FTSE 100 companies have ‘disconnect’ between purpose and ESG reporting, according to new research. With allegations of ‘greenwashing’ rising, firms need to make sure that purpose is not just a performative function, and that it translates into concrete action.

In a world where customers increasingly expect the brands behind their products to take ethical stances on issues such as climate change, diversity, and animal rights, many firms have sought to role out policies convincing shoppers they have no reason to abandon their goods. But with ‘purpose’ still being a vague term at best, a great deal of the pledges firms have crowed about has been talk, and talk alone.

Greenwashing is the most infamous example of this. Roughly defined, it is a form of advertising or marketing spin, in which green PR and green marketing are deceptively used to persuade the public that an organisation’s products, aims and policies are environmentally friendly. However, when caught applying green sheen to their marketing without walking the talk, brands can find that the loss of trust they experience causes their brand irreparable damage.

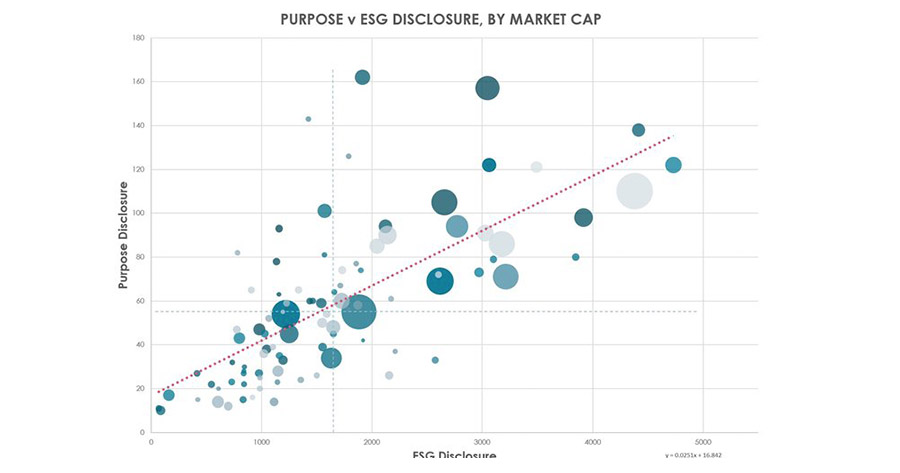

A new study from Blurred – a global strategic and creative consultancy – suggests that a large portion of the FTSE100 should be taking their potential ‘impact gaps’ more seriously. As part of the research, Blurred has created the first methodology for scoring the integration of ESG and Purpose in public companies, assessing their ESG disclosures versus their public corporate purpose claims. According to the analysts behind the research, the average integration score of companies assessed in the FTSE100 is 5.2 out of 10.

The FTSE100 is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. When examining the types of firms which were most likely to be lagging on fulfilling purpose commitments, Blurred found that most smaller companies clustered towards the bottom of their chart – holding off on both purpose commitment announcements, and environmental, social and governance reporting – in comparison to larger market cap companies, which are investing in putting a huge amount of ESG and purpose information out there.

This is not to say every large player is leading the field, though. Some sectors are also lagging behind – including their biggest brands. Illustrating this, health and pharmaceutical firms, and financial services players are far less forthcoming on purpose and ESG releases than utilities, and mining firms.

What may be worse still for firms is for them to issue false promises, however – and consumers are becoming especially critical of firms which put out more purpose-based promises than they do ESG-related reporting. The stand-out market in this regard was the fast moving consumer goods (FMCG) brands – which Blurred found were talking much more about purpose than the natural trend line indicated is the norm, in contrast to their ESG reporting. This is likely to see consumer brands lose trust in their promises – with even the ‘most green’ firms having recently come under fire for reportedly undermining their own promises, such as Ikea and Lush.

Blurred’s focus on FMCG brands should not come as a comfort to other sectors evaluated, though. The firm concluded that its overall finding was that “few companies in the FTSE100 are meaningfully connecting ESG to P in their highest-level communication.”

Blurred Chief Strategy Officer, Stuart Lambert, added, “The stated purpose of a huge number of FTSE 100 companies is not substantive – many are marketing straplines with no depth or connection to governance, values or decision-making. “Fundamentally, companies need to integrate their narratives around ESG and purpose, disclosing the harm they do before they make claims about the good they do.”