Economic and geo-political instability mean a massive relocation of global trade is on the cards. Organisations which prepare now could see major benefits to their bottom lines – but the majority of organisations are underprepared to handle supply chain disruption, according to a new report.

Research from Capgemini suggests that 25% of global trade is set to relocate in the next three years. According to the consultancy, the geographical distribution of supplier bases is set to transition from majority global to local by 2026 – reversing a 57:43 split.

The geographical distribution of manufacturing will undergo a similar shift, too. With geo-political tensions between the US, China, Russia and the Middle East reaching new heights in 2023, many supplier and manufacturers are having to adapt their operations to avoid disruption – even as they struggle to recover from the massive supply chainuncertainty wrought through the pandemic.

Businesses must also adapt their supply chain strategies accordingly, then. Amid this sea change in where materials are sourced, and products are created, firms must plan ahead, to avoid being caught out. According to Capgemini, firms which succeed in re-strategising now may even win leading positions in their respective markets.

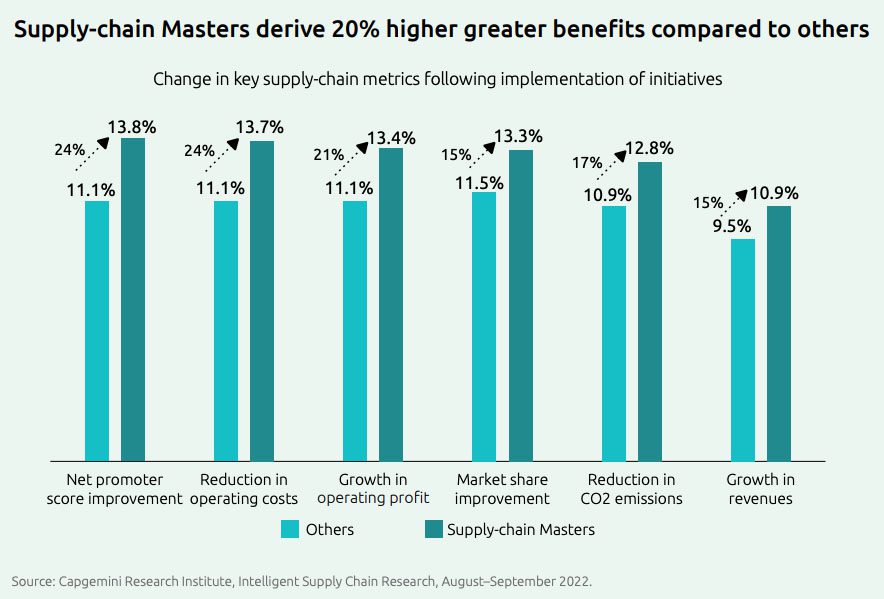

So-called supply chain masters derive 20% higher benefits from their supply chains, compared to the broader economy. Capgemini found that in particular such leaders enjoyed improved net promoter scores of 24% higher, and a reduction in operating costs of 24% more than the average firm.

As the global economy heads into recession, and a huge swathe of firms suddenly find themselves scrambling to find efficiency savings, this kind of headroom could be a life-line for some companies. At the same time, supply chain masters enjoyed 21% higher growth in operating profit, and an extra 15% boost in market share – something which could help them build a sustained advantage when the economy commences its recovery.

In spite of this opportunity, however, Capgemini found that many firms have been sluggish when it comes to building supply chain resilience. Even though warnings that failing to pay attention to supply chain strategy could come with huge costs – throughout the Covid-19 pandemic, war in Ukraine, the climate crisis, and record inflation – somehow, most are years behind where they need to be.

For example, 94% of organisations polled by Capgemini said that failing to secure customer and supplier market access would be ‘high business impact’, but only 11% identified as having the ability to address that. Similarly, 66% said being able to deploy pandemic-proof, agile planning and execution could have ‘high business impact’, but just 11% would be able to do so.

“The last few years have highlighted the need for organisations to build agile and resilient supply chains, not only to cope with disruptions but also to help them stay ahead of the curve, especially from a sustainability perspective,” commented Mayank Sharma, Global Supply Chain Lead at Capgemini. “It is clear that there’s no one-size fits all solution, but organisations that lay the foundation for a data-driven, technology enabled, scalable, and sustainable supply chain are the ones that will reap the most impressive returns in terms of driving improved customer loyalty, creating more business value and meeting sustainability goals.”