Even amid financial uncertainty, the behavioural changes of the last three years mean that consumers are resisting cutting back on health and wellbeing spending. While non-essential areas such leisure spending are declining, the majority of individuals intend to maintain or increase their spending on fitness in the coming year.

Amid the lockdown months of the early pandemic, health and wellness from home rose to be a key agenda item for many individuals. Even after measures relaxed, this saw a third of consumers still regularly working out at home, and many more looking to maintain their activities outside.

Due to this long-term behavioural change, around the world, the global health and fitness industry is expanding rapidly. As consumers look to continue their lockdown workout habits beyond the lockdown era. In the UK alone, the market adds more than £3 billion to the economy, supporting over 50,000 jobs.

While many experts might have expected this determination to be tested by a worsening economic scenario, new research suggests this is not the case. Even as consumers scale back spending on holiday plans (where 49% suggested they would reduce their current level of spending) and other forms of transactions considered non-essential, most intend to keep up their financial commitments to sport.

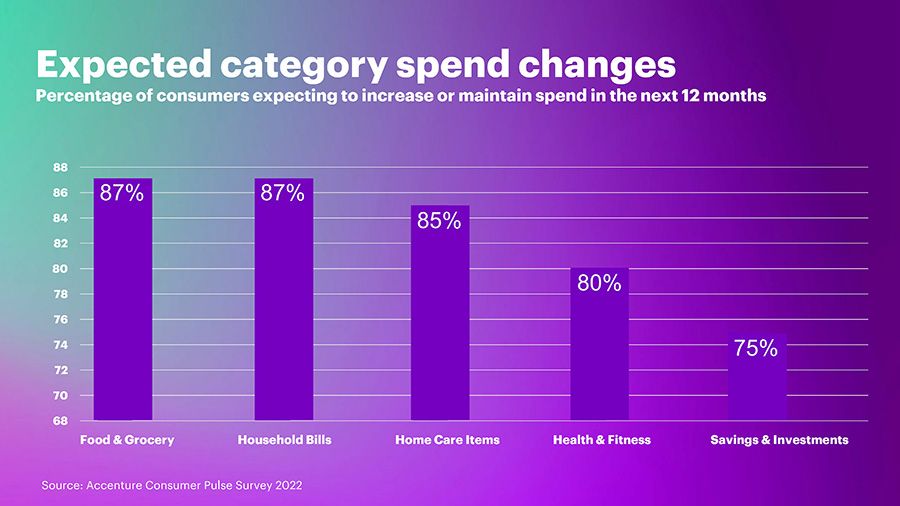

A survey from Accenture polled 11,000 consumers in 16 countries, and while it found that 66% of respondents were feeling ‘squeezed financially’, 80% stated they were planning on maintaining or even expanding their spending related to health and fitness. Exercise classes, vitamins and supplements were among the products considered ‘essential’ enough to justify this, according to researchers.

Rich Birhanzel, Head of Accenture’s global health industry practice, said, “People’s desire to take more control of their health and well-being is only increasing. It’s vital for the healthcare industry to continue to explore and partner with consumer-facing companies to improve access, experience and outcomes for people and their healthcare journeys.”

This may be because consumers increasingly understand health and wellbeing in all-inclusive terms, impacting other areas of life. With the cost of getting sick spiking dramatically amid record inflation, 42% said they would increase the amount of physical activity they participated in, while 33% said they were more focused on self-care than they were one year previously.