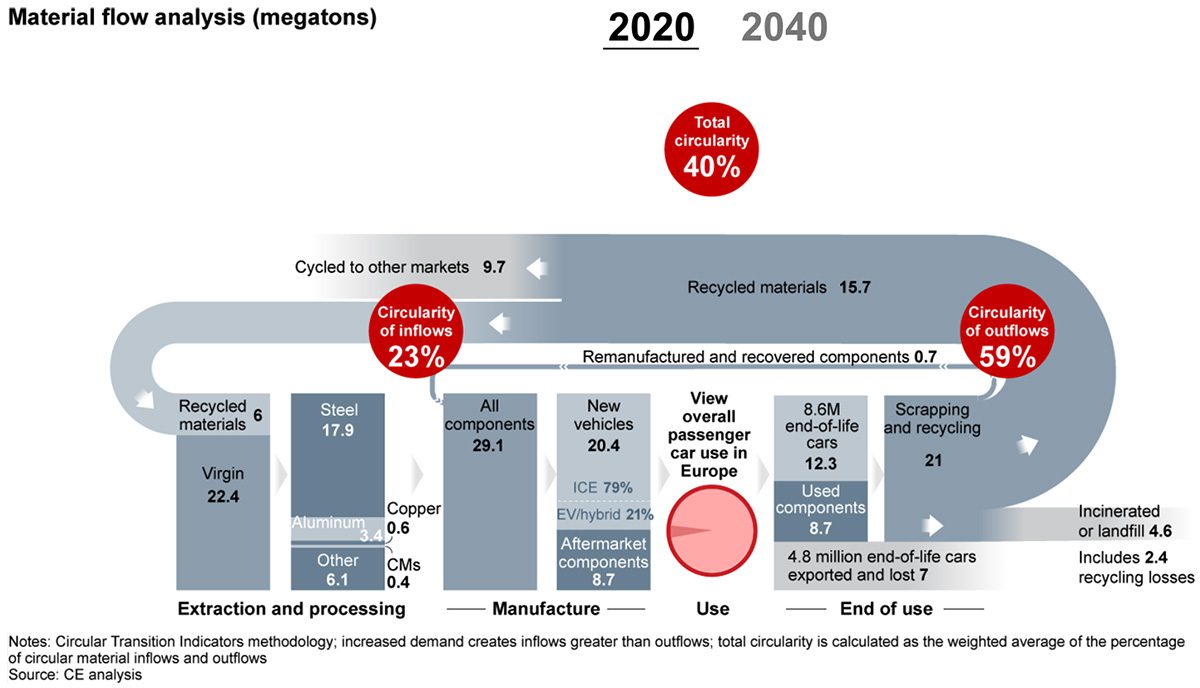

If the European automotive industry were to deploy circular technologies in the production process, it could reduce emissions from materials used by as much as 60% in the next 18 years. Widespread change to manufacturing techniques will need to be adopted, however, with recycled material use in Europe’s passenger vehicle market only accounting for 23% of materials currently.

Generally speaking, circular economics involves a change to the model in which resources are mined, made into products, and then become waste. A circular economy scales back material use, redesigns materials, products, and services to be less resource intensive, and recaptures “waste” as a resource to manufacture new materials and products.

Specifically relating to the automotive manufacturing process, this is seeing some producers look to recycle more often – and design products in the knowledge that they will one day be recycled, to maximise the materials that can be recovered from them. For example, Renault is currently looking to mobilise affiliates and partners to collect parts, materials, and EV batteries, before handing them to France-based subsidiary Gaia, to focus on battery repair, parts collection and reuse. This kind of recycling of materials from end-of-life vehicles may prove crucial, as demand for electric vehicles rises, but the materials needed to produce those units become scarcer due to geo-political conflicts and supply chain issues.

Despite the environmental and economic benefits of this – recent Accenture studies have suggested that moving to a circular value chain could increase profitability by 1.5 times, and enable revenues 15-20 times the vehicle sale price – automotive manufacturers have been slow to adopt circular models. According to a study from Bain & Company, less than a quarter of the materials used in Europe’s car manufacturing are recycled.

That could quickly change, though, according to the strategy consulting giant. Driven largely through strong EU regulation, European automakers becoming established as world-leaders in circularity, with a rate of 40%. As such, by 2040, the use of recycled materials in the sector’s production has the potential to double, from 23% to 59%. According to Björn Noack, a Partner in Bain & Company’s Automotive & Mobility practice in Munich, this could prove crucial in Europe’s automotive sector responding to mounting challenges in the coming years.

Noack stated, “Transport will continue to be an essential part of our life, well into the coming decades. But how we get from ‘A to B’ will change drastically – spurred on by a series of push and pull factors. A worsening climate, increasingly urbanised spaces and greater scrutiny over emissions and waste being key factors in this change toward a more circular automotive sector.”

At the same time, it could prove a vital boost in the economy’s drive to net zero – which has repeatedly stalled in recent months. Mobility currently accounts for 30% of all global emissions, with circularity set to play a key role in reducing lifetime emissions. If Bain is proved right by 2040, new vehicles produced could be 97% recyclable, up from 78% today, while a six-fold increase in the use of recycled parts in auto repairs, jumping from only 2% in 2020 to 12% by 2040, could also ensure better circularity throughout the lifetime of a vehicle. In all, this could result in a 60% reduction in sector emissions, compared to a scenario where it continues to use ‘virgin materials’ for production at present rates.

Doing so will be easier said than done, however. As with any key challenge, taking it on alone may well prove too much for some companies. As a result, Harry Morrison, partner in Bain’s Sustainability & Responsibility practice and co-author of the report, contends that cross sector partnerships will be essential to future levels of circularity. This is already seeing business leaders strengthen their manufacturing ecosystems with a clear perspective on where to collaborate, and where to compete, with Morrison pointing to The Global Battery Alliance as an example of this. The network saw over 120 public and private organisations come together “to help establish a sustainable battery value chain.”

Looking ahead, Morrison concluded, “Our analysis finds that automotive companies pioneering their transition toward greater circularity do three things well. They scan the existing value chain to identify the potential for improving circular flows, they combine today-forward and future-back perspectives to capture new opportunities and they scale the ecosystem for success.”