As the global economy looks to be headed for a recession, a new report has shown the majority of organisations are prioritising cost cutting campaigns to secure their bottom lines, over innovation which could help them get an edge on competitors. But as a result, many firms seem to be missing out on a major opportunity to win market share, with less than a quarter of organisations now able to bring breakthrough innovations to consumers.

Following the lockdown era, there has been a very visible split between business leaders who are ‘revivers’ and ‘survivors’. Revivers focus on acceleration, transformation, and investment in growth and innovation – while survivors focus on cost reduction and other means of insulating themselves from adverse conditions.

While the majority of businesses were initially found to be more positively-minded revivers by PA Consulting Group research, a looming economic slump seems to have changed the tune of many a leader. The latest study from the firm now suggests that 73% of business leaders now prioritise cutting costs and finding efficiencies, over investing in breakthrough innovations that can strengthen their organisations. Meanwhile, 76% added they were now more likely to pursue the oxymoronic ‘incremental innovation’, over more rapid change.

PA polled a selection of 520 C-suite decision makers to discover that this is leaving organisations struggling to remain relevant. While 42% of respondents said they “may not survive” without being able to consistently generate notable innovations, only 23% of organisations could actually deliver breakthrough innovations to market.

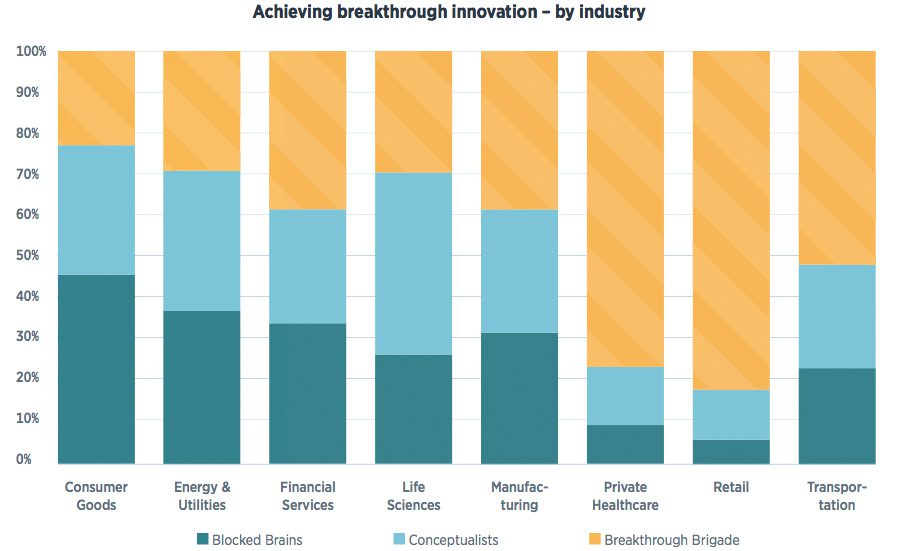

Certain markets are lagging significantly in this regard – suggesting that even if they weather the brewing financial storm, incumbents may struggle to bounce back in the following recovery. In particular, the consumer goods market looks to be in trouble, with the lowest proportion of ‘breakthrough’ firms in any sector. With those firms feeling the pinch amid collapsing consumer demand, being unable to re-engage with customers with a relevant offering post-recession could prove fatal.

Similarly, many energy and utilities firms are operating in an overly defensive manner. Over one-third of incumbents are what PA terms ‘blocked brains’ – and as innovation might be a crucial way to deliver more efficient, valuable service amid a boom in gas prices that looks set to continue; failing to modernise will probably prove costly for many operators.

In stark contrast, retail and private healthcare seem to be awash with breakthrough innovators. PA found that eight-in-ten retailers in particular were part of the ‘breakthrough brigade’ gearing up to find new ways of reaching customers, and meeting their needs in challenging times.

Similarly, private healthcare operators – possibly spurred on by the unforeseen challenges of the Covid-19 era – are forging ahead with innovation drives. In the event of a new pandemic, or even a relapse of the last one, such firms will be well positioned to meet with booming demand, as well as maintaining their other commitments to patients.

Andy Katz, a strategy and growth expert at PA, said, “In the current economic environment, organisations need to be brave and break free from what they know. Although we are facing some tough economic times, where some leaders will want to tread carefully, if they are to face their growth challenges head on – focusing on the needs of customers and the market – now is the time for them to rethink their innovation strategy, be bold and lean into their innovation agendas.”