The gradual shift of consumers to online retail was given a huge boost during the pandemic – as the bulk of non-essential commerce went digital. According to a new report, this development (also) presents opportunities well beyond the established names of e-commerce.

In recent years, e-commerce did offer many brands a new lease of life, with benefits of digitalisation and the creation of omni-channel shopping experiences boosting convenience and reducing costs for the consumer – something been emphasised by the global pandemic, as bricks-and-mortar retailers who have not adapted to life online have faced huge losses over the last 24 months.

However, according to research from OC&C Strategy Consultants, the agility and low prices of online marketplaces is set to further undercut the offerings of historic retail names in the years to come.

According to the study, the unstoppable rise of the online marketplace model – operated by the likes of Amazon, Expedia and eBay – is driving the largest fundamental shift in consumer spending since the first emergence of e-commerce in the 1990s.

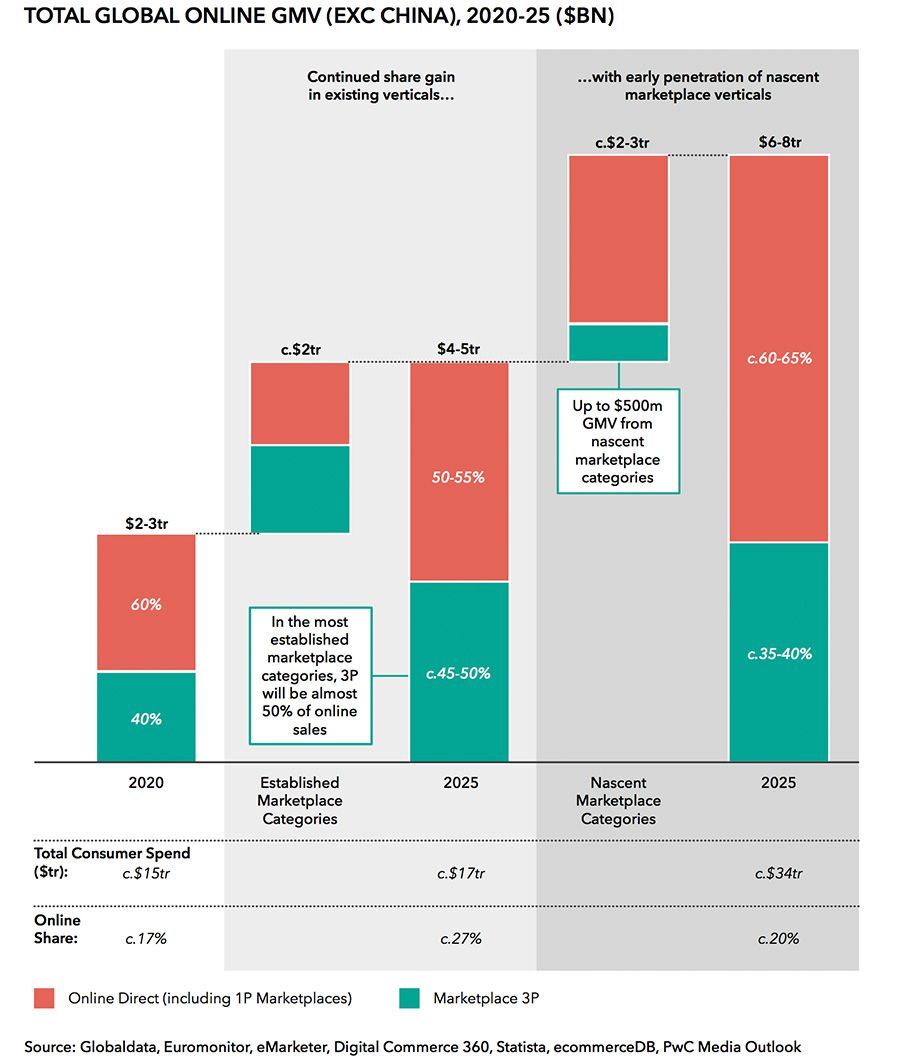

Titled ‘Trading Places’, OC&C’s report forecasts that by 2025, spending through leading online marketplaces will overtake the vast majority of established retail and travel e-commerce outlets. When the researchers considered this trend in terms of aggregate spending, they determined that marketplaces in those categories were set to catch up with direct e-commerce ahead of 2025.

