Demand for electric vehicles is set to surge by the end of the decade, according to a new study. However, the shift away from combustion engines could be hamstrung by continued supply chain disruption, as the global semi-conductor shortage continues.

For decades, the popularity of electric vehicles (EVs) has been touted as a key component of the push for a more sustainable economy. After hostility from fossil fuel giants, manufacturers, and the general public, perceptions finally look to be shifting regarding EVs, with multiple polls suggesting that the majority of consumers would now consider making an EV their next new car.

Tapping into this sentiment, the latest Global Automotive Outlook from AlixPartners asserts that EV sales could hit 33% globally by 2028, and 54% by 2035, as demand accelerates in most major markets.With bans on new combustion engine sales coming into effect across Europe in 2030, more consumers than ever are expected to shift to EVs in the coming eight years – even though globally, EVs still only account for 10% of car sales.

However, hinging the apparent greening of transport on consumer choice is not without its risks. Even as demand increases for the technology, the push to promote EVs as a ‘cleaner’ mode of individual travel may be derailed by the fact it requires huge adjustments in the global automotive supply chain.

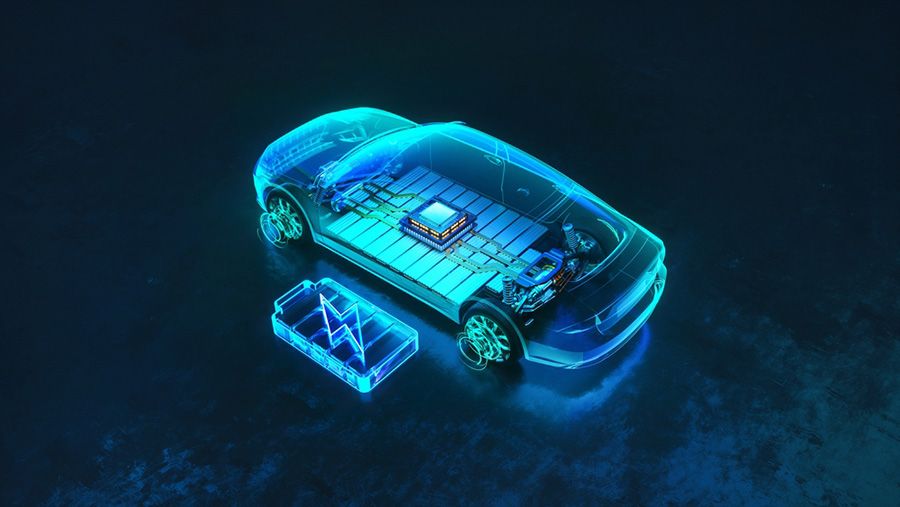

By the reckoning of AlixPartners, automakers and suppliers now expect to invest at least $526 billion on EVs and batteries in the years running to 2026. That is more than double the five-year EV investment forecast of $234 billion from 2020-2024. Producing EVs on such a level is going to be easier said than done, though. Supply constraints and the semi-conductor shortage will fester in the auto industry through 2024, according to the consulting firm.

“We see pent-up demand driving sales through it, but it’s a very important distinction from the many that are saying it’s getting better and it’s going to be gone,” Mark Wakefield, co-leader of the automotive and industrial practice at AlixPartners, explained. “We would say it’s getting better, but it’s not going to be gone for the next two years.”

The global consumption of semiconductors continues had grown rapidly before the pandemic. Within the lockdown months, supply chain disruption saw a mass shortage in the components, though, impacting manufacturing around the world on a massive scale. This remains the case, particularly in the technology and automotive sectors – especially as the production of semi-conductors has long been dominated by China, and therefore subject to deteriorating relations between the Asian superpower, and the West.

Meanwhile, heightened inflation, competition for resources, and supply chain disruption are also seeing the price of raw materials for EVs rise dramatically. The specialist materials for batteries et al now cost more than twice those used on internal combustion engines: $8,255 per vehicle vs $3,662 per vehicle, as of May 2022. If the growth of the EV market is to clear this hurdle, manufacturers need to quickly re-evaluate their production models, AlixPartners found.

Wakefield added, “Expectations are high for the industry to hit record economic-profit levels these next two years, even while funding for the beginning of the BEV transition is taking place ahead of sufficient volumes for economies-of-scale and cost competitiveness. While many companies are planning their own transition, proactive supply-chain redesign and rigorous cost management needs to be improved to avoid costly surprises down the road.”