While Irish boards are committed to making positive ESG progress, measuring progress remains a divisive issue. One-in-four Irish boards talk about ESG at every meeting, but the vast majority have not linked executive compensation to ESG performance – something which could incentivise much more efficient change campaigns.

A new report released today by professional services firm Diligent on behalf of the Institute of Directors (IoD) in Ireland, has found that 23% of Irish boards also indicate that they discuss ESG at every meeting, while 58% added that oversight on ESG matters is now board level – rising from 46% in 2021.

The poll was carried out among 270 respondents within the IoD membership. But while ESG is now clearly a clear item on the boardroom agenda, many firms have not confirmed on what basis they will prioritise it. At present, 47% do not have KPIs in place to measure progress at all. Meanwhile, of the organisations that have implemented KPIs around ESG, the majority indicated that it was challenging to implement these measures – and a total 79% of Directors in Ireland said they did not currently integrate ESG metrics into the compensation of their executive directors.

The news comes at a difficult time for relations between investors and businesses – and may give further cause for concern to private equity backers already wary of executives on ESG matters. Recent polls have shown a disconnect between the two camps in recent months, as business leaders have earmarked ESG drives for cost-cutting measures amid the economic downturn, while investors say they would be willing to divest from firms which did so.

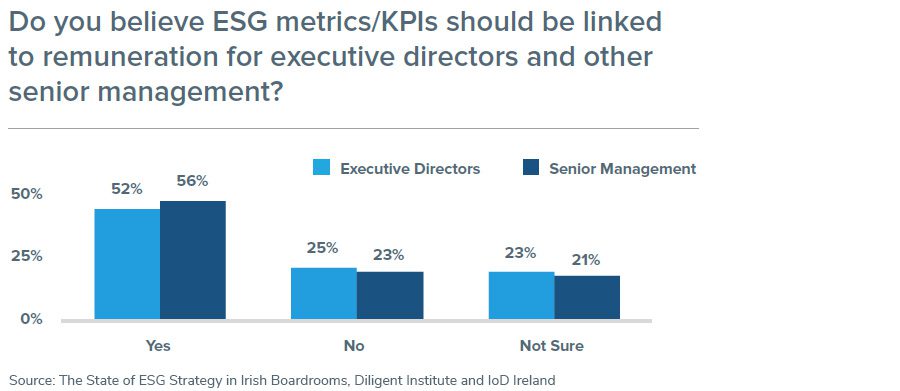

Looking ahead, it seems to Ireland’s Directors are aware of this disconnect, and the need to address it, though. A majority told the researchers that they believe ESG metrics and KPIs should be linked to remuneration for executive directors and other senior management figures – as a way of helping push ESG drives ahead. A 52% chunk of Executive Directors agreed with this, while 56% of senior management went the same way.

Caroline Spillane, the IoD’s Chief Executive Officer, commented, “It is crucial that all directors get up to speed on the essentials of ESG and what this means for their business, their sector and, indeed, wider society. This new research reveals the importance with which ESG is being regarded in boardrooms. Setting realistic and accurate KPIs to measure ESG successes or failures will be crucial in leading to real traction and change in reaching ESG targets.”

At the same time, many companies seem aware that ESG is central to their long-term business plans. When asked to pick the risk and compliance areas they would be most concerned about in the event of a crisis, 20% named geopolitical issues as the top issue, similar to 19% who went for climate disasters.

However, the largest chunk of 22% believed the most important thing was the reputational damage. While this might seem cynical, it also suggests that these group would potentially less willing to scale back of any of the ESG concerns listed – for fear it would count against them with discerning consumers, voting with their wallets.

Speaking on the overall study, Dottie Schindlinger, Executive Director of Diligent Institute, said, “It is positive to see that ESG is becoming increasingly important to Irish boards, but more support is needed to ensure directors are better equipped with the skills and knowledge to oversee an ESG function. With mounting pressure from regulators, investors and shareholders, directors and corporate leaders need access to information that is tailored specifically for them, to help focus on what is important for corporate strategy.”