Workers with the lowest salaries are in danger of being left behind, when it comes to support with their financial wellbeing. While overall, more and more companies have a financial wellbeing strategy, but almost seven-in-ten firms which pay a below-average salary do not offer any such service to staff.

Financial wellbeing is the state which enables a person to fully meet current and ongoing financial obligations, feel secure in their financial future, and is able to make choices that allow them to enjoy life. In the encroaching cost-of-living crisis, it is becoming a foreign concept to many workers – as salaries lag well behind the record inflation currently hitting their pay-cheques.

This makes the efforts of employers to enable financial wellbeing all the more important. Money worries do not stay at home – and if an employee has their mind dwelling on how they might meet debt repayments, rental fees, or be able to buy enough food to feed their household, they are going to be less productive.

Many firms are moving to support their staff through troubled times with a number of offerings. Such strategies go well beyond raising pay, and also include offering first-person financial wellness training and education, creating an employee discount and reward programme, among other items. What a financial wellbeing programme includes, and how effective it is, depends on an array of factors that vary between demographics and sectors, though. As such, according to Mercer, the most important thing to do when building one; is to listen.

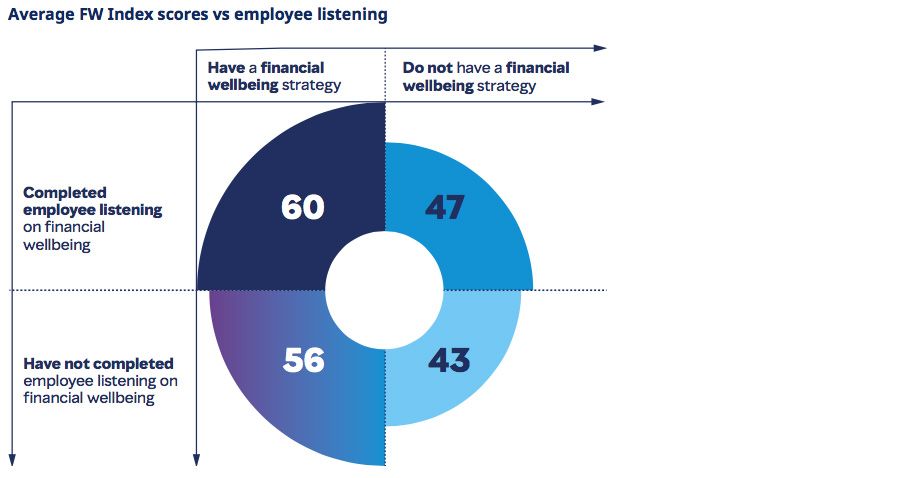

According to research from the consulting firm, a growing number of companies currently deploy some form of financial wellbeing programme. While in 2015, only 15% of organisations had a financial wellbeing strategy, but that has since doubled to 37%, with two-thirds of those planning further improvements. However, a poll of employees from those companies suggests that those efforts are less impactful if organisations do not listen to their employees while developing their strategy.

Failing to talk to staff means many firms may fail to understand how many employees are having difficulty, or how they might be helped. While 11% of firms believe very few employees are struggling, more than double – 26% – know they have many struggling workers; suggesting that if the 63% who currently have no idea either way were to survey their workforce, the majority would find they needed to better support their talent.

Jeremy Milton, Principal and Financial Wellbeing Leader at Mercer, explained, “For organisations to successfully level up and improve their financial wellbeing programmes in 2022 and beyond, organisations must fill that gap in knowledge and translate it into more cohesive and direct actions to build the right financial wellbeing frameworks, solutions and support for their own workforce – and that will enable their employees to be better equipped to help themselves in future, and take more positive steps and actions.”

Worryingly, companies which pay least seem least forthcoming with such support. The broader cost-of-living crisis is seeing the lowest paid are being hit hardest – struggling to make ends meet without, for example, cutting pensions contributions; potentially creating a different crisis further down the line.

At present, the percentage of firms which offer financial wellbeing strategies is highest in firms where the salaries are highest, however. The portion is smallest at firms which pay below average, meanwhile, as less than one-third of such employers cater to financial wellbeing. This risks widening a gulf between the haves and have nots of the wider workforce, and leaving a huge section of consumers in an ever-deepening crisis. There is some cause for positivity in this regard, however, as Mercer did also find that a higher percentage of firms paying lower wages had a debt solution offering. While 38% offered at least one kind, 24% gave emergency pay advances, and 28% operated salary deducted loans.