Across all of these established categories, the analysts estimate that marketplace growth will remain steady at 15% per-year in the West, accounting for between 45% and 50% of online spend. Illustrating the feasibility of this scenario, 2020 saw marketplaces already account for over $1 trillion of total consumer spend in these categories, and 40% of total consumer spend online.

Mostyn Goodwin, Partner at OC&C Strategy Consultants, commented, “Given the sector remains in its relative infancy, there will be no shortage of opportunities for both new and incumbent players to operate profitably. Marketplaces will be springing up across new sectors and the success of ultra-specialist marketplaces like Vinted shows it can be worth carving out a niche. That said, eCommerce giants should be confronting these industry changes head on if they want to avoid the fate of bricks and mortar retailers and travel agencies.”

Driving forces

Unsurprisingly, it seems that Covid-19 drove a significant increase in online penetration across most categories. With consumers effectively forced to transact online in many cases, seeing marketplaces mop up large amounts of the online traffic established retail categories enjoyed amid the lockdown months.

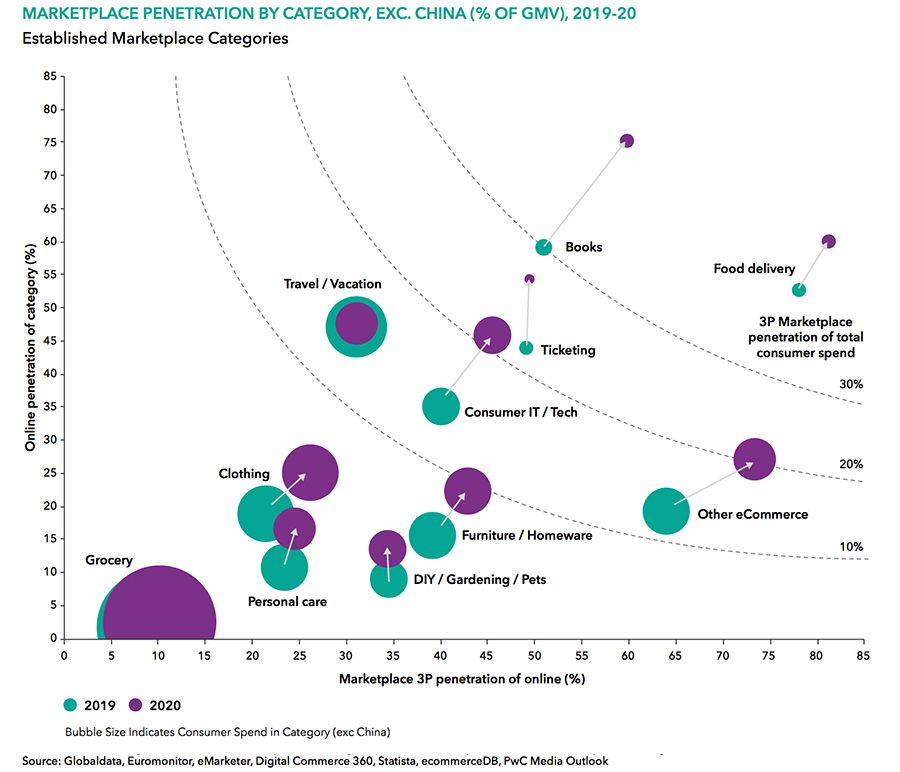

In 2020, books, food delivery and consumer technology all saw huge boosts to the percentage of online penetration, when it came to consumers purchasing their goods there. And each of these categories saw the marketplace penetration of this online consumption boom – accounting for half or more of all spending in each category.

Few retail categories were insulated from this change. Naturally, grocery retail was relatively unaffected, due to grocery stores remaining open during lockdown as essential services. On the other end, travel was not impacted notably in 2020, as much of the industry was shuttered amid the initial stages of the pandemic. This may change in the coming years, however, as tourism picks up, but learned behaviours from the pandemic linger.

