As the UK’s cost of living crisis continues to deepen, a new survey has shown that many employers have taken care of their own needs relating to inflation, but have not done their staff the same service. While the majority have ramped up their prices, fewer have increased pay in-line with inflation.

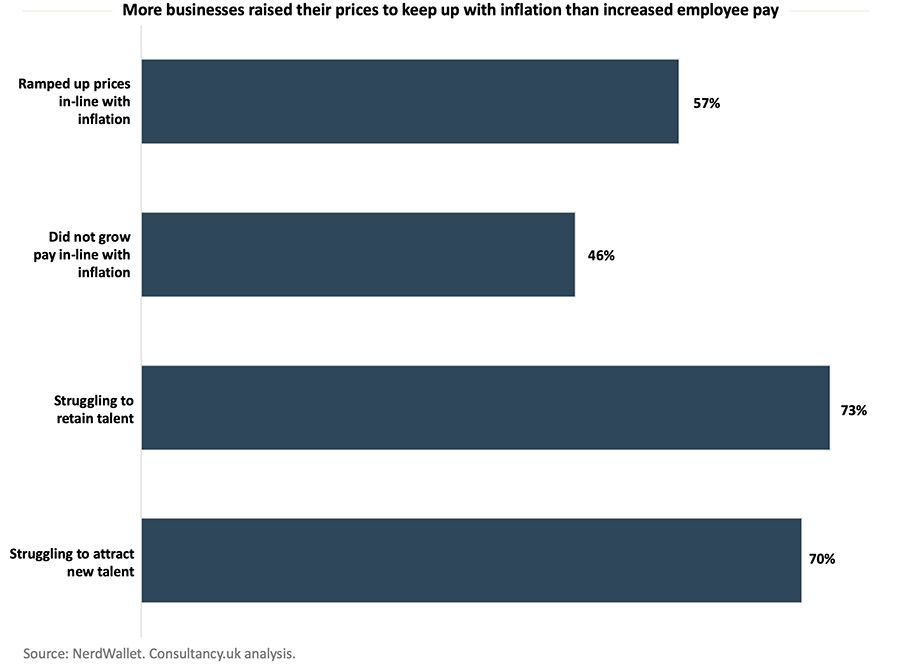

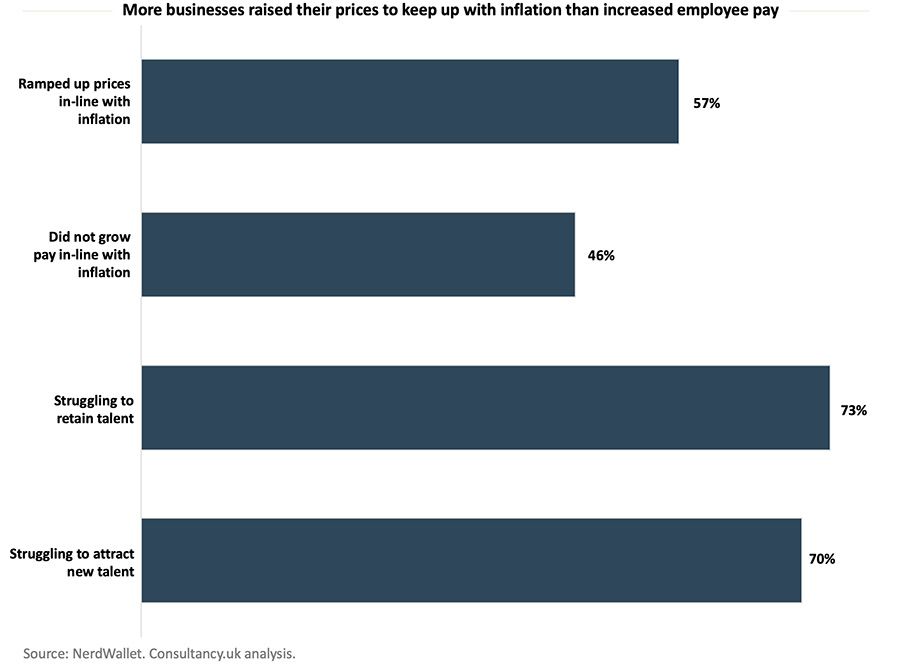

A new study from NerdWallet has found that of 402 UK small and medium enterprises (SMEs), 57% of businesses brought up the price of their goods “in-line with inflation”. While the study did not confirm how many firms did the same for employee wages, the fact 46% of decision makers admitted they had not raised salaries by the same amount suggests at least 3% fewer businesses did.

Oddly enough, this has seen many businesses also start to notice it has become difficult to attract or hold onto talent. Around three-quarters of UK SMEs said they were finding it hard to retain staff, and 25% said this actually poses a ‘major’ threat to their organisation. Meanwhile, a similar number said they struggled to acquire new workers – and 26% said this was a ‘major’ problem.

This comes as 52% of SME decision-makers claim to be actively looking to recruit new members of staff. So, what could they possibly do to win the hearts and minds of prospective recruits, or current employees? According to Connor Campbell, Personal Finance Expert, at NerdWallet, SMEs cannot afford to ignore the matter, whatever they do.

Campbell explained, “Ensuring that all wages are raised in line with inflation – which currently sits at a thirty-year high of 7% – may seem like an impossible task for SMEs, given the financial pressure they are already facing. However, this could also be a key driver of mass-resignations within UK businesses. After all, employees will also be experiencing strained budgets and as such, feel that they have little choice but to resign in search for a higher salary.”

This does not mean that cash-strapped firms necessarily need to resign themselves to a staff exodus, however. Campbell noted that in some cases, employees may simply want some honest and open communication from their bosses on the matter.

Rather than boasting of ‘record profits’ as some firms have, while trying to push back on wage-discussions, this means business leaders should explain how “current economic circumstances are impacting the organisation, and the actions they plan to take” – something which can help ensure that the workforce at least feels it is being listened to.

Campbell added, “Of course, business-owners cannot stop employees from leaving the business; but such conversations could certainly help to put their teams mind at ease and minimise potential disruption driven by resignations.”

Clashing pay-grades

Others have struck a less conciliatory tone on the matter, however. With inflation having risen at a historic rate, despite wages being repressed for decades now, the Bank of England’s Governor, Andrew Bailey, recently suggested workers should “think and reflect” on whether to ask for pay rises. Harking back to the received economic wisdom that inflation is caused by rising wages – despite the present situation suggesting the contrary – Bailey prompted ire from workplace representatives across the UK.

Gary Smith, GMB General Secretary, fired back, “Pay dropping at the same time as inflation runs rampant could spell disaster for too many working people. Real wages have suffered their biggest drop for a decade – yet the boss of the Bank of England still thinks people shouldn’t ask for a pay rise.”

Smith contended that the best way to get wages rising was “to empower trade unions”, before noting “GMB is winning above inflation pay-rises for workers all across the country.” However, he did not believe this was enough on its own, and added that “we need urgent action from the government to help people with the cost-of-living crisis.”