UK households face an unprecedented financial squeeze, according to a new study, as inflation diminishes the value of pay in real terms, while interest rates make borrowing more expensive. As a result, overall consumption is expected to fall by 0.4% in the next year.

Over the last year, headlines in the UK have been dominated by record rates of inflation – which reached double digits in July 2022. Hitting 10.1%, inflation has since ‘eased’ to a still-abnormal 9.9%, with supply chain issues, material shortages and heightened fuel costs ramping up the price of production.

A new study from KPMG suggests that the worst may still be to come, too. While the UK Government’s decision to cap domestic energy bills at £2,500 from October has limited further increases, headline inflation is still expected to hit 10.5% in October. While researchers suggest this could begin to subside over the coming two years, many households will still struggle to make ends meet, as prices continue to explode around them.

At the same time, life is likely to become more difficult for the majority of UK consumers, due to rising rates. Talked about as ‘counter-inflationary’ mechanisms, heightened interest rates are being deployed by the Bank of England, making it more costly to borrow. This is because the Bank asserts that the Government intervening at all in the matter of inflation is likely to increase it.

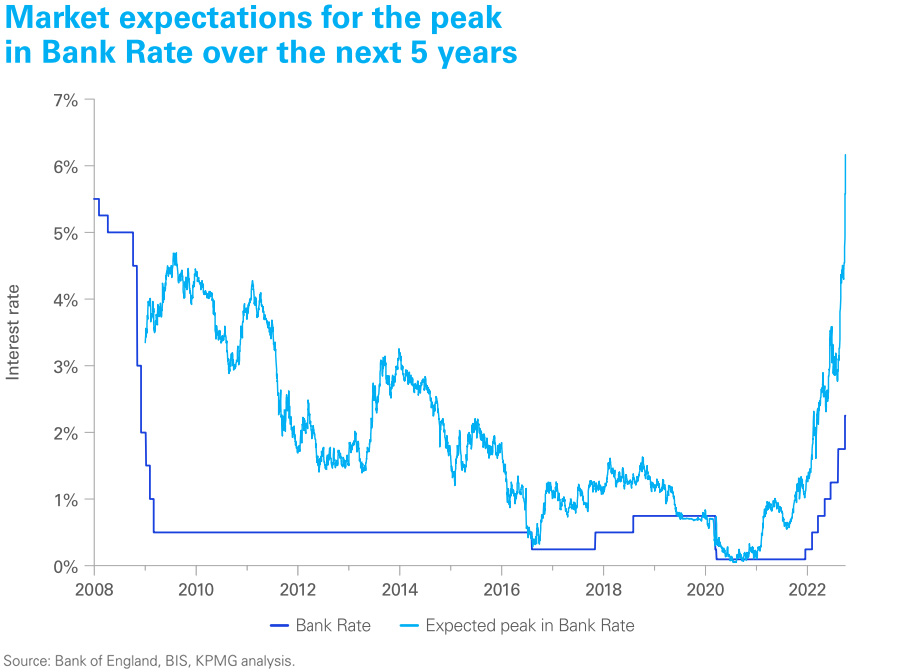

As a result, the broader market anticipates interest rates to push toward 7% by the end of the year – though they have currently hit 2% so far. Whether or not rates hit those heights, however, making it more difficult to borrow threatens to derail the UK’s consumer economy. With wages having stagnated for more than a decade, inflation has rapidly shrunk spending power, leaving consumers with the choice to turn to things like credit cards, or cut back on spending.

As a result, UK consumer confidence currently resides at an all-time low. With less money to spend in real terms, KPMG believes this could signal a shift in spending towards only essential goods and services – as well as looking to maintain higher reserves of savings. This will likely weaken consumption growth substantially – from expanding by 3.7% in 2022, to a contraction of 0.4% in the coming 12 months. In turn, this is likely to put pressure on the labour market.

Senior Economists Michal Stelmach and Dennis Tatarkov explained, “We expect the economic slowdown to gradually filter through to the labour market, with lower demand putting less pressure on employers to recruit new staff… Our forecast now sees the unemployment rate averaging 4.3%.”

While some economists believe this ‘correction’ could finally help employers quash the Great Resignation, which has seen applicants use labour shortages to argue for fairer pay – this could also have an impact on spending further down the line. Prior to the pandemic, the failure to see wages grow meant that increasing consumption became dependent on expanding how many people had paid employment, and were enabled to function as consumers. If the unemployment rate rises, that potentially reverses, and further decreases consumer demand in the coming year.

In spite of this, KPMG concluded that in comparison to other crises, the coming recession could be “relatively mild”. The firm suggests the UK is already in a recession, and has been since the second quarter of 2022. Forecasting this to last for three quarters, GDP may begin recovering in 2023 – meaning year on year, the fall of GDP between 2022 and 2023 might only be around 0.2%.