Metaverse curiosity around the world is booming – and 93% of consumers now term themselves ‘metaverse curious’. But major barriers to mainstream adoption still remain; in particular, the widespread abuse which the majority of current metaverse users acknowledge is prevalent across the technology.

Web3, or Web 3.0, is an idea for a new iteration of the World Wide Web. Its advocates insist it is seeking to use technology to incorporate concepts such as decentralisation, transparency and fairness into a modern transaction economy. In recent months, perhaps the most talked about part of this project has been the rise of the metaverse – which seeks to build a network of 3D virtual worlds focused on social connection, and is forecast by some as the next iteration of the internet; with the global network finally manifesting a single, universal virtual world.

In the biggest sign of the metaverse’s growing momentum, research from Capgemini suggests that only 3% of consumers are currently ‘metaverse sceptics’. Meanwhile, 93% of the 8,000 individuals surveyed are ‘metaverse curious’ – and 4% are already metaverse experienced. But while many proponents of Web3 would crow that this points to an inevitable groundswell in use for metaverse technologies, there is a catch here. Of the 7,426 ‘curious’ customers, one-in-ten would not use it in its current form, while one-third would “not use metaverse technology until my friends and family use it”.

Determining what is making these individuals apprehensive about the metaverse will be important in boosting its wider usership. To that end, Capgemini does not mention in its report if it asked the sceptics why they were reluctant to engage with metaverse technology. However, the researchers did ask those already using metaverse technology about their experiences – and may have uncovered some of the reasons why people might think twice before making jumping into virtual worlds.

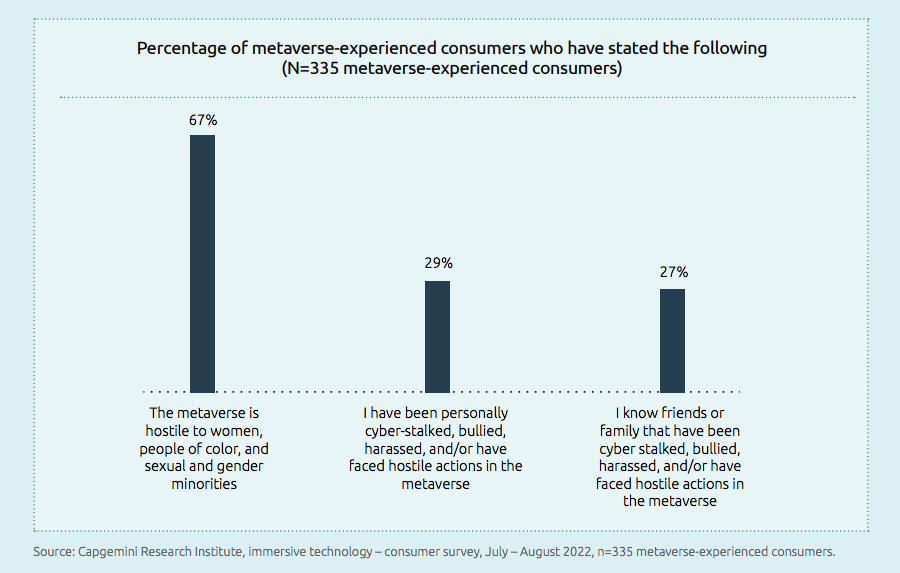

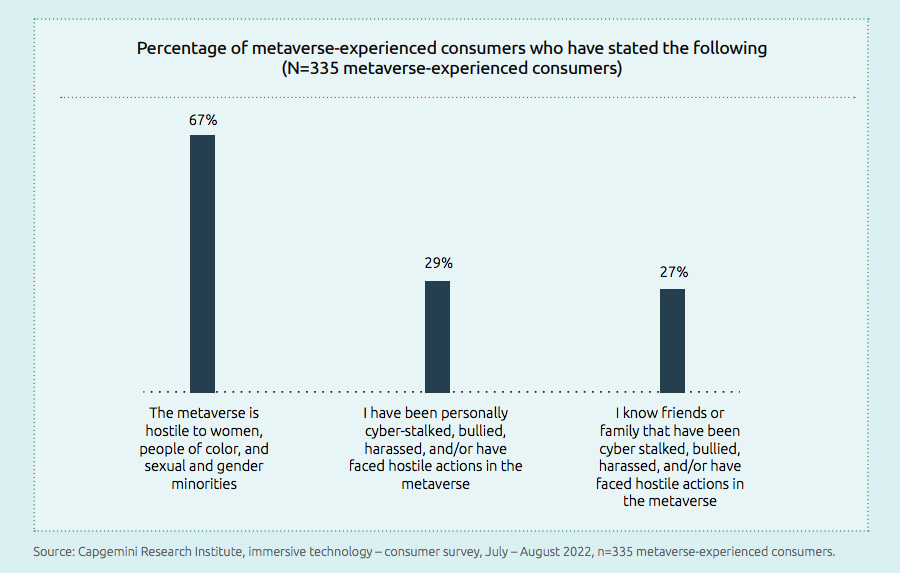

Of 335 metaverse-experienced customers polled, 67% said they had found the metaverse to be “hostile to women, people of colour, and sexual and gender minorities”. This adds to previous evidence that the ‘revolutionary’ technology’s developers are already simply re-creating the biases and inequalities of the world as it is – for example, only 10% of metaverse businesses securing funding are currently founded by women – despite claims Web3 is being built on principals of transparency, accessibility and equality.

At the same time, many metaverse consumers had suffered first-hand abuse on its platforms – or knew someone who had. A 29% chunk had been cyber-stalked, bullied, harassed, or had faced hostile actions in the metaverse – while 27% knew friends or family who had received such treatment. Considering much of the technology’s future popularity looks to be based on word-of-mouth, and whether loved ones feel it is a ‘safe environment’ for interaction, this is something of a dent in the hype surrounding the metaverse as an ‘era defining communications advance’.

A 43% portion of the ‘curious’ camp would primarily use the metaverse for interacting with friends and family, and a further 39% would use it to interact with work colleagues. Those are probably not the kinds of users many metaverse creators are really interested in. More likely they are salivating over the 28% who would use it for commerce, or 27% who would use it to buy products and services. But normalising the metaverse as an interactive space people would actually want to be is a key part of building those more lucrative markets, beyond the volatile and delusional cliques that currently dominate those spaces. Due to this, many organisations lack a clear strategy to scale immersive and metaverse initiatives.

After all, modern brands would be hesitant to launch a store in an unregulated shopping mall filled with sexual predators and violent cultists – so why would they be any keener to launch a digital presence in platforms dominated by the fans of Elon Musk? At present, 62% of businesses admit that there is no management commitment to immersive initiatives. For the consumer products and retail sector specifically, some businesses are piloting immersive use cases – such as AR for virtual home decor, electronics and other items at 24%, or to create new, more engaging, consumer experiences at 25%. But as the economy heads into recession, the low numbers of businesses seeing this as a priority to boost sales speaks volumes.

Charlton Monsanto, Global Immersive Experiences Offer Leader at Capgemini, commented, “This report supports the notion that early interest in the consumer-facing metaverse, propelled by investments from major players, needs to give enough thought to the real challenges around ergonomics, accessibility, safety and privacy, which organisations are now working to address. The potential of the metaverse is transformative and consumer curiosity remains high. Immersive experiences – including the metaverse – for internal use cases could be more impactful for organisations, certainly in the short term.”