BCG subsidiary Inverto has released the 2022 edition of its ‘Risk Management in Procurement’ study, shedding light into what is keeping chief procurement officers up at night and how their risk agenda looks like for the coming months.

The study by the international procurement and supply chain consultancy canvassed the views of procurement managers and managing directors on the state of risks landscape. Respondents came from across western Europe, predominantly from the chemical, consumer goods, automotive, and mechanical and plant engineering sectors.

Thibault Lecat, Managing Director and Regional Leader for Western Europe at Inverto, walks through the top three risks identified by the report.

1) Securing supply

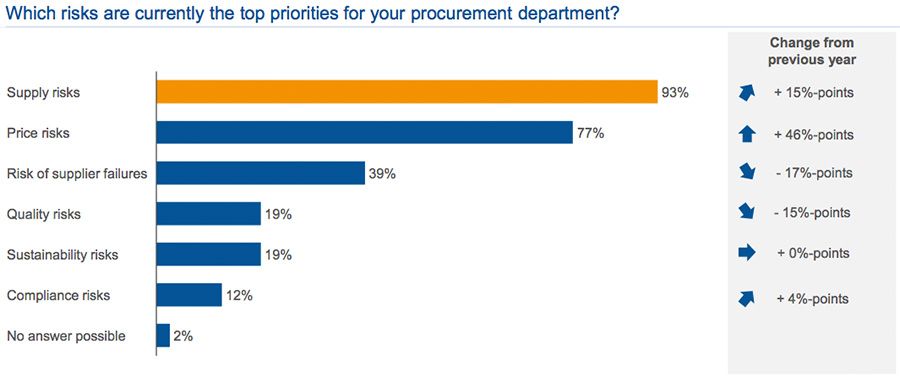

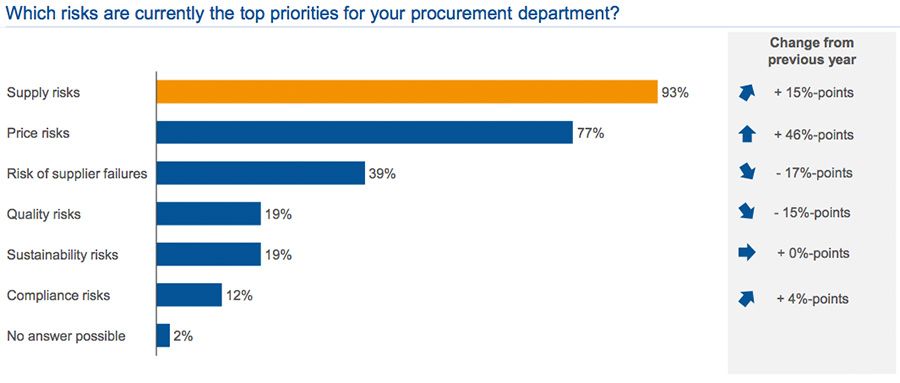

Securing supply tops the list (93%) as the greatest perceived risk to companies by Procurement Managers and Managing Directors. This represents a 15% rise on the previous years’ study. In fact, supply chain risks are continuing to plague companies across the UK and Europe, with the vast majority of businesses (90%) already affected and not receiving all of the preliminary products they had ordered in the last six months.

With more than 90% of companies impacted, it’s clear that root and branch reform is needed to de-risk supply chains. Digital solutions and decarbonisation should feature heavily in these discussions, to future proof businesses from potential disruptions.

2) Procurement price rises

Procurement price rises was the second greatest risk (73%) identified in the study. Yet it’s position on the list belies its growing importance to procurement professionals, with only 27% identifying it as an issue last year; this represents a rise of 46%.

This sharp increase is due in large part to inflation continuing to drive up prices across the supply chain, however 85% of companies continue to see a large/very large impact on purchasing prices due to Covid-19, with 71% expecting cost pressure.

In order to mitigate for expected increases in material costs, companies should be vigilant and scrutinise the price demands of their suppliers – savvy companies are becoming increasingly conscious of supplier mark-ups, while realising that not every rise is entirely justified. So-called ‘cost break downs’, in which an upstream product is broken down into its individual parts and then evaluated, can provide indications.

Potential savings should be specifically sought and exploited, for example through leaner processes or in non-strategic goods – allowing price increases to be balanced out and competitiveness increased.

3) Reducing CO2 emissions

Sustainability factors are increasingly gaining importance within procurement and decarbonisation continues to be the primary risk for businesses within the sustainability space. The study identified reducing their carbon footprint as the largest ESG challenge for business (70%) followed by the risk of environmental damage (51%) and labour rights (42%).

There exists unprecedented stakeholder pressure to create sustainable supply chains, and not just by reducing Scope 1 and Scope 2 emissions – in fact, indirect Scope 3 emissions produced by suppliers and partners are the trickiest obstacle for most organisations to overcome and tackling them requires a long-term roadmap, which may not immediately yield financial benefits in the short-term.

However, to fully identify the business value to decarbonisation, cost reduction analysis based on category context is necessary. By balancing the potential emissions reduced by a specific policy against the cost of implementing such a policy, the financial benefits of decarbonisation in a defined category can be easily identified and prioritised.

Managing the risk

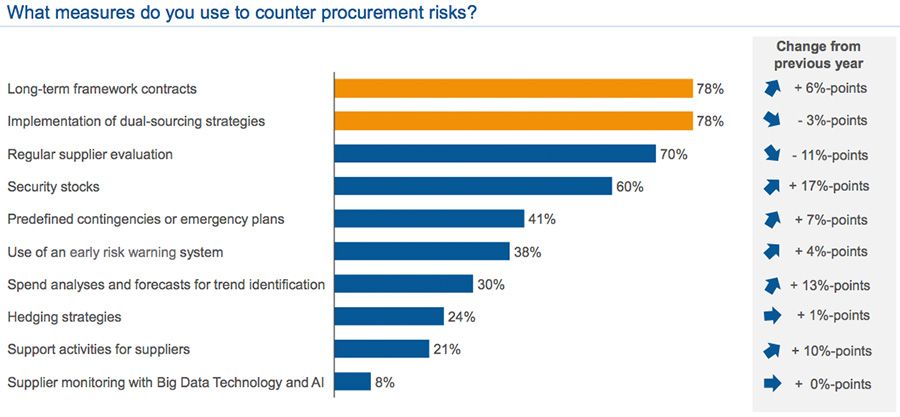

In spite of the supply chain challenges and increasing risk across energy prices and inflationary issues, the number of those practicing strategic risk management and controlling it with digital tools has not increased year on year. In the future, however, business and procurement leaders want to tackle the issue more proactively, with 89% expecting risk management to play a more important role.

At Inverto, we know from our clients that the constant supply chain problems tied up a lot of time and resources. This left little room for planning and further development and while there is the intention to tackle the issue, the onset of the Ukraine war and resulting impact on inflation and energy prices has once again placed extreme strain on procurement teams.

Despite the significant geopolitical and economic events dominating the agenda, businesses should look to further expand proactive risk management and leverage digital solutions in anticipation of unexpected disruptions to their supply chains. After all, investing in fire protection is always better than fighting fires.