A capabilities gap, and a lack of board oversight are holding back companies when it comes to delivering their ESG agenda. A new study suggests that 40% of boards cite their own inability to execute ESG policies as one of the key factors holding back progress.

As consumers place ever more emphasis on the importance of sustainability, a growing number of companies are making ESG factors part of their core business strategy. As is so often the case when it comes to businesses walking the talk on environmental matters, however, practicing what they preach is proving to be easier said than done.

At one time or another, regulatory risk, flawed reporting methodologies, and a lack of mid-management buy-in have each been cited as factors preventing businesses making good on their ESG pledges. But a new study from Boston Consulting Group (BCG) suggests that the buck actually stops with the board room. The survey found that while many directors are concerned their ESG drives may fail, they generally lack knowledge of ESG issues, and are not being proactive enough to change that and help their own policies succeed.

“It is critical for boards to move from a compliance mindset when it comes to ESG to bringing a true strategic lens to those issues,” said Ron Soonieus, a Senior Advisor at BCG. “However, many have not yet remade the board agenda to make time for that critical strategic thinking.”

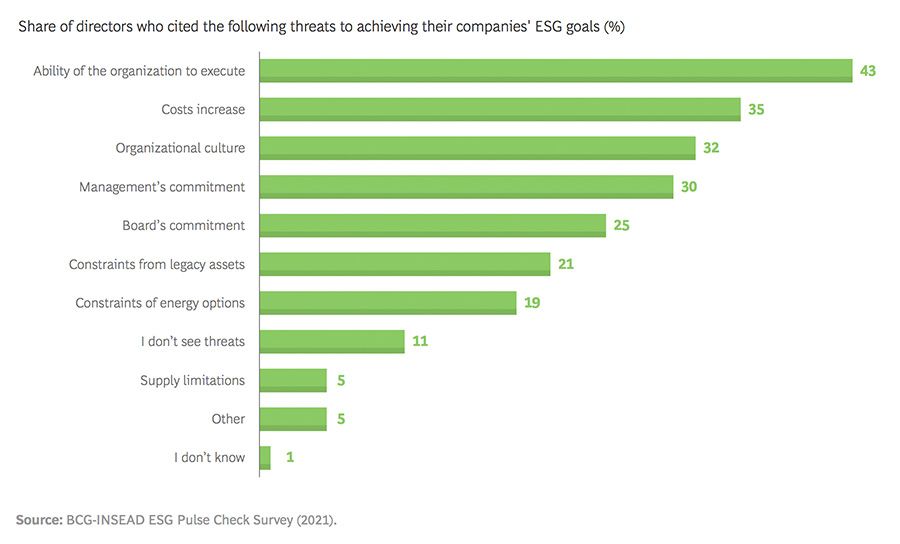

At present, 43% of directors do not believe their organisation has the ability to execute ESG goals. And while 35% suggested cost increases were partially behind this, a similar number stated organisational culture was to blame, or that mid-management was not committed.

In order to change that, boards need to overhaul their corporate governance and corporate strategy, to ingrain ESG within the firm’s DNA. However, around 70% of responding directors told BCG that they were only moderately – or not at all – effective at increasing board oversight on the matter, and so integrating it into the company’s strategy and governance.

Knowledge gap

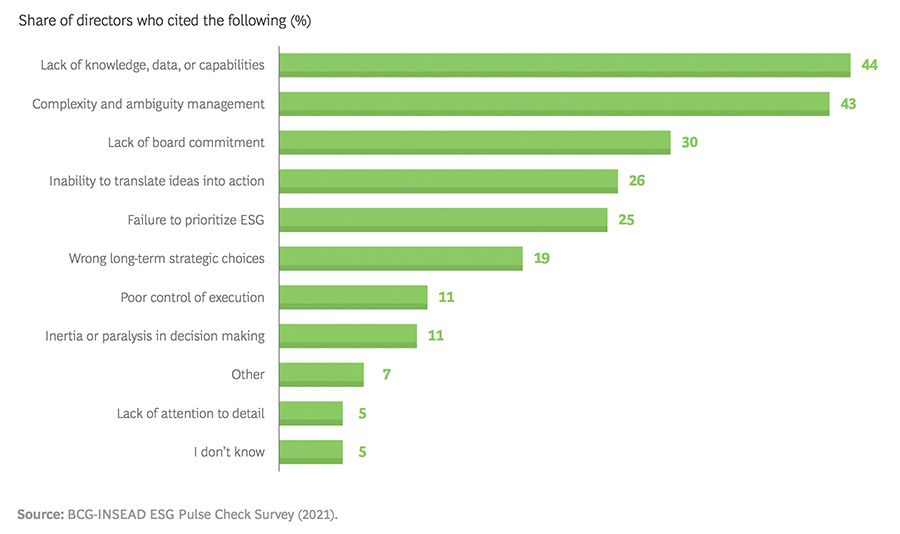

The chief stumbling block for directors in this regard was identified as a lack of knowledge – which 44% of directors said was the case for them. Meanwhile, data, and capabilities as the top barrier to providing effective ESG oversight. Highlighting the importance of this, one director told BCG that while “traditional knowledge and experience remain important,” they believed “one-third of the board should have knowledge and experience in how the role of business in society is changing and what that means for corporate strategy” – without which, sustainability could not be effectively “embedded into board dynamics.”

Boards are taking action to address that gaps, however. Firms are working to supplement board knowledge in a number of ways. These include 48% offering regular updates from an internal executive with responsibility for ESG, and 40% of firms deploying intermittent updates from external experts.

“Directors have significant scepticism about whether companies they oversee can deliver on ambitious ESG targets,” noted David Young, a BCG Managing Director who co-authored the report. “That makes it more critical than ever that boards enhance their governance of ESG issues, focusing on the matters that are truly material and connected to advantage and value creation for the company.”