In the wake of record heatwaves this summer, the difference an extra degree-and-a-half could make to the global climate has been sharply illustrated. As citizens prepare to pressure businesses on their sustainability efforts on this basis, many board rooms still suffer from a major disconnect between publicly stated ESG goals and material results – which could cost their firms dearly in the near future.

In July 2022, the UK endured its worst recorded case of extreme heat, when parts of the country reported temperatures hitting 40C for the first time. In a country where the infrastructure is woefully ill-equipped for such temperatures, experts predicted that around 1,000 people may have died due to the heat, while train tracks were damaged and while wild fires gave the London Fire Brigade its busiest day since the Second World War.

And while this kind of heat wave was once an anomaly, Britain may not have to wait long for a second taste of 40C life. According to a long-term outlook from the UK MET Office, the UK could already be on course for a second 40C day in the early part of August. While that is by no means certain, meanwhile, climate scientists have long been warning that this kind of climate event will become a common aspect of British summer, if more action is not taken to decarbonise the global economy.

As residents around the world become ever-more wary of the impacts of climate change, a new report suggests that temperatures in board rooms are also rising. Discussions on environmental, social and governance (ESG) matters are coming to a head, as it becomes apparent that many firms have been good at talking the walk, but are failing to walk the walk on climate change.

The survey by L.E.K. Consulting, in conjunction with research firm Longitude, asked 400 C-Suite executives in the US, Europe and Asia their opinions on ESG, and found that on the face of it, sustainability has significant momentum in the private sector. Around 700 of the largest 2,000 publicly traded companies have claimed net-zero commitments; while 60% of the FTSE 100 have committed to net zero by 2050, and two-thirds of the S&P 500 have emission reduction targets.

However, a number of respondents also flagged up one of the main factors that is holding back progress on this front: the economic system they operate under is motivated primarily by profit. That means, whether change might benefit broader society and the environment – and indirectly their businesses in the long term – executives are reluctant to support plans that may compromise their bottom line.

While L.E.K.’s assertion “51% of executives agree that their company should address ESG issues — even if doing so reduces short-term financial performance” sounds positive on this front, it also suggests 49% are less compliant on the matter. Indeed, many may be unable to do more, even if they would like to – with 51% suggesting they faced short-term earnings pressure from investors, including activist investors, “which impedes our longer-term investments in sustainability”.

Significant challenges

Following on from that, 58% of executives added there were subsequently “significant differences of opinion within the leadership team” on balancing short-term priorities with long-term ESG goals. This has led to a significant gap between what many companies have promised on ESG goals, and what they have been able to deliver.

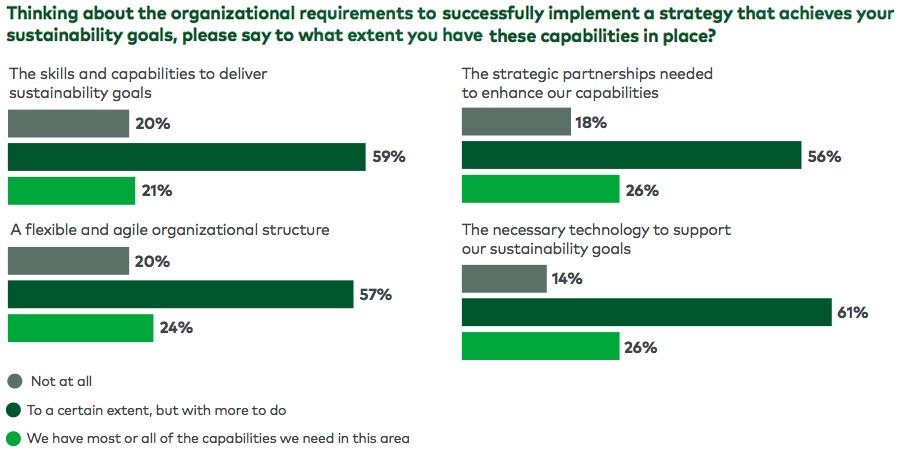

At present, 79% of executives said their organisation needed to invest more thoroughly to acquire the capabilities needed to deliver sustainability goals. One-fifth do not have any such capabilities at present. A majority of 54% noted their company had not made significant strides in integrating ESG factors into the way the company allocates capital – with fewer than half having even incorporated ESG into their R&D activities – and a sizeable chunk of 48% also did not believe their company’s current product and service portfolio meets the needs of a more sustainable future.

Meanwhile, the front that might help executives prove their business case for sustainability to the board room, and investors, remains vastly underexplored. A 59% portion of executives told L.E.K. that their company was yet to make substantial progress in understanding the financial risk and financial opportunity posed by climate – something which might enable them to get fellow leaders beholden to short-term profit-driven decisions to re-evaluate. Engaging more with metrics to prove the case for sustainability may be key to turning the situation around, though.

“There are a number of avenues organisations can take to overcome barriers to deliver on ESG goals,” John Goddard, Vice Chair of Sustainability for L.E.K., said. “They involve establishing a common language with which to develop sustainability goals and begin to understand the strategic choices required to achieve the goals; investing in educational programs and support; engaging the full leadership team in analysing the financial and non-financial strategic choices that might be involved in achieving ESG goals; begin to set measurable goals in order to set KPIs and enable reporting and tracking, and putting in place interim targets so remuneration can be linked to ESG strides.”