Massive inflation rapidly outstripping wage growth is leading to a huge fall in living standards in many of the world’s leading economies. A new report from the US shows that lowest-income households are hit hardest by inflation, as it sees prices for fuel rise most dramatically – forcing the majority of shoppers to downsize expenditure on food and drink, and daily use household items to maintain their transport options.

The state of public transport in the US is widely regarded as being shambolic for a developed economy. Unlike many European nations, political debate focuses on public transport as a form of ‘welfare’, meaning it is assumed it is only for society’s poorest – and politically most marginalised – citizens. In a land where the free market is supposedly king, this has seen it buried on the agenda of successive governments.

As a result, most American cities have public transit systems that serve an outdated commute at best, or make it impossible to get around without a car at worst. And the situation is even worse in rural areas. This means that when the price of fuel rises in the US, it also has a potential knock-on impact of isolation and social alienation for all but America’s most wealthy.

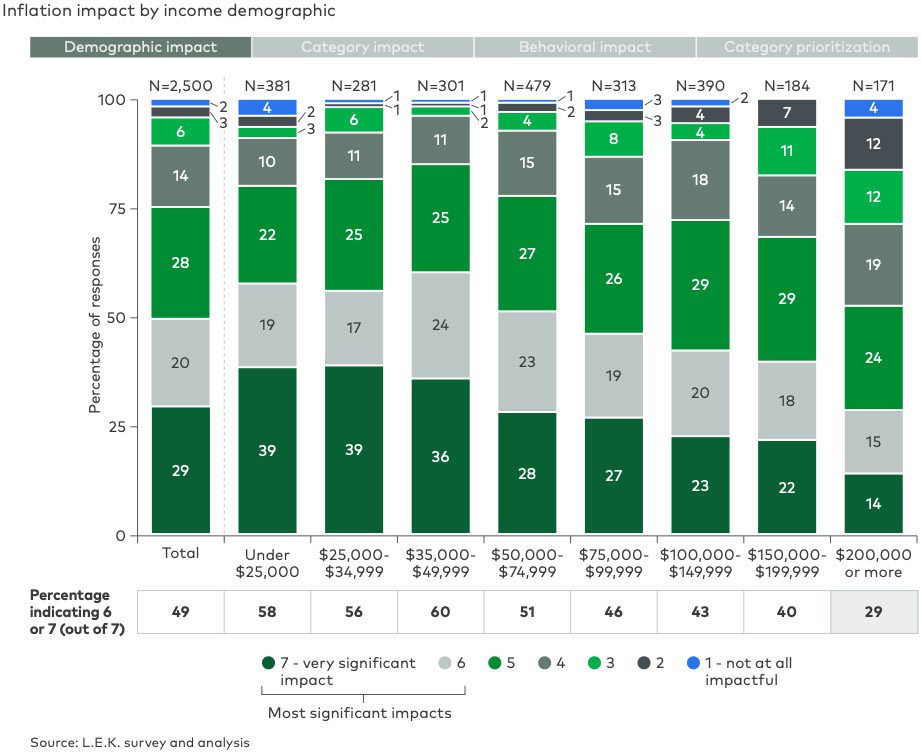

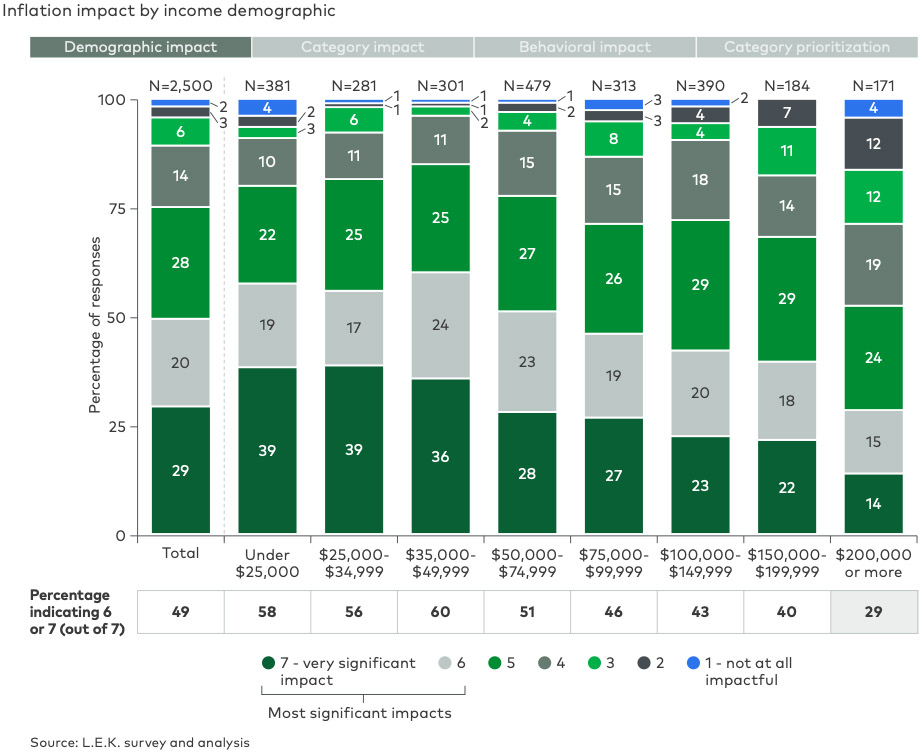

A new study from L.E.K. Consulting shows that inflation across the country has its heaviest impacts on those earning the least. Polling consumers across the country, the firm found that 26% of those earning over $200,000 per year did not feel inflation was impacting them much, if at all. In comparison, 28% of those earning between $50,000 to $74,000 – the 2022 median average according to the Bureau of Labor Statistics – felt it had a ‘very significant impact’. Almost four-in-ten workers earning under $35,000 per year said they had also been impacted in the worst way.

L.E.K.’s study found that the most heavily inflated goods were gasoline and automobile parts, with 56% of respondents seeing a ‘significant impact’ on prices in the last year. This puts personal transports costs ahead of food and beverage costs – ‘significantly impacted’ for 54% of consumers – in terms of having the greatest impact on household expenses.

But while you might think that food and drink spending would be more essential than purchasing gasoline, and therefore likely to be less targeted by spending cuts, the situation is not so clear cut for many Americans. With car ownership so important for reaching essential services and work – with walkable space and public transport rarely prioritised by civil planners – more individuals are having to maintain the same level of spending on automobile fuel and maintenance, than fuel and maintenance for their own bodies, or those of their families.

While 40% of consumers buy gasoline and parts for cars at the same frequency now, only 8% have been able to purchase less of those goods. In stark contrast, meanwhile, a meagre 27% of consumers are able to by the same items of food and drink at the same rate they did a year ago, while 26% simply make do with buying them less frequently.