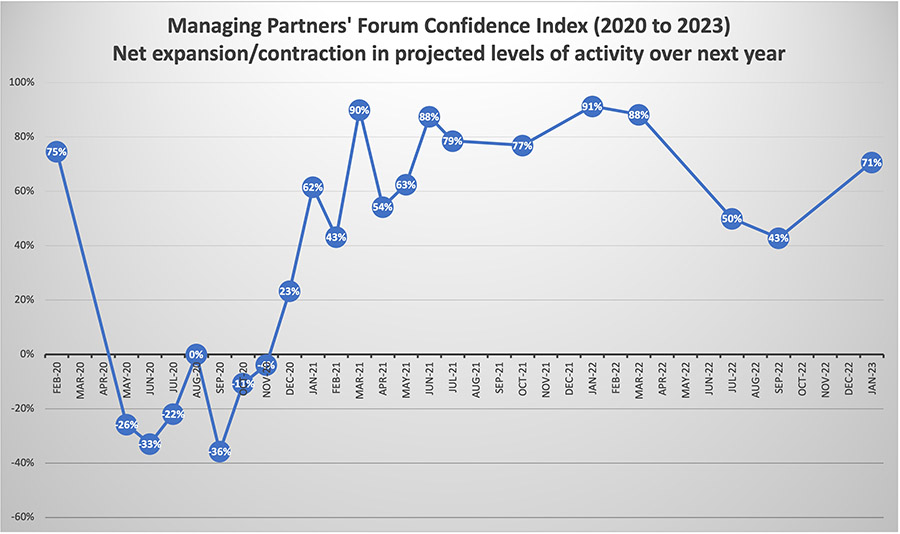

Confidence of mid-market leaders in the professional services sector has rebounded at the start of 2023, after economic challenges saw it fall at the close of the previous year. New research suggests that the industry’s leaders now see strong prospects, while acknowledging that challenges still remain.

Each calendar quarter, the Managing Partners’ Forum asks a selection of 75 leaders for their opinions on the professional services market. The respondents – who mostly come from mid-sized professional services firms across the UK – are surveyed to see which project expansion, and those projecting contraction. A net confidence score – excluding those who predict no change – is then generated.

At the end of 2022, this saw confidence in the professional services market fall to its lowest rate since January 2021 – as the Covid-19 pandemic continued to stifle economic activity. In the months since vaccines steadily returned confidence to markets around the world, professional services leaders became increasingly buoyant – hitting 91% confidence a year later. The short, chaotic term of former Prime Minister Liz Truss, combined with a slowing economy, saw this drop to 43% in September 2022 – but news that the UK has steadied since has seen a rebound in the months since.

Speaking on what professional services firms may be looking forward to, Richard Chaplin, Founder & Chief Executive of the Managing Partners’ Forum said, “The expertise of professional advisers will play a vital role in reviving growth in the UK economy through providing not only compliance services but also commercial advice that supports innovation and growth and helps clients fulfil their strategic goals – for example in relation to environmental and social sustainability.”

Organised by industry body the Managing Partners’ Forum since 2011, the research shows professional services leaders’ confidence in future activity levels, new workflow and headcount growth. As of January 2023, confidence has hit 71% in the sector – though this does not necessarily mean that there are no more worries ahead. Due to the study’s mid-market focus in particular, the firms in question may well face heightened pressures from issues that larger firms are content to ride out. While large generalists can expect to pick up work in rising areas of prominence – such as restructuring – when other revenues like those relating research and development fall, smaller specialists may not have that luxury.

At the same time, the war for talent continues, with a major skills gap reported in relation to digital abilities. The mid-market may struggle to recruit against larger firms in this environment, as they are less able to match pay demands amid the cost-of-living crisis – or to offer the diversity of work and development options that the likes of the Big Four can. These firms need support to that end.

Chaplin added, “While sector confidence has markedly picked up in the last quarter, Government must not rest on its laurels in policy making to support this vital sector. With firms increasingly under pressure from resource constraints, the time is right for Government to address skills shortages through prioritising education in digital and interpersonal skills; clarifying pathways into the sector; and encouraging collaboration between sector firms, education providers, and local government.”

Even so, the number of firms expecting a rise in new contracts grew at the start of 2023. An 81% majority now expects new work flow to expand for the coming year, compared to just 64% in the middle of 2022. Meanwhile the number who expected to add to their headcount also rose, from 54% to 74%.