McKinsey & Company has collaborated with several other companies to launch a new carbon removal investment group. The consortium, named Frontier, will contribute hundreds of millions of dollars to further carbon removal technologies.

As the world’s biggest consulting firms look to bring their industry in line with the global push for net-zero, it has become clear that while their direct carbon footprint is important, it pales in comparison to the amount of emissions firms could cut out of the atmosphere if they worked to help their clients with their own net-zero ambitions.

This saw McKinsey & Company launch a new practice specialising in sustainability and ESG work in 2021. McKinsey Sustainability focuses on building new green businesses and innovations; retiring and repurposing the highest carbon intensity assets; and scaling nature-based solutions by scaling voluntary and compliance carbon markets.

Now, as the firm looks to further promote the greening of the economy, McKinsey has sought to back investment in carbon removal technologies. Collaborating with Stripe, Alphabet, Shopify and Meta, McKinsey has developed an early market commitment in the world of carbon removal technologies, with the consortium of giants reserving a combined $925 million (€850 million) for their efforts.

Named Frontier, the collaboration will function as a subsidiary of Stripe – and will also be funded by the tens of thousands of companies that buy carbon removal through Stripe Climate. This will make Frontier the largest coalition of carbon removal buyers in the world, both in funding and membership.

Funding the future

An advance market commitment (AMC) is a concept initially taken from vaccine development. The first AMC accelerated the development of pneumococcal vaccines for low-income countries, something which eventually saved an estimated 700,000 lives.

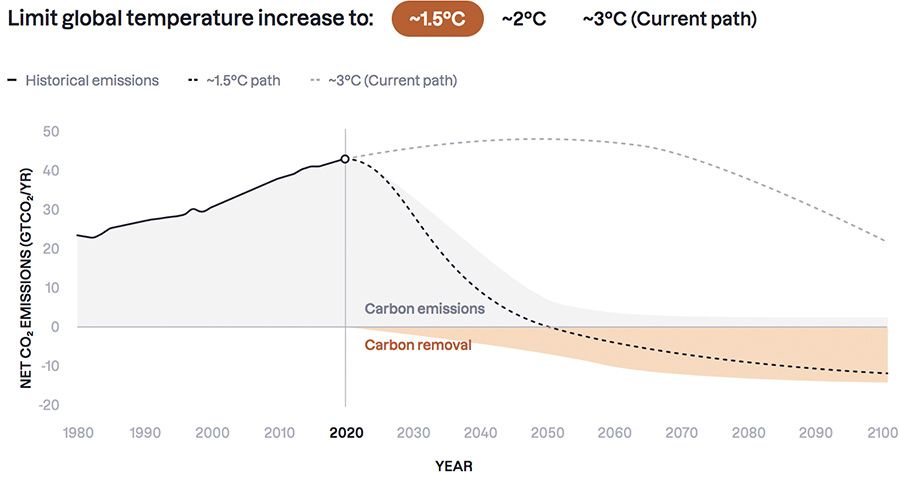

Operating as an AMC, Frontier aims to accelerate the development of carbon removal technologies by guaranteeing future demand for them. This is intended to send a signal to researchers, entrepreneurs, and investors that there is a growing demand for the technologies – providing a profit incentive to encourage the production of carbon removal technology.

While investment from venture capital and private equity is pouring into the climate tech sector, research suggests not enough of it is targeting the reduction of greenhouse gasses – with investors favouring projects they see as providing more rapid returns. Similarly, while sustainability can bring huge benefits to manufacturers, a minority of 11% are scaling their sustainability initiatives at present as they look to improve their bottom lines elsewhere.

To address this, Frontier hopes to deploy solutions from the vaccine development market to carbon removal. While both face uncertainty about long-term demand and unproven technologies, the entity asserts that AMCs have the power to send a strong and immediate demand signal without picking winning technologies at the start.

Nan Ransohoff, Head of Climate at Stripe, said, “With Frontier, we want to send a loud demand signal to entrepreneurs, researchers, and investors that there is a market for permanent carbon removal: build and we will buy.”

“In practice, Frontier’s team of technical and commercial experts facilitates purchases from high-potential carbon removal companies on behalf of buyers. Over time, we plan to open Frontier to new buyers to further increase demand and spur new supply.”

Dickon Pinner, senior partner and co-leader of McKinsey Sustainability: “Our research shows that the amount of carbon removals needed by 2025 to achieve the IPCC’s 1.5°C pathway will be missed by 80 percent, based on the current pipeline of projects. Frontier will play a catalytic role in enabling the supply of high quality carbon removals.”