Nearly one-in-ten European corporates are in distress and in need of a turnaround, according to new research. On top of this, one-fifth of corporates have a weak balance sheet, with the consumer, healthcare and manufacturing sectors experiencing the highest stress levels – suggesting the number in distress may rise further in 2023.

Companies across Europe are coming under increasing pressure – as the continent’s economy continues to flirt with recession. With limited prospects for growth, and rampant inflation still crippling consumer spending power, many firms are being pushed to the brink of insolvency.

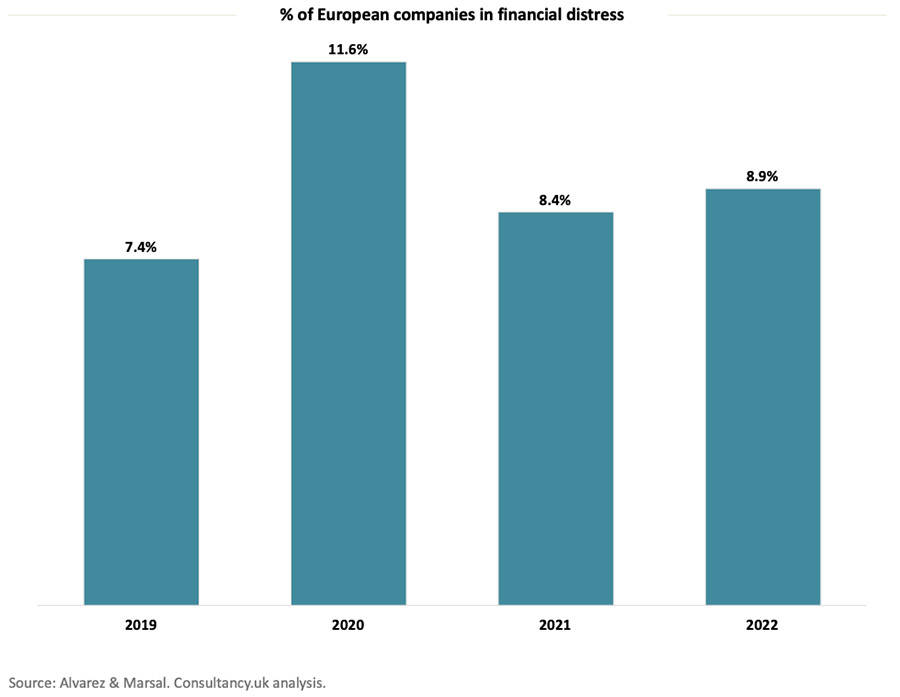

According to a new study from global professional services firm Alvarez & Marsal, the number of distressed companies needing a turnaround in 2022 grew to 8.9%. The study saw A&M analyse the financial performance and balance sheet robustness of more than 4,400 companies across Europe, and found that such cases were on the rise once more – having briefly declined following the relaxation of lockdown rules.

In the early stages of the pandemic, the number of firms in need of turnaround work rose steeply – with the sudden absence of footfall for customer-facing businesses seeing many suddenly facing a cash-flow crisis. The number of companies in distress rose to 11.6% in that context, before falling slightly to 8.4% in 2021.

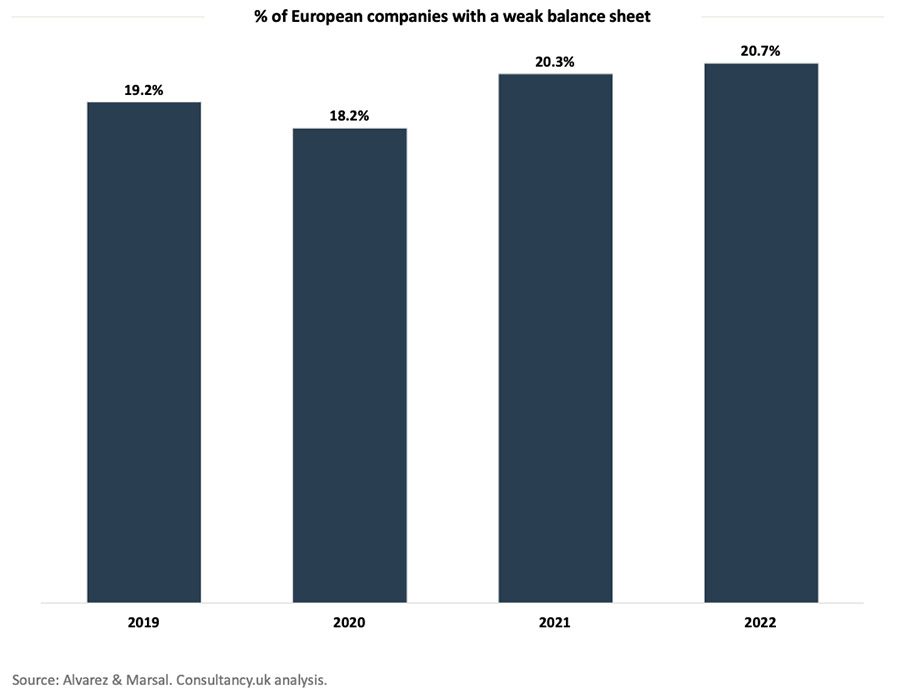

Now, the figure looks to be on the rise again – and while 8.9% is still not as bad as was seen at the height of the pandemic, it is still higher than 2019’s 7.4% – which was hardly a time of economic strength either. At the same time, in both 2019 and 2020, the number of businesses reporting weakened business sheets was lower – suggesting worse may be still to come in 2023.

Paul Kirkbright, Managing Director and Head of Financial Restructuring Advisory at A&M, said, “Covid support measures and high levels of liquidity have kept troubled companies afloat for an extended period, but the tide is turning. Many have debt maturities in 2024 and Boards now face the new reality of inflation sapping consumer demand, disrupted supply chains, higher interest rates and more cautious lenders. Our advice both to corporates and lenders is to start talking and taking action now to avoid a more severe restructuring scenario in the medium, or even near, term.”

In 2019, A&M found there were 19.2% firms with a weak balance sheet – and amid the 2020 financial year that actually fell to 18.2%, partially due to governments offering furlough grants and maintenance loans to keep companies afloat in the early pandemic. This rose to 20.3% however, as repayment for those loans began, and tax authorities began chasing outstanding amounts they had pushed back in the lockdown months. At that stage though, firms were operating on the assumption there would be an economic recovery post-lockdown, something which makes the rise of weak balance sheets to 20.7% in 2022 especially ominous.

The downturn was worse still in specific segments of the market – in particular, consumer companies such as electronics and home and furniture stores, as well as hypermarkets. These have seen a 72% increase in distress year-on-year, caused by a marked reduction in consumer spending as a result of the cost-of-living crisis, plus higher operating costs. Meanwhile, the proportion of healthcare companies in distress rose by 47% between 2021 and 2022, while distress in manufacturing rose by 39% in the same period, caused by rising energy prices and supply chain disruption weighing on profitability.

Despite rising levels of distress, however, A&M suggested there were also “some bright spots emerging”. In particular, the number of travel, hospitality and leisure businesses in distress has declined by 63% in the period – having booming amid travel restrictions. This reflects the strong sales rebound last year on the back of pent-up tourism demand. The continued cost-of-living crisis may yet put strain on that industry too, however, meaning liquidity may still decline in hospitality too.