UK family businesses have bounced back from the 2020 recession, with two-in-five reporting double-digit growth over the last 12 months. If they are looking to keep this momentum going, however, many will need to build trust with their consumer base, as inflation continues to put pressure on spending in the coming year.

A new paper from PwC suggests that a 71% majority of family businesses reported growth in their latest financial year, while 43% reported double-digit growth. Looking ahead, 77% believe that they expect to enjoy further growth in the coming 24 months – but that may be easier said than done, according to the researchers behind the study.

The Consumer Prices Index (CPI) is once again on the rise. While the 12-month inflation rate to January 2023 was beneath the record high of 11.1% in October 2022, it was still well above the normal rate at which companies across the economy decide to increase prices. And further showing that the trend was far from over, February’s 12-month average rose to 10.4%, as firms once again began bumping up prices at an accelerated rate.

Amid this rampant inflation, consumers’ pay – which has generally not kept pace with heightened pricing – is spread its thinnest in a generation. At the same time, the Bank of England has increased interest rates – raising the cost of debt, and making it harder for the average customer to borrow money and maintain their spending on essentials. As a result, family businesses may find it more difficult in the coming months to compete for customers, whose ability to spend continues to shrink.

In this scenario, family businesses may need to re-evaluate their approach to building trust – something which both customers and employees value extremely highly when it comes to interacting with them. Customers expect action from business on social issues, and are more inclined to spend on firms they feel they can trust. This can already be seen when it comes to environmental, social and governance (ESG) policy – something customers take as a key signifier of trustworthiness – with 50% of businesses PwC surveyed that had agreed and communicated ESG strategies saw double-digit growth, in contrast to just 42% of those which were not advanced in this area.

At the same time, with competition for top talent high, amid a talent market in which workers have more choice between vacancies, purpose and trustworthiness have become key methods of attracting and retaining staff. Illustrating the impact this is already playing, a 53% majority of high performing firms had deployed employee incentives, while 52% had boards committed to diversity – and this may grow in the coming period.

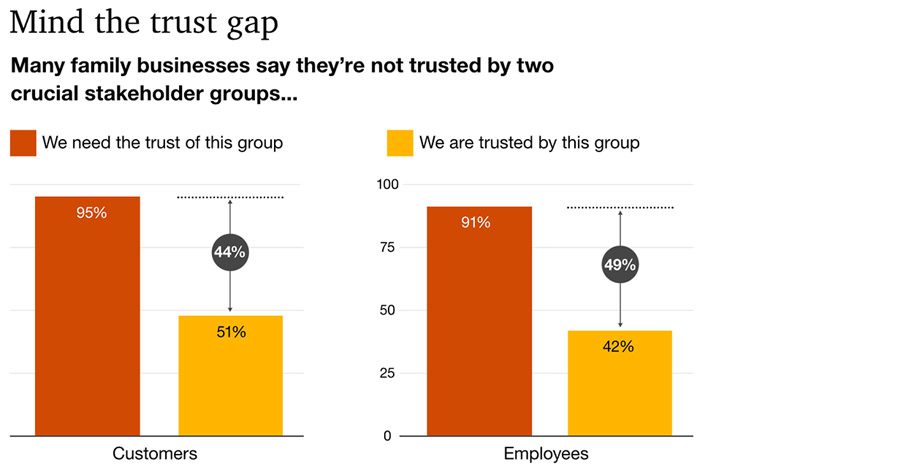

Despite this, many businesses have so far failed to win adequate trust among either group of stakeholders. PwC polled over 2,000 family businesses across 82 countries, and found that 95% of respondents felt they needed the trust of customers – but only 51% had obtained it. An even larger gap was found with employees, where 91% of employers identified the need for trust from staff – and only 42% felt they had it.

Even so, many firms admitted they had not taken the required steps to increase trust. An 85% chunk said they had no clear and communicated ESG strategy, while 84% were apparently unwilling to take a public stance on important issues like climate change. Meanwhile, 79% did not have a purpose statement, or a commitment relating to diversity and inclusion – making it harder for them to attract new talent.

Peter Englisch, PwC Global and EMEA Family Business Leader, concluded, “While market pressures and rising costs mean survival is the main priority for family businesses globally, our latest data shows that those family businesses which are focussed on digital transformation and diversity, are reaping the rewards. Now more than ever, building competence and achieving strong financial performance are linked to corporate responsibility. The message is clear, for family businesses to survive, they must transform. And that transformation is now.”