The amount of foreign direct investment in the global economy has risen beyond $2 trillion. According to new research, the UK is the fifth most popular destination for such investment.

Over the last 12 months, the vast bulk of humanity has been subject to a massive fall in living standards, relating to spiralling inflation, and wages which have not kept pace with it. While being ‘all in the same boat’ remains a popular phrase among businesses and the political class, however, it is clear that not everyone has been impacted by this crisis in the same way.

While colossal rises in the prices of energy, telecoms and the weekly shop have forced consumers to scale back ‘non-essential spending’, wealthy investors are forging ahead with their inflation-proof fancies around the world. According to new research from Kearney, the global total for foreign direct investment (FDI) hit a six-year high in 2022, passing the $2.1 trillion over 12 months.

An FDI is an investment in the form of a controlling ownership in a business, in real estate or in productive assets such as factories in one country by an entity based in another country. The cumulative value of FDIs around the world had fallen steeply in the years before the pandemic – crashing to a decade-long low in 2018 – but has been rebounding rapidly since. In 2021, the level of FDIs had already increased to more than $2 trillion, for the first time since 2016.

Looking ahead, it seems likely that the positivity this upswing has caused will help the FDI market build more momentum in 2023. While the last year has broadly been characterised by governments and business leaders insisting cost pressures and supply chain disruption meant they could not afford to bring salaries in line with inflation, or that they would need to pass costs onto consumers themselves, other companies pushing ahead with FDI plans caused a surge in optimism among respondents of a Kearney survey. Some 87% now said they were planning to increase FDI, citing it as more important to their competitiveness in the next three years.

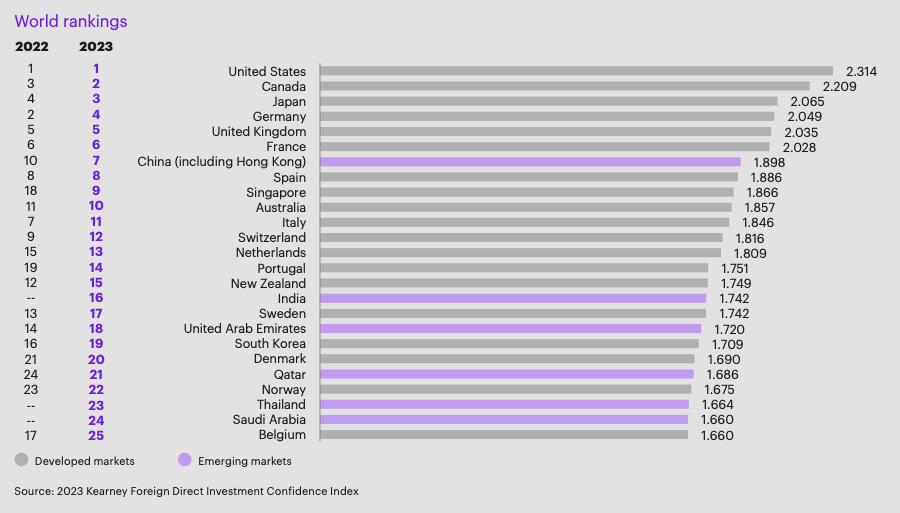

When it comes to who is benefitting from this major increase in investment, it seems as though the same old locations are the focus of most FDIs. Of the top 25 FDI destinations, 19 were developed markets. The world’s largest market, the US, retains top ranking for the 11th year in a row, ahead of Canada and Japan. Meanwhile, Germany and the UK round out the top five. According to Kearney, this largely relates to perceived political risk which many developing countries are most associated with – balanced against the rewards presented by the usually favourable tax regimes of the world’s largest economic powers.

“While investors are generally optimistic about the outlook for FDI, our results this year also reflect a degree of caution,” commented report co-author Erik R. Peterson, Managing Director of Kearney‘s Global Business Policy Council. “Investors cited a rise in commodity prices, an increase in geopolitical tensions, and rising political instability in emerging markets as among the top risk factors over the next three years.”

The UK received over $2 billion in funds from FDIs over the course of 2022. And despite the country’s flatlining GDP growth, investors still seem upbeat about the country’s prospects – suggesting this will grow in the next year. The UK ranks eighth for investment sentiment, as it has the joint-second most pessimism associated with it, at 14%. However, it also has the fifth-best level of optimism, at 45%.

It remains to be seen how warmly the results of this study will be received in the UK. A sustained public health crisis, crumbling infrastructure, and a rising number of people stopping pensions contributions to make ends meet, mean the UK ranking fifth at attracting investment in real estate or factories is unlikely to result in street parties. At the same time, with the government of more-than-a-decade struggling to define what its legacy is, beyond biting austerity and the removal of the country from a secure economic union, some readers of the research will probably be left wondering what exactly all this investment has gone towards.