A global CEO survey has shown most businesses anticipate recession in the coming 12 months. However, many remain positive about the situation, believing it will be a ‘mild’ slump, for which they are well prepared – having scaled back spending on ESG measures, and paused hiring.

Big Four firm KPMG polled 1,300 CEOs, to get their thoughts on a world currently ridden with geopolitical crises, huge inflation triggered by gas and oil companies, and a pandemic which is still not over. In this situation, it is not strange that CEOs have their doubts; KPMG’s survey found that 86% of business leaders are already bracing for a recession in the current year.

And that will inevitably impact bottom-lines. Of those expecting a recession, 71% CEOs predict a recession will impact company earnings by as much as 10% in the next 12 months.

But even so, having come through the 2008 collapse, and the pandemic recession of 2020, 58% are still upbeat about their prospects. Asserting the recession will be ‘short’, 76% of respondents believe they already have appropriate plans in place to deal with the recession. As a result, after mid-2023, CEOs expect to enter a post-recession recovery period, while 71% believe that in just three years their company will have grown, compared to where they stand today.

What is clear is that even a short-term recession will see a downturn in corporate spending and investments, however. KPMG believes there may be four key impacts of this.

Recession driving talent freezes

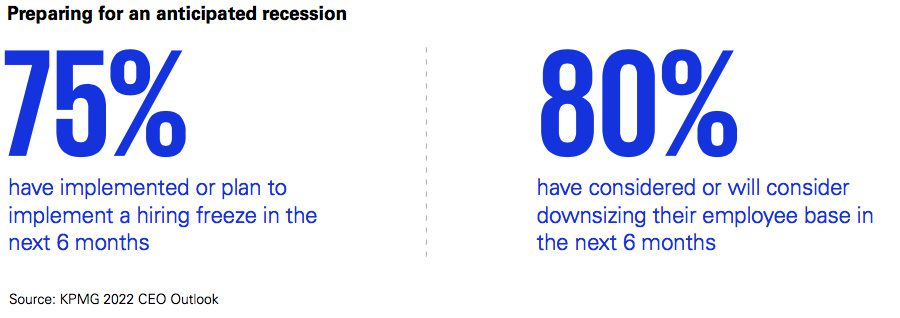

With a recession looming, there’s a significant emphasis on hiring freezes and headcount reductions. A large 39% percent of CEOs have already implemented a hiring freeze, while 46% are considering downsizing their workforce over the next six months. But when CEOs take a longer-term view, it seems they believe this will be a temporary measure. A majority of 79% percent expect their organisation’s headcount to increase over the next three years, and CEOs are still investing in their existing workforce, with half currently focused on boosting productivity.

Less money for digitalisation

In the last decade, businesses have thrown a seemingly limitless amount of cash at digitalisation projects, carried along with the fear of missing out on the ‘major benefits’ of things like blockchain, AI and augmented reality. But with the jury still out on the boost those investments supposedly helped realise, many bosses are rethinking how ‘essential’ digital spending actually is. Four-in-five CEOs note that their businesses are pausing or reducing their digital transformation strategies to prepare for the anticipated recession. Even beyond the recession, they will be more discerning too – with 70% saying they need to be quicker divesting from areas where they encounter digital obsolescence.

Redesigned supply chains

CEOs also indicate that geopolitical uncertainties will continue to impact their strategies and supply chains over the next three years. As the war between Russia and Ukraine, mounting tension between the US and China, and record rates of inflation have added to the burden of the pandemic, the continued frailty of supply chains has become abundantly clear. So, while offshoring to economies like China previously seemed a cost-effective means to obtaining cheap labour, it now represents a major risk. In response, 81% of CEOs have adjusted or plan to adjust their risk management procedures considering geopolitical risk, and 21% of CEOs will be increasing measures to adapt to geopolitical issues to achieve their growth objectives.

ESG becomes slower

Another set of agenda items seemingly destined for the back-burner comes from Environmental, Social and Governance (ESG) policy. Following the trend of CEOs reassessing initiatives in many areas of the business (e.g. transformation and staffing), as economic uncertainty continues, 50% of CEOs are pausing or reconsidering their existing or planned ESG efforts over the next six months, and while 34% have already done so.

Commenting on the report’s findings, Bill Thomas, Global Chairman and CEO of KPMG, said, “Once-in-a-generation issues – a global pandemic, geopolitical tensions, inflationary pressures and financial difficulties – have come in short succession and taken a toll on the optimism of global CEOs. It’s unsurprising the economic climate is now the top concern for business leaders.”

“As the possibility of recession looms, many are already prepared with a deep focus on planning and agility. And some see opportunities through this fog of uncertainty brought on by the promise of technology, talent and ESG. Our findings should provide some cautious optimism that, in contending with and overcoming these ordeals, executives are emerging more confident in their companies’ resilience and hopefully the markets will follow suit, mitigating some of the greater uncertainties we’ve all felt.”