Lending to small businesses has plummeted in the UK, with finance applications becoming far more difficult in the wake of the pandemic. Businesses need to look elsewhere in this case, but new research suggests that one-fifth of entities are being held back by a lack of awareness around growth funding options.

According to figures from the Federation of Small Businesses, just 9% of small firms applied for finance in the first quarter of 2022, the lowest proportion since SBI records began. Meanwhile, the share of these which saw their applications approved was a meagre 43% – also at a record low. This prompted the UK’s largest business group to warn banks against “pulling up the drawbridge” to small firms, as it could ultimately stifle economic growth with the UK’s economic recovery already floundering.

With banks in a cautious mood following a rocky two years, however, companies would be wise not to assume the situation will change any time soon. Instead, they would be better advised to weigh up other sources of finance. Indeed, according to new research by alternative lender Boost & Co, many intend to do so.

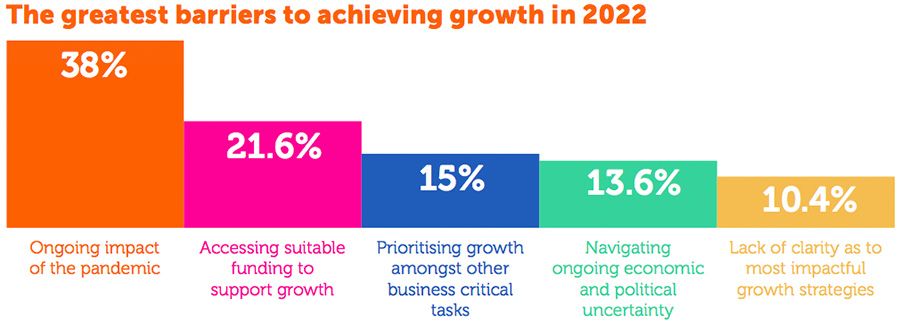

With 21.6% of firms believing access to funding had become a “significant roadblock to achieving growth” (only surpassed by the lingering impacts of the pandemic), Boost & Co’s ‘2022 Geared for Growth’ report found that 70.2% of businesses intend to access external funding to support the growth of their business in the next 12 months. The problem is, this is easier said than done – and a large portion of organisations are actually unsure of how to obtain this funding.

Almost one-fifth of business leaders reporting a lack of awareness of the options available to help their businesses grow – at 16.6% of those polled. Similarly, 10.4% of UK smaller business leaders admitted to lacking clarity around which growth strategies would be most impactful for their business.

Joanna Scott, Managing Director at Boost & Co, commented, “It is evident that there is a real appetite for growth from UK SMEs, but it is also clear that there is a lack of awareness around how this growth can be achieved. Not enough is being done to make it easier for businesses to seek funding support and without knowledge of the options available to them, it could be that many SMEs are missing out on vital opportunities to accelerate the growth of their business.”

In terms of how this knowledge gap might be narrowed, Scott added that it was “crucial” that business leaders were made aware of growth strategies and alternative routes to funding. Contending that funding “is a partnership,” she argued that equity investors, lenders and advisors all had a role to play to this end.

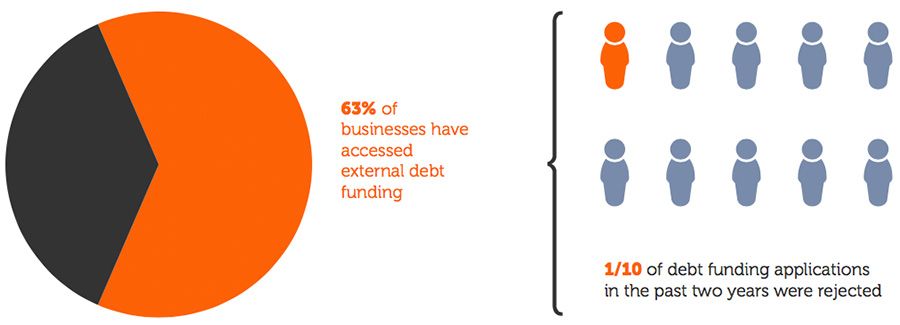

Boost & Co is a provider of growth capital for innovative, fast-growing UK SMEs. The independent asset manager offers loans of £2 million to £10 million, covering all sectors. Looking to play its own part in educating businesses on the options available, its report particularly noted the potential for debt funding. According to the study, 63% of businesses have already accessed external debt funding, and 47.8% have done so successfully in the past two years. Meanwhile, only 10% of funding applications in the past two years were rejected by a traditional bank (6.6%) or another lender (1.8%) – suggesting there is better chance of accessing this kind of financing.

With that said, there is still a need to access support when applying for external debt funding. In particular, SMEs outside London may need greater support in navigating the funding application process. Around 75% of London-based firms successfully accessed capital in the two years in question, compared with 41% of businesses in the South West and just 29.4% in the East of England.

Scott concluded, “There are many ways that business leaders can make their 2022 growth ambitions a reality, be it through greater access to resources, advice or alternative sources of funding. Debt funding is a great option for businesses looking to scale up but a route that only 63% of the business leaders we surveyed had taken, either via a bank or another lender.”