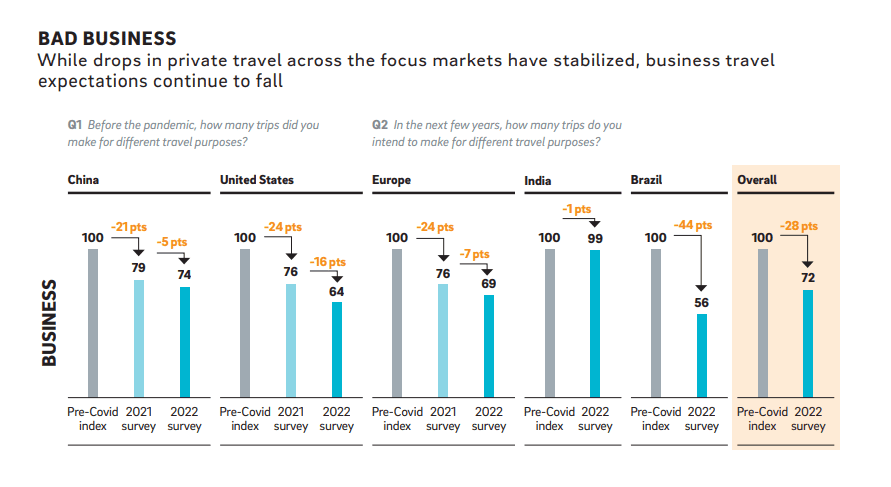

Air travel increased in 2022 across the globe, bouncing back from the pandemic lows of2020. However, digital communications mean that post-pandemic business travel is seen as less urgent – and demand for it has shrunk by one-third in the UK, along with other leading European economies.

Long-distance travel is not expected to surpass pre-Covid levels in 2023, according to a study by consulting firm Roland Berger. The report drew from a consumer survey, conducted in late 2022, which drew on responses from almost 7,000 people in the US, Germany, France, UK, China, India, and Brazil, all key markets for the airline industry.

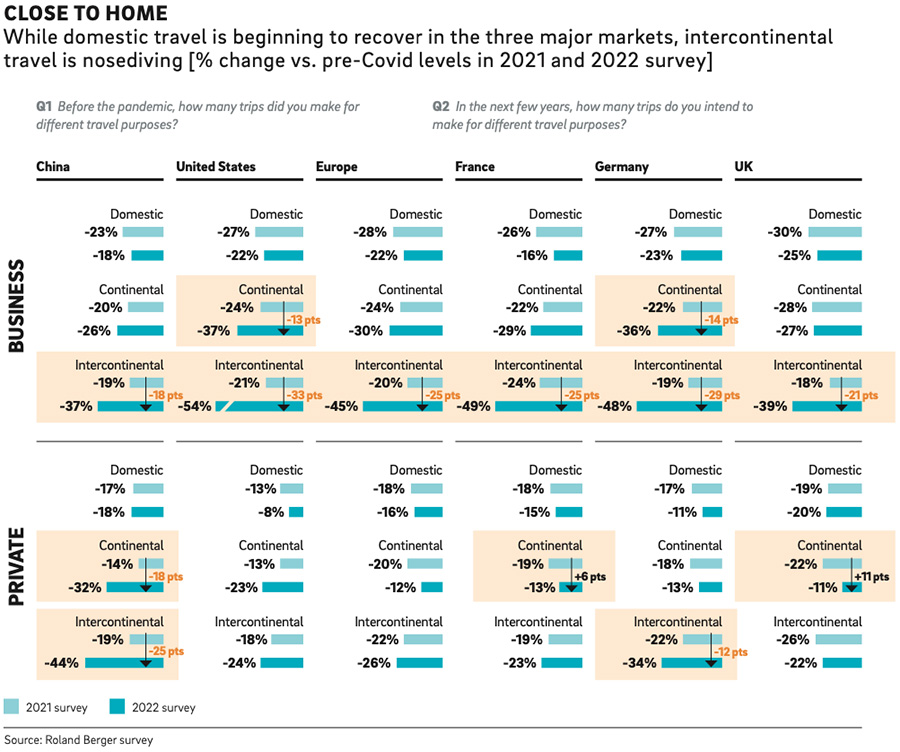

Survey participants gave two main reasons why they remain hesitant to travel by air, particularly long-distance. The first is the ease of online communication in a post-pandemic world, which makes long-distance business travel less necessary. The report confirmed that video conferencing “remains the main driver behind the decline in planned air travel.”

The trend was felt worst in the US, where Roland Berger found that demand for businesstravel was 36% lower than pre-Covid levels, and 12% lower than in 2021. However, Europe is faring only marginally better. Airlines in the UK, France and Germany also witnessed falls of between 30% and 35% from pre-Covid levels.

Environmental concerns

With businesses finding face-to-face contact is less necessary than it used to be, air travelis increasingly coming under scrutiny for its environmental impact. To that end, the second major reason respondents gave for avoiding flights was their carbon emissions. The majority of respondents were eager to travel more by rail and car – with 30% saying they would be willing to travel by rail instead of flying.

There are opportunities for airlines to adapt to these new sustainability demands ofcustomers, though. A 90% portion of passengers said they were willing to pay more for a plane ticket if it helped the cause of lowering carbon emissions. One example of airlinesalready capitalising on this came from the Luftansa Group, which includes several regional airliners like Swiss Airlines and Eurowings. The organisation now offers a green option when buying a flight, with 20% of an added cost going to sustainable fuels and 80% tooffsetting emissions by funding certified sustainability projects.

While greener flights have the potential to offset emissions, however, some climate campaigners argue that more drastic measures need to be taken, including significantly reducing air travel, not just changing the fuel they use. These sustainable flight initiatives have been criticised as ‘greenwashing’ and simply a way for consumers to buy out of ‘flight shame’.

Recovery elusive

A previous Bain & Company study from early 2022 determined that air travel would fully bounce back to pre-Covid levels in 2023. In comparison, this more recent consumer survey by Roland Berger shows travellers’ continued reluctance to return to business as usual.

A full global recovery in long-distance air travel to pre-pandemic levels is therefore not expected in 2023, according to the report. Looking at the world’s largest economies, this may have also been driven by China. The easing of Covid restrictions in the US and Europe did see travel numbers rise toward pre-pandemic levels. However, China’s zero-Covid policy, which was mostly lifted in early 2023, prevented a comparable recovery there in the same timeframe.

As a result, while 2022 saw strong uptake in travel worldwide, China still lags behind. Long-distance air travel demand in the US rebounded to 87% of pre-pandemic levels by the first half of 2022. That is compared to 60-80% in Europe and a drastically lower 32% in China.