More than half of potential car buyers are considering the purchase of an electric vehicle, according to a new study. However, this is still proving slow to translate into demand, with fewer than one-in-ten global consumers ultimately plumping for an electric option.

Perceptions seem to finally be shifting regarding electronic vehicles (EVs). For the longest times, consumers and the corporate lobby were hostile to the idea of non-combustion-engine transport, however, studies increasingly show that drivers no-longer distinguish them as ‘different’. Around 69% of one poll said they would expect to merely refer to ‘cars’ when speaking about electric vehicles in 10 years’ time – and this familiarity would finally drive a burst in sales that the technology has been waiting to see.

Earlier in 2022, a study from EY suggested that the purchase of vehicles which were at least hybrid would account for around half of all motoring purchases. Now, research from Roland Berger asserts that full-fat EVs are also set to encounter rising popularity – albeit in muted terms.

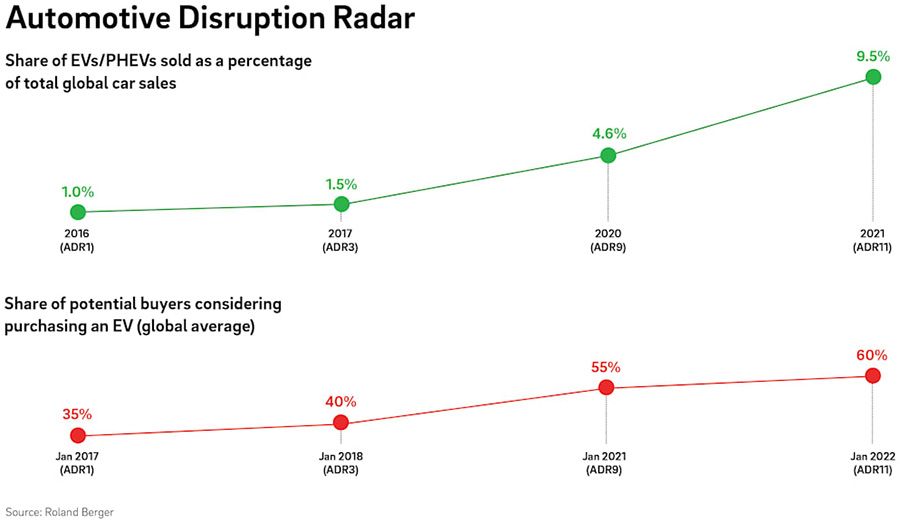

According to Roland Berger’s research, in 2017, only 35% of consumers would consider purchasing EVs – and that has almost doubled to 60% in just five years. While sales have increased, however, they remain disconnected from the alleged intent of shoppers.

In the same frame of time, purchases of EVs have risen from just 1% of global car sales to 9.5% today. While that has given some experts cause to claim the EV market is ‘booming’, it suggests that the majority of those considering EVs for their next vehicle are ultimately not purchasing them. Amid a mounting cost-of-living crisis, it may well be that many consumers – whatever their ethical stance on climate change and consumption habits – do not feel in a position to “pay a premium for sustainability”, as many producers seemingly expect them to. This might be something new companies could pick up on to disrupt – and energise – the EV market, though.

“If the incumbent OEMs do not adapt fast to the new conditions on the market and redesign their business model from both a financial and a technological standpoint, they will find themselves overtaken by the competition,” stated Stefan Riederle, Partner at Roland Berger.

At present, the way things are means EVs tend to perform most strongly in countries where a will to buy ‘sustainably’ could be matched with higher median incomes. Norway is far and away the biggest market for EVs on this basis, with sold units rising from 61.8% of the nation’s car market in 2020, to 76.4% in 2022. Sweden and the Netherlands were the next largest markets in this respect, but neither saw EVs account for a majority of sales.

In comparison, Brazil, India, Thailand, Russia, Indonesia, and Saudi Arabia all saw EV sales languishing at beneath 1% of the market. Meanwhile, though the UK is currently boasts the fifth-largest market share of EV sales, at 16%, its rate of growth is slow – possibly due to the sustained economic hardship its consumers have undergone – and will almost certainly be overtaken by China in the next two years. There, purchases of EVs rose from 5.6% to 14.5%. According to Roland Berger, however, with so much room for growth still available, any one of the EV markets could explode into a leading position over the coming months.

Looking ahead, Wolfgang Bernhart, Partner at Roland Berger, noted, “Even though many countries have made progress, we are only just beginning to reach an inflection point for modern mobility. The task now is to take existing technologies to the next level. The automotive industry should take this challenge as an opportunity to build competitiveness for the future. The customer demand is there. Automakers that act fast can power ahead of their competition.”