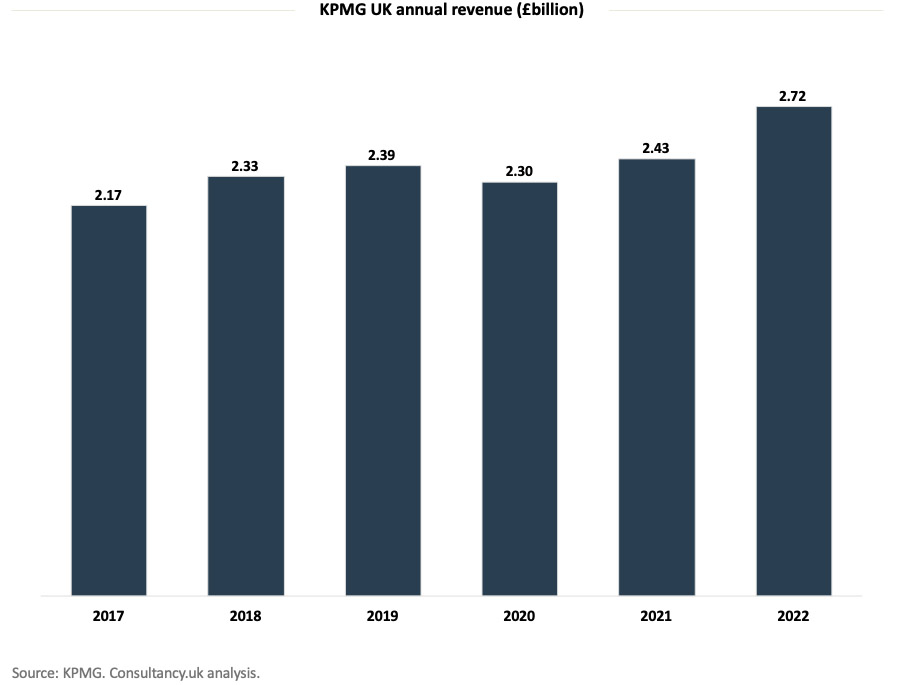

The revenues of KPMG’s UK business grew by double digits in its last financial year. According to the Big Four firm, revenues expanded by 16% in the 12 months leading to September 30 2022 – passing £2.7 billion.

The news represents a second year of growth for the firm – which has more than recovered from the slowdown it endured amid the UK’s Covid-19 lockdown. Reports then suggested that revenues declined from £2.39 billion to £2.30 billion.

But KPMG’s £2.72 billion haul for 2022 has rewarded executives’ continued belief in its “multidisciplinary model”, according to the firm’s UK leader. Much of the growth was on the back of fast-paced expansion in its consulting and M&A deals advisory divisions – supplementing its historic bread-and-butter of accounting work.

Chief Executive Jon Holt told business news site City A.M. that the firm’s performance was an indicator it is on the right track as a combined entity. Holt also rejected notions that the firm might follow EY in pursuing a global split. Instead, he doubled down on KPMG’s combined accounting and advisory model, which involves both arms working as a single unit – asserting his belief that it had been crucial in helping the firm “weather the ups and downs of the economic cycle.”

“We’re not splitting up our business,” Holt added. “As a sector, auditors are facing a number of upward cost drivers including increased regulatory requirements, new standards and a range of inflationary pressures.”

Illustrating this, KPMG UK’s 2022 results show an uptick in pre-tax profits of 3%, in spite of these pressures. Driving forces behind this were KPMG’s M&A deals advisory arm posting sharp growth, with revenues increasing 24% to hit £443 million – even as M&A activity slowed around the world – while income from the firm’s consulting arm jumped by 22% to hit £811 million. Audit fees also rose, though, with KPMG enjoying a 10% increase to £695 million there, and income from its tax and legal business rising 13% to £455 million.

As a result, the average pay out given to KPMG’s 786 UK partners has been able to increase by 10% – hitting an estimated £757,000 each. The news sees KPMG make ground on its rivals PwC and Deloitte, who each gave handouts of more than £1 million in their most recent round of results.

The news comes as fellow Big Four competitor EY continues mooting a separation of its audit and advisory brands. In May 2022, the firm announced a strategic review to spin off its consulting business into a new entity. If approved, the move would mark the biggest shake-up in the accounting and consulting sector since the 2002 collapse of Arthur Andersen, which saw the ‘Big Five’ reduced to the ‘Big Four’.