The global fashion industry could reduce waste and cut costs by reducing its production levels, and prioritising quality over quantity. A new study suggests that some fashion categories are producing as much as 15% too much output, with most of that ending up in landfill.

In spite of this, fashion producers seem more committed than ever to the service of the fast fashion market. Fast fashion is a term used to describe the clothing industry’s business model of replicating recent catwalk trends and high-fashion designs, mass-producing them at a low cost, and bringing them to retail stores quickly, while demand is at its highest. In years gone by, this hit-and-miss technique of producing enough cheap gear to make a profit – even if a portion of it never sold – proved an effective business model. Recent changes have left it seemingly increasingly outdated though.

With consumers more concerned than ever by the impact products have on the environment, companies are beginning to feel the pinch of sustainable-focused consumption. Studies suggest that 35% of UK consumers, representing £150 billion of retail spend, are now actively avoiding brands they understand are damaging the environment. As spending continues to tighten amid a sustained economic slowdown, ignoring this growing appetite for longer-use, sustainable items is proving costly for the purveyors of fast fashion. Meanwhile, the impact of inflation on such producers’ margins is also something that makes that model less profitable than it previously was, anyway.

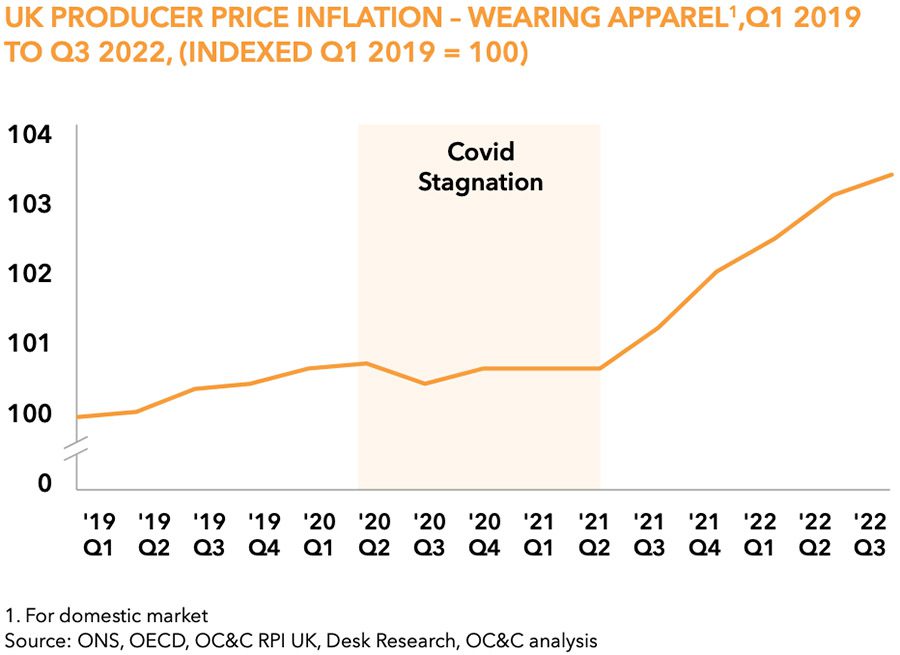

According to new research from OC&C Strategy Consultants, producer price inflation has exploded since the second half of 2021. This is putting unique pressure on fashion brands which use planning and buying models with an inherent risk of overbuying, to reduce the likelihood of products running out of stock. Failing to evolve these practices now runs the risk of large losses, though.

OC&C’s study – in collaboration with WGSN – suggests that by reducing overbuy and avoiding unnecessary spending, firms could increase their total contribution by as much as 3% by product category, enabling brands to re-invest this into other areas. This stems from a range of factors, including improved sell-through rates, and a higher proportion of goods sold at full price.

There are a wealth of opportunities for reducing overproduction in the fashion segment, too. The study found that as many as of the 150 billion fashion items produced each year, 45 billion are never sold or worn – and mostly end up either in landfill, or being incinerated; at growing cost to both producers and planet. If nothing changes, this may even grow – and if current trends continue, OC&C estimates that overproduction will rise 1.2 times before 2030.

The researchers suggest that technology can play a key role in this process. For example, agile, AI-informed buying processes are already enabling some brands to refine their range in line with consumer demand, operate more efficiently, and therefore drive significant value.

Pointing to leading examples of this, OC&C used one case study from 2022, showing how a mass-market retailer could have improved its margins by as much as £1.5 million. This would start with savings from reducing overproduction in its line of women’s skinny jeans, if it could use accurate forecasting data to help it meet demand. Buying in line with the decline in market demand would have resulted in 10,000-40,000 fewer units of terminal stock – gaining back up to £600,000 in its Open-to-Buy plan, enabling it to invest more wisely in other categories – and therefore deliver improved top-line growth.

Commenting on how the findings might help its fashion clients, Mairi Fairley, Head of Retail at OC&C, said, “We speak and work with fashion brands that are under significant pressure as the complexity of business models continues to increase, cost inflation rises, and there is a need to operate more sustainably. Evolving planning and buying to be more demand-led is a practical first step, enabling significant margins to be gained, and unnecessary waste and CO2 emissions to be reduced.”