Many CEOs around the world remain relatively optimistic on the health of the global economy, despite a sustained economic slowdown, and a chaotic geopolitical landscape. A new report suggests that bosses in the UK, Germany, France, Italy and Spain are especially upbeat – with four-in-ten anticipating global growth in the next five years.

2022 was a challenging year for businesses around the world, to say the least. Post-lockdown hopes of a rapid commercial recovery swiftly dissipated, as huge rises in the cost of energy sent shockwaves through the global economy – contributing to rampant inflation that decreased the spending power of consumers – while Russia’s war in Ukraine exacerbated matters, and added further strain to an international supply chain still under strain from the pandemic.

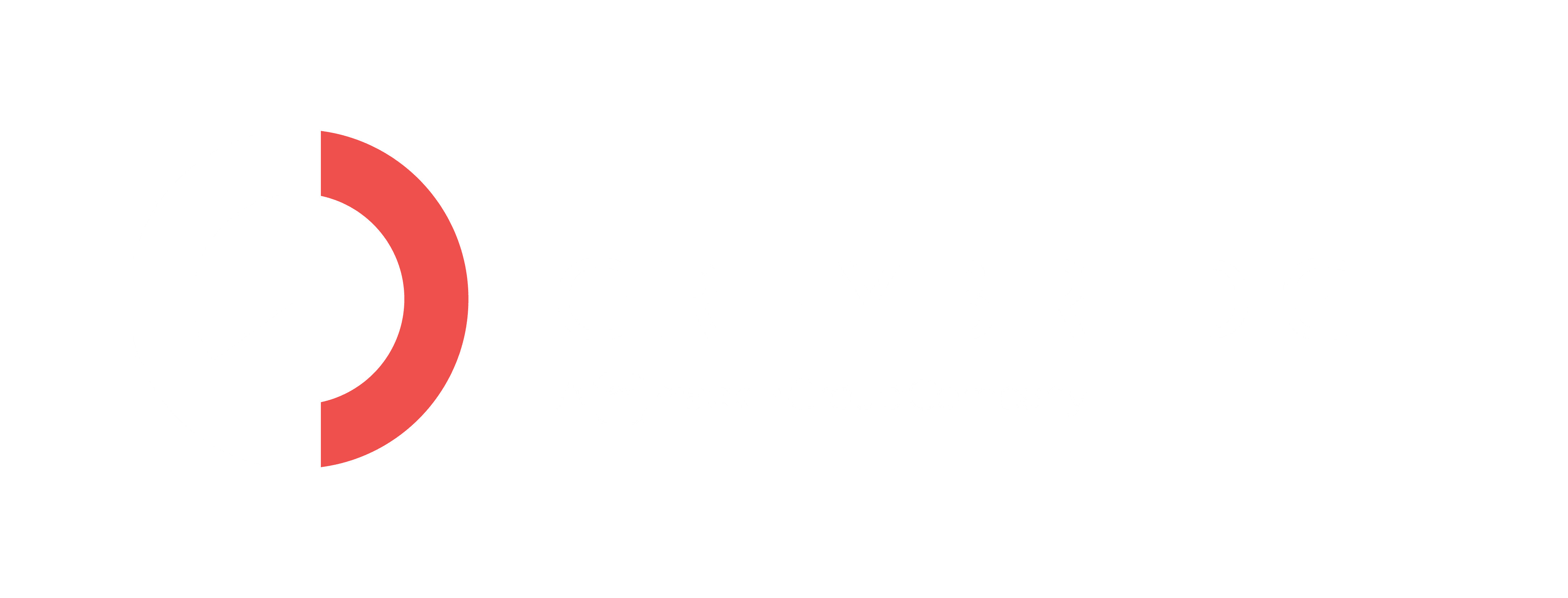

In spite of a turbulent 12 months, however, many CEOs remain optimistic about the future. A new study from Arthur D. Little suggests that 63% of businesses believe the economic outlook will either remain stable or increase in the coming three-to-five years. Those who thought the worldwide economic outlook would decline meanwhile found themselves in a 37% minority.

For its study, Arthur D. Little surveyed nearly 250 CEOs from companies worldwide with a combined turnover of more than $1 billion. Looking at this sample, the researchers also found that optimism for economic growth did vary between regions, though. Optimism was lowest in Asia – where half of respondents believed the outlook would worsen – and Africa, which saw no respondents suggest things activity would increase in the coming years.

In comparison, optimism was highest in Europe’s five largest economies of the UK, Italy, Spain, Germany and France. There, 38% of respondents said they expected increasing activity – in keeping with recent research suggesting that British businesses were the most optimistic in Europe, at least with regards to their own prospects.

Further to that, a sizeable portion of the CEOs that anticipated growth expected their firms would grow faster than the market. A 30% portion said as much, nearly three-quarters of whom stated an intent to increase investment in order to facilitate that growth. When asked which areas they might focus their spending to this end, half of all CEOs pointed at geographic expansion into greenfield markets, highlighting the continued potential for globalization.

Next in line on the growth agenda are expanding client segments, and cost optimisation, which can unlock funding to drive growth investments – both trends holding relatively steady. This marked a major shift from the last three years – which were largely defined by consolidating core business focuses in the hope of simply riding out the impacts of Covid-19. That was the priority of 55% of respondents in the last three years, but in the coming three years, that has fallen by 23%.

Getting it right

Driving growth is notorious for its challenges, and Arthur D. Little’s CEO survey reconfirms that leaders are very well aware of the pitfalls, and success factors. Business leaders believe that technology innovation will be the most critical factor when it comes to their future growth.

A global average of 26% identified it as the leading factor – rising to 27% across Europe’s leading five economies, and 34% in South America. 12% of CEOs are meanwhile prioritising environmental and climate change as a factor in future growth, though the UK and the other Big Five are behind on this trend, at 10%.

Talent is another area of concern, with the ‘war for talent’ raging across countries and sectors. According to Arthur D. Little, CEOs struggle to organically attract new capabilities and talents and are focused on acquiring them either via headhunters, corporate venture capital, or direct acquisition. Just 21% of key employees are developed internally, with headhunters the favoured option for 29% of companies. Meanwhile, firms are increasingly focusing on diversity, equity, and inclusion as a means to attract and retain talent over the long term.

At the same time, organisations are also transforming their operational remit when it comes to leveraging technology. CEOs expect to increasingly expand their technology set-up, from supercharging the IT department to ensuring large-scale adoption of technology across the entire organisation. Many bosses also want new technology to underpin their entire growth agendas, with artificial intelligence, cloud, data analytics, automation and robotics considered as fundamental technologies relevant in practically all sectors.

Commenting on the report’s key finding, Arthur D. Little CEO Ignacio García Alves said, “Despite current challenges and many dark macroeconomic previsions for 2023, most CEOs are optimistic for the future. They see opportunity in adversity, looking beyond the current crisis to embrace a more positive future for their companies and wider society.”