A new study has confirmed that the challenge e-commerce presents to retail is not returning to ‘normal’ – with most economies having seen it rapidly gain market share during the pandemic. Researchers believe most segments are also nearing a ‘tipping point’, where physical stores will no longer be viable commercial options for businesses.

The gradual shift of consumers to online retail was given a huge boost during the pandemic – as the bulk of non-essential commerce went digital. This presented opportunities well beyond the established names of e-commerce, too. In recent years, e-commerce offered many brands a new lease of life, with benefits of digitalisation and the creation of omni-channel shopping experiences boosting convenience and reducing costs for the consumer – something been emphasised by the global pandemic, as bricks-and-mortar retailers who have not adapted to life online have faced huge losses over the last 24 months.

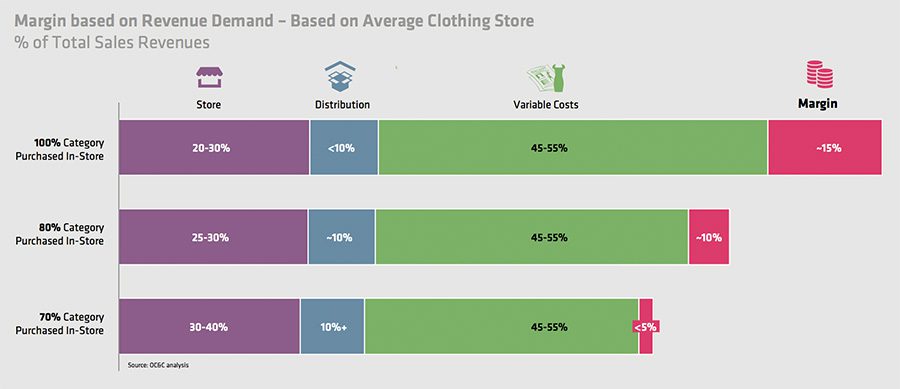

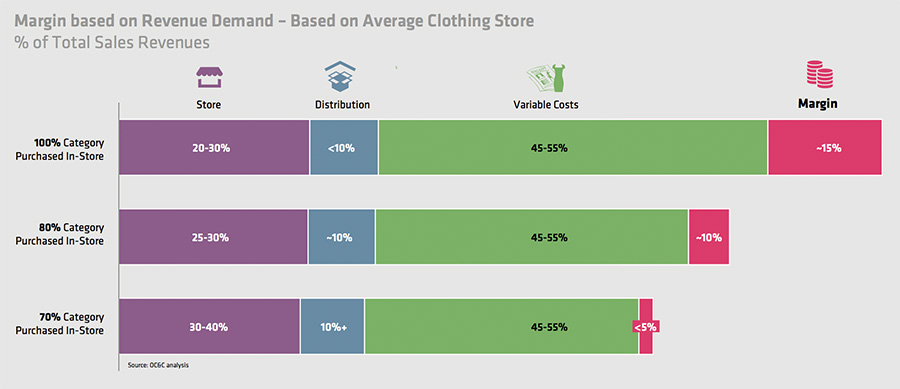

Now, however, analysis by World Retail Congress and OC&C Strategy Consultants suggests that rather than ushering in a new era of hybridised retail, this is more likely to usher in the end for one particular kind of retail. According to the researchers, when digital retail obtains 30-40% of the market share, retail sectors in any given market are due to reach a tipping point, where bricks-and-mortar store margins become unviable.

By 2025, nearly half of all retail categories will be at or beyond the ‘traditional retail frontier’, where digital will be the dominant force. Indeed, because of the decisive acceleration of the digital shift from Covid-19, many markets have found the progress of this trend to have skipped ahead by years. With even older customers changing behaviour profoundly, the UK in particular has seen e-commerce acceleration occur by 4.5 years, according to OC&C. This is faster than any other economy analysed – from China at 1.6 years, to France at 2.6 years, to the global average of 3.6 years.

James George, Partner at OC&C, commented, “The Covid-driven acceleration has taken many sectors beyond a tipping point where traditional retail economics start to break. This has resulted in 30% of sectors passing the tipping point already, and over the next three years this will rise to more than 40%. We are about to hit the steep part of the retail industry’s digital transformation ‘S-curve’ – when we can expect the landscape to change more in the next five years than in the previous ten.”

By OC&C’s estimations, the ‘tipping point’ comes when bricks-and-mortar store contribution margins become unviable, losing out to online channels. This occurs when digital sales reach up to 30% of overall retail sales. This is termed the ‘retail frontier’. Showing how dramatically the picture is changing, in 2015, only entertainment retail demonstrated an online share of over 40% across all geographic markets. Electricals and clothing and footwear had only crossed the frontier in the most advanced markets though. Today, clothing and footwear is also accelerating through the Frontier in Europe, North America and developed APAC markets.

But what does that mean for retailers who are facing disruption? According to OC&C, the firm previously found that 76% of the world’s leading retailers believed their model needs to change for them to remain relevant in the next five years and a further 21% said they have doubts about the sustainability of their business models.

Speaking to that end, Ian McGarrigle, Chairman, World Retail Congress, added, “This report shows what this continued trajectory of online growth actually means for the existing retail model and bricks-and-mortar in particular. Big decisions are needed by retailers around the world to embrace this new balance between on and offline and how best to serve their customers in this newly emerging era of digital transformation.”

The relative positioning of retailers to the frontier will impact the strategic actions that retailers should take. In market segments beyond the 40% mark, traditional retailers must be proactive in finding partners in the digital sphere, or face irrelevance. Between 20% and 40%, firms need to adopt a position where they build flexibility in cost base and operating models, and find ways to improve customer retention – as they still may find ways to ensure loyalty to their offering. But firms from markets beneath 20% have the most room for manoeuvre. As well as learning from segments which went before them, they can also develop their own digital offerings, to try and pre-empt disruption from e-commerce players.