Half of business leaders maintain their economies are not on course for recession, in spite of reams of evidence suggesting otherwise. And while some firms plan to curb costs – including reducing investment on sustainability and cloud technology – many more hope to pivot their business to see out any slowdown.

With stagnant wages and record high inflation crippling consumer spending power across leading economies, GDP growth is expected to grind to a halt in 2023. In the UK, a technical recession consists of two consecutive quarters of negative growth – so while 2022’s third quarter saw a 0.3% contraction, surprise 0.1% growth in the final quarter means experts are reluctant to declare a recession yet. However, it is widely acknowledged that one will occur by the middle of the year – as is the case across much of the world.

In spite of this, a new survey from Capgemini has found that even in the face of historic economic headwinds, many organisations do not believe a recession will occur. Overall, 50% of global respondents said their economy was either in recession, or would enter one in the next six months. In the UK, this was slightly higher, at 53%, but that still suggests 47% are quietly optimistic.

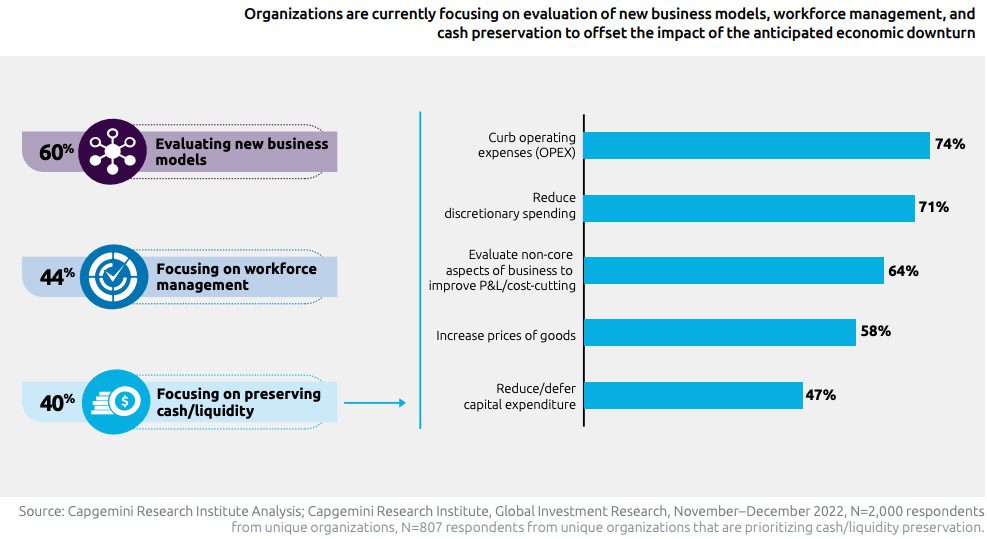

While business leaders’ investment habits are broadly in line with this assumption, too. Of 2,000 respondents from organisations with revenues over $1 billion, across 15 countries, the vast majority were exploring new business models, rather than cuts.

Some 40% did say they were planning to preserve cash liquidity. Of this, a 74% majority said they were looking to curb operating expenses, while another 58% said they would increase the price of their goods – suggesting inflation may continue to bite through 2023. A larger 60% said they were evaluating new business models, though.

Capgemini CEO, Aiman Ezzat, commented, “Global business leaders are focusing their investments on the areas that will continue to drive their business transformation. They should seize the opportunity that technology offers, not only to make their business more efficient, sustainable, and resilient, but more importantly to enable long-term growth opportunities.”

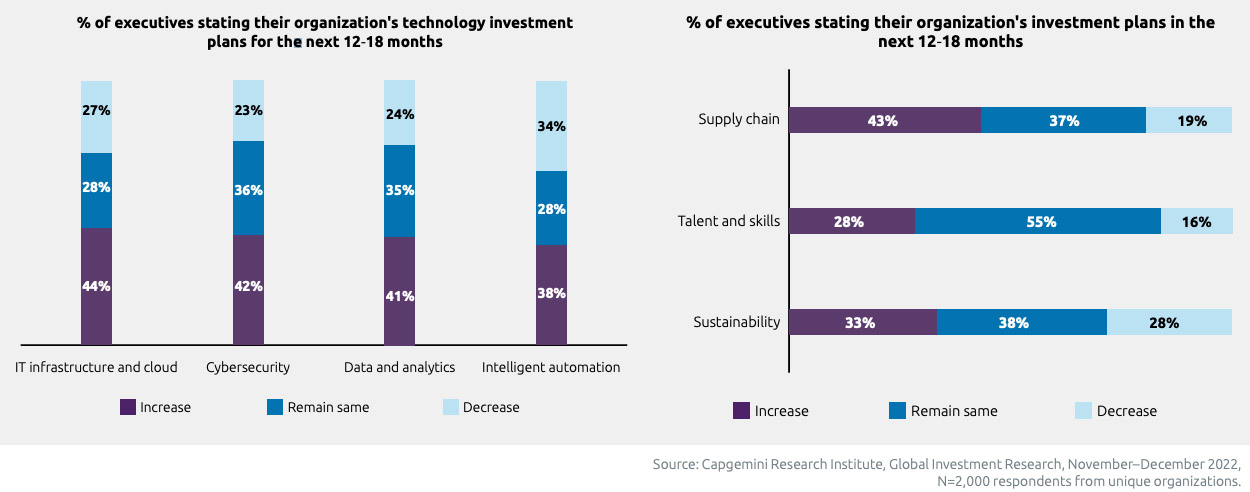

In particular, firms look set to boost their spending in digital lines of work. Majorities said they would maintain or increase spending on IT infrastructure and cloud, cybersecurity, data and analytics and intelligent automation in the next 12-18 months. In particular, 44% of firms were committed to increase IT infrastructure spending.

At the same time, firms are committing to strengthen the fundamentals of their organisations. In particular, with supply chain disruption persisting through the last year, 43% said they would spend more to optimise their supply chains. At the same time, with the war for talent continuing, only 16% of companies said they would reduce spending on talent and skills – the lowest number across the categories evaluated.

Not all lines of expenditure seem to have been ring-fenced in the same way, though. A 34% chunk of executives said they were considering a decrease in investment on intelligent automation, in spite of its potential benefits. And sustainability is on the cards to be cut according to 28% of executives – even as investors warn they may divest in firms underperforming on ESG grounds. Both fronts could prove costly to companies if they need to secure funding in the coming months.