One-in-eight of the world’s central banks have considered launching a central bank digital currency, according to a new study. However, major economies remain cautious of adopting the new technology, citing fears of money laundering, fraud and the potential funding of violent crime.

Cryptocurrency is a digital payment system that doesn’t rely on banks to verify transactions. It’s a peer-to-peer system that can enable anyone anywhere to send and receive payments. Like any currency, cryptocoins are only worth what investors are prepared to believe they are worth – but the amount of belief invested in these mechanisms is surging on all fronts at present. With this being said, however, the amount lost to scams involving apparent cryptocurrencies also continues to spiral – and exacerbated by the inability to police the crypto-space, this has led to the market’s famous volatility rendering values so unstable that crypto still has no practical use beyond speculative investment.

Increasingly, crypto-evangelists are touting state interaction with the digital currency market as a means to stabilising it. Of 150 decision makers at financial institutions recently polled by FTI Consulting, 56% anticipated there would soon be increased traction on Central Bank Digital Currencies (CBDCs). With the digital Euro among state projects suggesting central banks may be set to enable the general public to make digital payments, this factor is seen as having a potentially greater impact on financial services than any of the other traditional hype factors surrounding crypto or blockchain technology.

Indeed, according to a new study from PwC, the idea of CBDCs is gaining global traction among governments and central banks. The Big Four firm found that 80% of all central banks globally had considered launching a CBDC, or had already done so. CBDCs are a kind of ‘stablecoin’, and their widespread roll out could transform the prospects of cryptocurrency as a practical economic asset. A stablecoin is a cryptocurrency designed to have a relatively stable price, typically through being pegged to a commodity or currency or having its supply regulated by an algorithm.

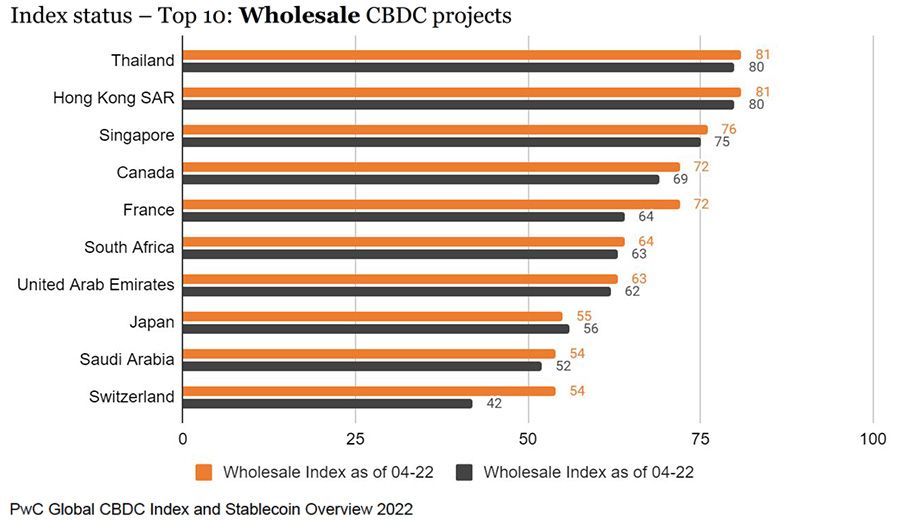

“Wholesale CBDCs have the potential to streamline security token post-trade operations through atomic delivery-versus-payment and increase the market efficiency for several asset classes,” said Benoit Sureau, PwC France and Maghreb financial services risk and blockchain partner.

“The role of the stablecoin in the crypto markets has and will continue to evolve as adoption of crypto increases, forcing a more prominent role of stablecoins across the larger financial ecosystem,” Matt Blumenfeld, director and digital asset specialist at PwC added. “Regulation will only strengthen the importance and give credence to the role that stablecoins will play.”

Caution

However, it should be noted that for all the suggestion central banks were ‘thinking about’ implementing a CBDC, the banks to have made the leap have predominantly been developing markets. Notably, in the UK, the Economic Affairs Committee of the House of Lords trashed CBDCs as “a solution in search of a problem,” while arguing that for all its potential to make cheaper and faster cross-border payments, the technology negated these benefits by presenting significant challenges for financial stability and the protection of privacy.

And while the European Commission currently is planning to propose a bill for a digital Euro in 2023, implementing that bill could take years. At the same time, the European Central Bank’s Governing Council is yet to make a final decision on whether a digital Euro is actually needed. Germany and France have since urged the ECB to speed up this process, citing fears of the Eurozone being left behind by the CBDC trend – but PwC’s data shows why looking before leaping might be prudent.

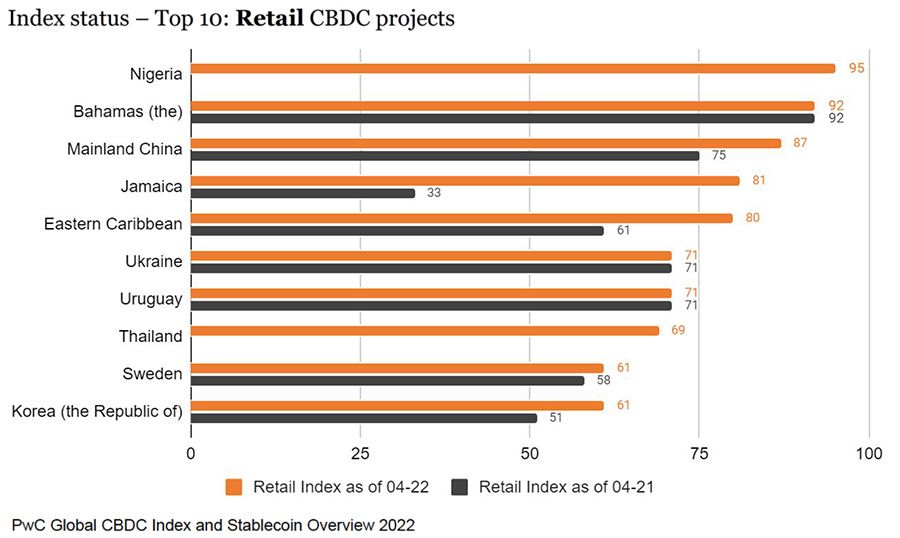

The report identified two categories of CBDCs: retail and wholesale. Regarding retail CBDCs, the country ranking first in its rate of adoption is Nigeria, which launched its eNaira digital currency in 2021. While this saw it become the first African country to take the leap, amid claims it has ‘hit the ground running,’ it experienced glitches with its digital wallet during its launch, and adoption has been well below expectations. On top of this, the International Monetary Fund (IMF) has since claimed that the eNaira could potentially be used to launder money and fund terrorism.

This might not concern the economies which have similarly taken a dip into the CBDC market. The Bahamas, Mainland China, Jamaica, Eastern Caribbean, Ukraine, Uruguay, Thailand, Sweden, and South Korea complete the top ten list, respectively – and the benefit of growing their economies may outweigh security worries. But for markets of greater scale (China being the exception), the risks appear to be perceived as far greater when adopting CBDCs.

With regards to wholesale CBDCs, this trend also played out to an extent. Thailand topped the list for wholesale CBDC developments alongside Hong Kong. The Bank of Thailand and the Hong Kong Monetary Authority launched a joint effort called mBridge, in 2019, focusing on a wholesale CBDC that enables real-time cross-border payments between the two nations.