Banks are looking to boost sustainability measures, as a means of improving their reputation, and attracting customers from more climate-conscious younger generations. However, only half of entities in the banking sector are ready to meet relevant regulatory reporting standards on ESG, according to a new study.

The pre-pandemic transformations of European banking took place in the strategic fields of business model alignment, cost reduction and digitalisation. While this shielded many institutions from larger losses during the Covid-19 pandemic, however, these changes did not position banks for accelerated growth.

If they are to overcome their freeze in the growth of profitability, many banks are looking to boost their environmental, social and governance credentials. With environmental and social issues have become increasingly important for society in general and financial market players, banks are committing themselves to comply with specific minimum standards and principles, and various ESG instruments and securities have emerged that banks actively promote.

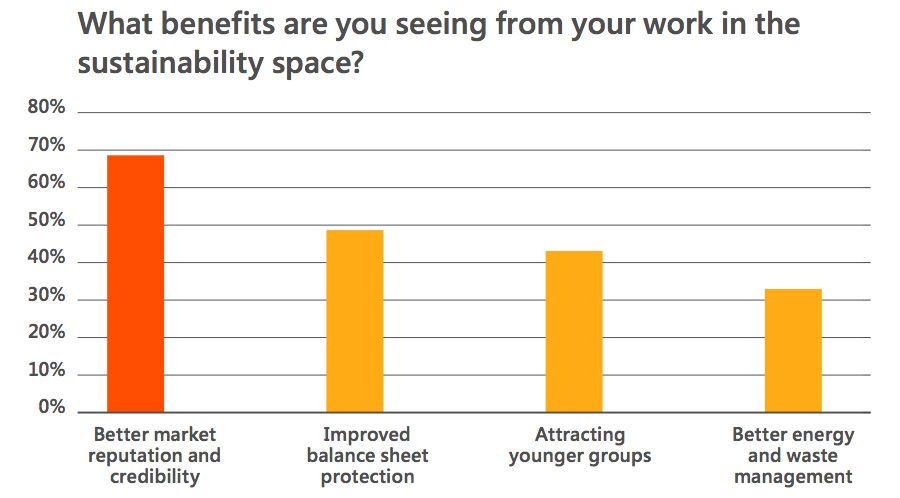

According to a new study by advisory firm Avanade, most banks believe that their ESG efforts have had impacts well beyond their environmental performance. Though 34% did say their energy and waste management had improved, a larger 70% of banks now see their ESG work as having a positive impact on their market reputation and credibility. Following on from this top benefit, 50% of banks added that this boost in reputation had improved balance sheet protection, and 44% said it had attracted younger groups, such as Millennials and Generation Z.

This may well grow further in the future, too. While the majority of banks are working to improve their ESG credentials, the process is still very much in its nascent stage (as implied by only 34% currently stating their energy or waste management was improving). Only 5% of banks told Avanade they were in “advanced” stages of execution, while a further 7% identified themselves as “leaders”.

In contrast, 36% of respondents have a plan, as 26% are starting to execute on one. At the same time, 26% are executing but experiencing challenges. One of the most prevalent challenges holding back wider levels of ESG execution is meeting regulatory reporting standards.

ESG reporting is the disclosure of environmental, social and corporate governance data. As with all disclosures, its purpose is to shed light on a company’s ESG activities while improving investor transparency and inspiring other organizations to do the same.

In the European Union, this is underwritten by the Corporate Sustainability Reporting Directive, an EU law which requires certain large companies to disclose information on the way they manage ESG, helping investors, civil society organisations, consumers, and policy makers to evaluate the non-financial performance of large companies. Meanwhile, the EU taxonomy for sustainable activities is a classification system established to clarify which investments are environmentally sustainable, in the context of the European Green Deal. The aim of the taxonomy is to prevent greenwashing and to help investors make greener choices. Other regulations apply in different geographies.

Worryingly, however, almost half of all banks are not ready to meet such regulatory reporting requirements. Almost one-in-five are still unclear as to what the requirements are, and almost one-third will not be ready for at least another year, leaving Avanade to conclude it would be “interesting” to see how regulators respond to this.