Dominance and opportunities

This is not to say that all marketplaces are created equal, however. Some are enjoying a colossal piece of the pie thanks to their previous dominance, while others are struggling to make up any ground on tech monopolies like Amazon.

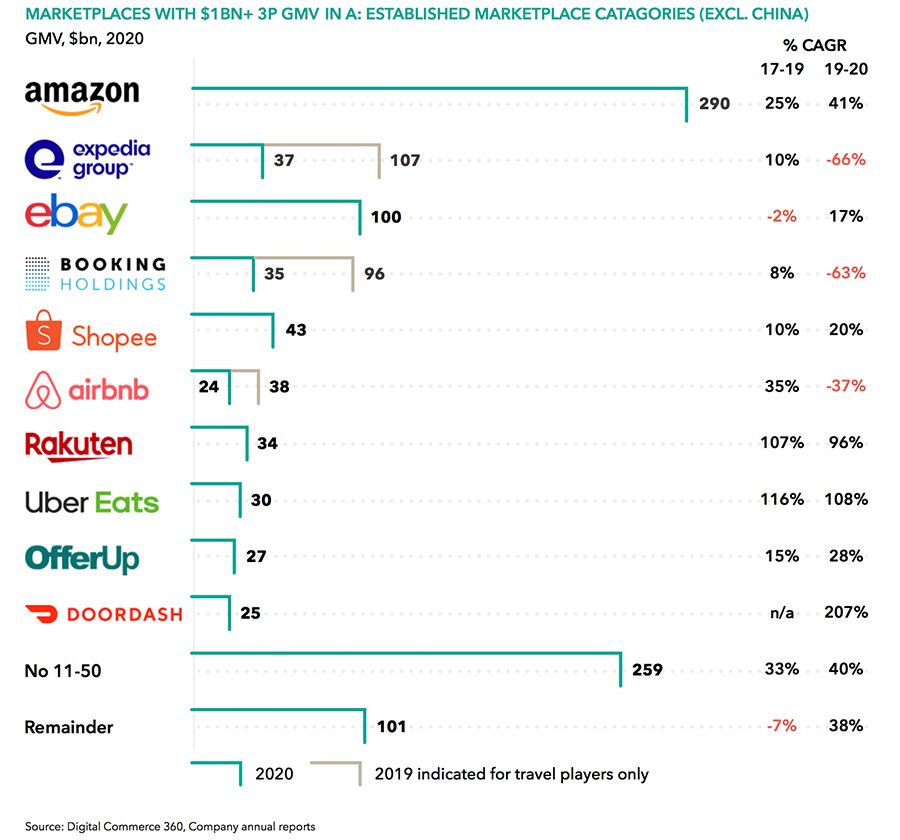

Using their already-strong position in e-commerce, these companies had the resources to pivot their businesses, and roll out services which could monetise opportunities amid the pandemic most others could not. This performance means the likes of Amazon and Expedia have created a highly consolidated landscape.

The top 10 marketplaces account for around 70% of marketplace gross merchandise value (GMV) in Western markets, with eight of the top 10 marketplaces of US origin.

In comparison, while some European marketplaces such as Zalando are operating successfully, many more are unable to compete with their US counterparts in terms of size and scale. European firms do not account for any of the top 10 grossing marketplaces, and they make up just a quarter of the top 50, contributing a small 5% of GMV.

Instead, the largest threat to US marketplaces currently come from China, which currently possesses three of the world’s four largest e-commerce marketplaces in the world. Taobao, Tmall and JD.com (owned by Alibaba) are all expected to expand their presence in Western markets by 2030.

However, OC&C concluded that there are still opportunities for new entrants to thrive in Europe, as well as the broader global e-commerce scene. With the marketplace sector continuing to evolve at pace, as well as overtaking direct e-commerce spend in categories such as retail and travel, the report predicts that the next cohort of verticals to benefit from online marketplaces will be those where buyers already use price comparison as part of the purchasing journey. These include real estate, automotive, retail and financial services.