With sustainability continuing to climb the agenda of institutional investors, firms issuing their shares cannot afford to slack on their climate-related policies. New research suggests investors spend millions each to analyse the climate data of firms independently, before backing them.

Environmental, social and governance (ESG) issues have become increasingly important for society in general. As consumers become more wary of firms which do not meet their expectations, investors are becoming wary of backing firms with poor ESG credentials. As a result, socially responsible investing has grown significantly in recent years through the consideration of ESG factors and has become a megatrend.

Many firms still seem to underestimate how seriously investors are taking this, however. While it is hard to find an executive who would be unwilling to pay lip-service to the importance of these factors, real change on the matter of ESG remains slow. This might be about to change though, as a new study compiled by The SustainAbility Institute by ERM illustrates the extent investors are now using ESG metrics to inform their decisions.

ERM is the largest global pure play sustainability consultancy, and its research completed for Ceres and Persefoni found a yawning gap between corporate issuers (a legal entity which develops, registers and sells securities to finance its operations) and institutional investors. While public firms trading their shares are spending $533,000 annually on climate-related disclosure, institutional investors are sinking an average of $1,372,000 annually into collecting, and analysing climate data, to inform their investment decisions.

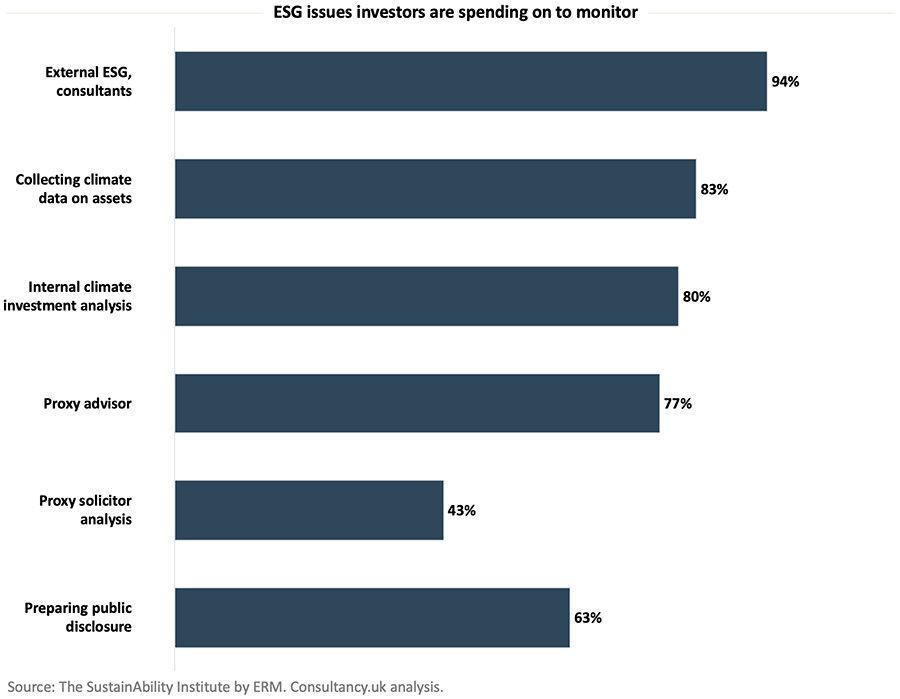

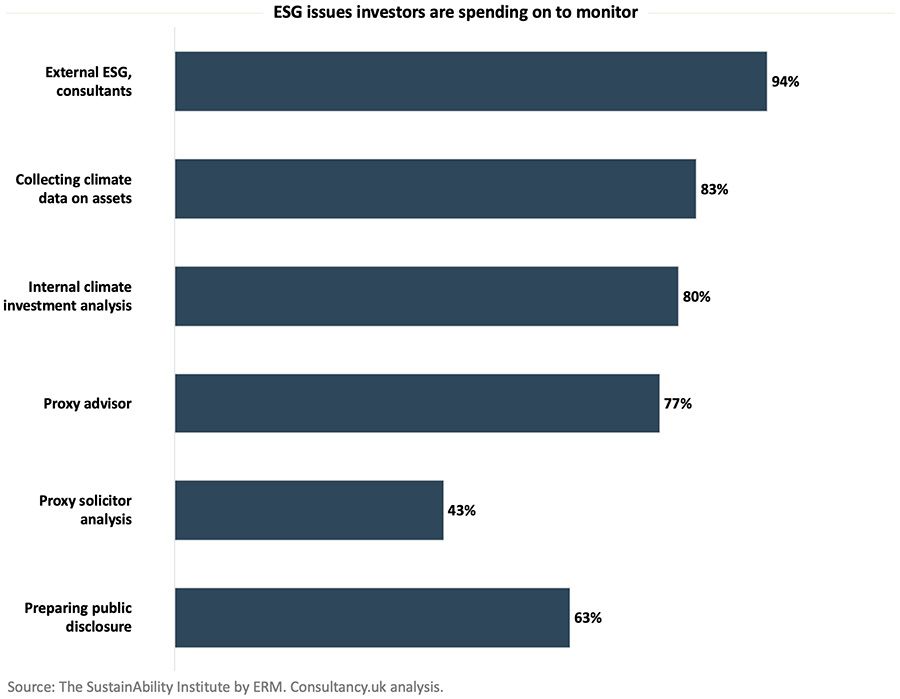

The research saw ERM poll 35 institutional investors for more detailed data. This revealed the areas in which most is being spent – and what kind of decisions the data gained is being used for.

Top of the list was external ESG ratings, data providers and consultants – used by 94% of the investors analysed. This was also the area firms spent most on; with an average of $487,000 being spent to receive external expertise on the ESG sensibilities of possible deals. Close behind were collecting climate data related to assets, on 82%, and internal climate-related investment analysis, at 80%.

In terms of what investors put such capacities toward, two most common answers presented themselves. Around 85% of investors used climate data and advice to weigh up decisions on shareholder engagement via stewardship management, and the same number put it toward proxy voting decisions for shareholder proposals – something which will likely see activist investment continue to rise on the corporate agenda in the following years.

Investors did not only use climate data on firms they already owned, however. Around 80% used it to consider portfolio construction, while another majority chunk put it towards buy-sell-hold decisions for individual securities. In other words, poor ESG metrics might cause investors to think twice before bringing a company into their portfolios.

In the wake of pandemic, businesses are finding finance hard to come by from traditional lenders. A recent poll found 21% were struggling to access suitable funding to support their growth. In this case, improved ESG performance might throw them a lifeline, by catching the eye of potential backers in the form of institutional investors.